Volvo 2001 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2001 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

14

Significant events

Volvo acquires Mack and Renault V.I.

On January 2, 2001, AB Volvo’s acquisition

of Renault’s truck operations, Mack and

Renault V.I., became effective. Under the

terms of the acquisition AB Volvo acquired

all the shares of Renault V.I. in exchange for

15% of the shares in AB Volvo. In connection

with the acquisition of Mack and Renault

V.I., Renault V.I. Finance was acquired for

approximately FRF 154 M.

Volvo’s repurchase of Company shares

During 2001, Volvo effected a repurchase of

Company shares amounting to 10% of the

total number of Volvo shares, whereof 5%

were purchased to finance the final payment

to Renault for the shares in Renault V.I. and

Mack Trucks, and 5% were purchased in

order to optimize the capital structure of the

Group. As a result a total of SEK 8.3 billion

was transferred to Volvo’s shareholders.

Divestment of the insurance operations

in Volvia

On February 8, 2001, Volvia reached an

agreement covering the divestment of its

insurance operations to the If insurance

company. The divestment resulted in a capi-

tal gain of SEK 562 M.

AB Volvo and Renault SA

Volvo and Renault have entered into arbitra-

tion regarding the final value of acquired

assets and liabilities in Renault V.I. and

Mack. This process could result in an adjust-

ment in the value of the transfer. Any such

adjustment will affect the amount of

acquired liquid funds and Volvo’s reported

goodwill amount.

The outcome of this arbitration cannot be

determined with certainty. However, Volvo

believes that the outcome will not lead to an

increase in goodwill.

Volvo Aero enters Rolls-Royce’s Trent

engine program

In May 2001, an agreement was signed

through which Volvo Aero becomes a risk-

and-revenue sharing partner in two Rolls-

Royce engine programs, the Trent 500 for

the Airbus A340-500/-600 and the Trent

900 for the new Airbus A380.

Divestment of shares in Volvofinans

On June 28, 2001, Volvo reached an agree-

ment to divest its entire 50% holding in AB

Volvofinans to Ford Credit International,

Inc., for a total purchase price of SEK 871 M.

The divestment had a marginally positive

effect on Volvo’s earnings.

Divestment of shares in Mitsubishi Motors

Corporation (“MMC”)

On June 29, 2001, Volvo sold its 3.3% hold-

ing in, and all rights and obligations relating

to, MMC to DaimlerChrysler. The divest-

ment resulted in a net capital gain of SEK

574 M.

Volvo divests its Low Cab-Over-Engine

(LCOE) business

On July 27, 2001, Volvo Trucks North

America agreed to sell its Xpeditor®LCOE

truck product line to Grand Vehicle Works

Holdings, LLC. By divesting its LCOE oper-

ations, Volvo met the condition imposed by

the US Department of Justice for approval

of its acquisition of Mack and Renault V.I.

Volvo Trucks launches the new Volvo FH

and FM trucks

In November, Volvo Trucks introduced the

new Volvo FH and FM models. The three

new models – the Volvo FH12, Volvo FM12

and Volvo FM9 – have features such as new

engines with improved fuel economy, and

the fully-automatic Volvo I-Shift gear-chang-

ing system.

The year 2001

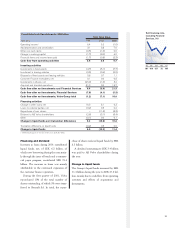

The Volvo Group in euro

2000 2001

Net sales, EUR M 14,249 19,540

Operating income, EUR M 789 (73)

Income after

financial items, EUR M 739 (202)

Net income, EUR M 557 (159)

Income per share, EUR 1.33 (0.38)

Dividend per share, EUR 0.95 0.87

In 2001, EUR 1.00 = 9.2434 SEK, annual average

In 2000, EUR 1.00 = 8.4494 SEK, annual average

EU countries

Member of EMU

Non-EMU members

Volvo and the euro

Volvo’s gradual conversion to the euro,

for operations within the EMU was

completed in 2001. The cost of Volvo’s

changeover to the euro within the

EMU is estimated to be less than 0.1%

of sales. The dominant portion of

these costs is related to information

technology.

After having established the euro as

the internal currency within the EMU,

administrative cost savings has been

realized within distribution, inventory

control and marketing. Substantial

savings have also been made within

treasury operations at the same time

as risks have been reduced due to a

lower foreign currency exposure.

Currency hedges for EMU currencies

have been denominated in euro since

the start of the EMU, in 1999.

BOAR D OF DIRECTOR’SREPORT