Volvo 2001 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2001 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

71

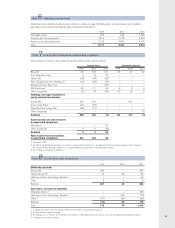

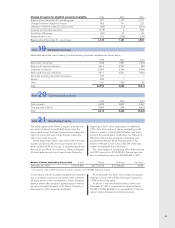

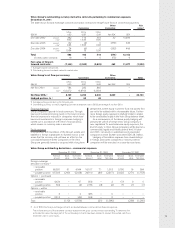

Value in Value in Provisions Acquired and Trans- Value in

balance balance and divested lation Reclassi- balance

sheet 1999 sheet 2000 reversals Utilization companies differences fications sheet 2001

Warranties 3,594 3,644 5,289 (5,429) 2,264 343 (122) 5,989

Provisions in insurance

operations 2,491 2,488 93 – (2,334) 18 – 265

Restructuring measures 1,621 798 2,658 (1,786) 548 154 (30) 2,342

Provisions for residual

value risks 519 725 425 (41) 411 130 66 1,716

Provisions for service

contracts 937 1,276 142 (84) 156 123 92 1,705

Other provisions 3,452 3,745 1,634 (2,022) 1,959 274 (224) 5,366

Total 12,614 12,676 10,241 (9,362) 3,004 1,042 (218) 17,383

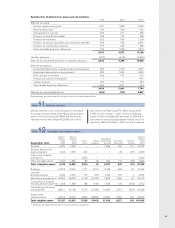

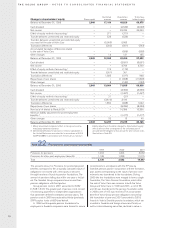

The listing below shows the Group’s non-current liabili-

ties in which the largest loans are distributed by curren-

cy. Most are issued by Volvo Treasury AB and Volvo

Group Finance Europe BV. Information on loan terms is

as of December 31, 2001. Volvo hedges foreign-

exchange and interest-rate risks using derivative instru-

ments. See also Note 32.

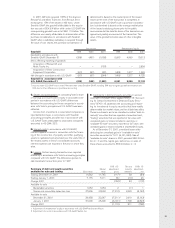

Bond loans 1999 2000 2001

FRF 1995–1997/ 2005–2009, 6.13–7.63% 3,271 3,383 3,599

GBP 1999/2003, 4.6% – 142 154

DKK 1998/2005, 4.30% 377 389 317

SEK 1997–2001/2003–2008, 3.98–9.8% 3,101 2,952 2,502

JPY 1995–2001/2003–2011, 0.30–3.33% 4,654 4,812 2,130

HKD 1999/2006 7.99% – 122 136

ITL 221 – –

NLG 1998/2003, 3.58% 248 256 273

CZK, 2001/2004–2007, 5.0–6.5% – – 466

USD 1998–2001/2004–2008, 2.32–5.87% 1,918 667 2,070

EUR 1999–2001/2003–2009, 2.5–5.92% 10,002 17,505 19,035

Other bond loans 446 644 33

Total bond loans 24,238 30,872 30,715

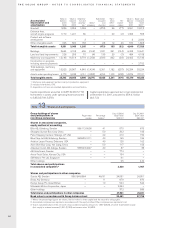

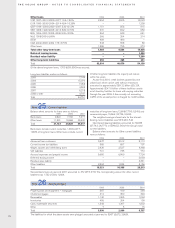

2001 as a result of the downturn on the stock market.

Consequently, the value of the foundation’s assets was

292 less than pension commitments at year-end 2001.

As a result, a provision is reported to cover this deficit in

the Volvo Consolidated financial statements for 2001.

In the mid-1990s and later years, surpluses arose in

the Alecta insurance company in the management of the

ITP pension plan. In December 1998 Alecta decided to

distribute, company by company, the surpluses that had

arisen up to and including 1998. In accordance with a

statement issued by a special committee of the Swedish

Financial Accounting Standards Council, surplus funds

that were accumulated in Alecta should be recognized in

the financial statements when the present value could

be calculated in a reliable manner. The rules governing

how the refund was to be made were established in the

spring of 2000 and a refund of 683 was recognized in

Volvo’s accounts during 2000. At year-end 2001, a

refund of 412 had yet not been settled with cash.

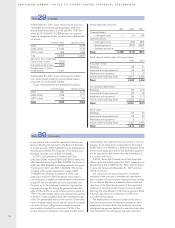

As a result of the acquisition on January 2, 2001 of

Mack Trucks Inc. and Renault V.I., the Volvo Group

received provisions for post-employment benefits total-

ing 8.3 billion. The provision pertained to commitments

for pensions and other post-employment benefits, mainly

healthcare benefits, which are not secured through the

transfer of funds to independent pension plans. During

2001, the provision within the acquired operations

increased, partly due to contractual occupational pen-

sions in conjunction with restructuring measures during

the year as well as the reporting of an additional mini-

mum liability pertaining to pension obligations within

Mack Trucks. The additional minimum liability is calculat-

ed in accordance with local rules (U.S GAAP) and per-

tains mainly to the deficit in the company’s pension plans

at year-end.

Additional information regarding Volvo’s outstanding

commitments for pension and other post-employment

benefits and the status of the Group’s pension plans is

provided in Note 33.

Note 23 Other provisions

Note 24 Non-current liabilities