Volvo 2001 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2001 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

19

Financial position

Total assets

The Volvo Group’s total assets at the end of

December, 2001, amounted to SEK 260.9

billion, corresponding to an increase of SEK

60.2 billion compared with year-end 2000.

Acquired and divested companies, primarily

the acquisition of Mack and Renault V.I.,

represented an increase of SEK 53.7 billion.

In addition, the weakening of the Swedish

krona resulted in an increase in total assets of

SEK 13.8 billion. The continued expansion

within Financial Services contributed to the

increase in assets offset in part by divestment

of shares and reductions in inventories and

receivables.

The purchase price for the shares of Mack

and Renault V.I. was set at SEK 10.7 billion,

based on the Volvo share price on the acqui-

sition date (January 2, 2001). The fair value

of acquired assets and liabilities was estab-

lished in the fourth quarter and goodwill

related to the acquisition was set at SEK 8.4

billion. See also information regarding arbi-

tration between AB Volvo and Renault SA

on page 14.

Shareholders’ equity

Shareholders’ equity amounted to SEK 85.2

billion as of December 31, 2001. The

changes in shareholders’ equity since year-

end are specified on page 70.

Net financial position

The Volvo Group’s net financial debt at

December 31, 2001 amounted to SEK 7.0

billion (net financial assets of 9.4 billion).

The decrease of SEK 16.4 billion is shown in

detail in the adjoining table.

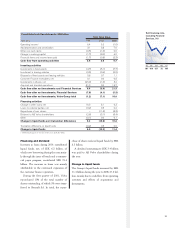

Volvo Group consolidated balance sheets, Volvo Group, excl

December 31 Financial Services 1Financial Services Total Volvo Group

SEK M 1999 2000 2001 1999 2000 2001 1999 2000 2001

Assets

Intangible assets 6,518 6,781 17,366 100 144 159 6,618 6,925 17,525

Property, plant and equipment 17,318 19,652 30,370 2,470 2,579 2,864 19,788 22,231 33,234

Assets under operating leases 1,611 4,245 15,020 10,726 11,883 14,060 12,337 14,216 27,101

Shares and participations 35,296 37,366 35,145 744 778 203 29,213 30,481 27,798

Long-term customer finance receivables 0 10 19 17,817 23,026 26,256 17,817 22,909 26,075

Long-term interest-bearing receivables 17,605 5,091 5,627 0 23 0 17,605 5,032 5,554

Other long-term receivables 2,337 2,186 9,017 147 90 73 2,484 2,232 8,902

Inventories 21,053 22,998 30,557 385 553 518 21,438 23,551 31,075

Short-term customer finance receivables 9 5 95 16,487 19,168 23,732 16,496 18,882 22,709

Short-term interest bearing receivables 1,012 14,195 6,799 0 1 82 1,012 14,196 2,525

Other short-term receivables 18,738 22,696 29,798 2,797 2,627 2,647 21,535 24,120 31,044

Marketable securities 17,990 5,682 12,997 2,966 3,886 517 20,956 9,568 13,514

Cash and bank 6,475 5,276 11,877 1,838 1,764 2,417 8,313 6,400 13,869

Total assets 145,962 146,183 204,687 56,477 66,522 73,528 195,612 200,743 260,925

Shareholders’ equity and liabilities

Shareholders’ equity 97,692 88,338 85,185 6,827 7,663 7,550 97,692 88,338 85,185

Minority interests 544 593 391 0 0 0 544 593 391

Provision for post-employment benefits 2,118 2,619 14,632 12 13 15 2,130 2,632 14,647

Other provisions 9,861 8,277 14,085 4,971 6,620 4,342 14,832 14,941 18,427

Loans 12,206 18,233 29,710 41,139 49,048 57,956 53,345 66,233 81,568

Other liabilities 23,541 28,123 60,684 3,528 3,178 3,665 27,069 28,006 60,707

Shareholders’ equity and liablities 145,962 146,183 204,687 56,477 66,522 73,528 195,612 200,743 260,925

Shareholders’ equity and minority

interests as percentage of total assets 67.3% 60.8% 41.8% 12.1% 11.5% 10.3% 50.2% 44.3% 32.8%

1 Financial Services reported in accordance with the equity method.

Change in net financial position

SEK billion

December 31, 2000 9.4

Cash flow from operating activities 9.7

Net investments in fixed assets

and leasing assets (7.1)

Customer finance receivables, net 0.8

Operating cash flow,

excluding Financial Services 3.4

Investments in shares, net 3.2

Acquired and divested operations1(6.7)

Dividend to AB Volvo’s shareholders (3.4)

Repurchase of own shares (8.3)

Change in provision for

post-employment benefits (2.5)

Other, including foreign

currency translation (2.1)

December 31, 2001 (7.0)

1Including purchase amount and financial net debt in

acquired companies. See further Note 2.