Volvo 2001 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2001 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

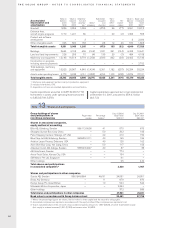

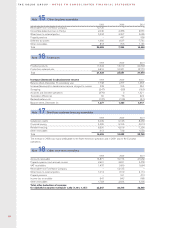

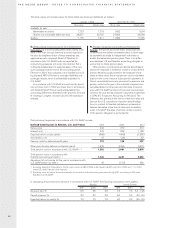

THE VOLVO GROUP · NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

72

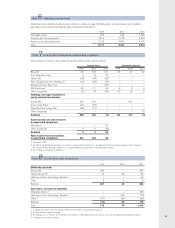

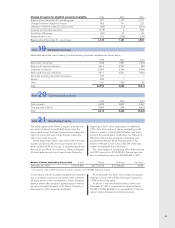

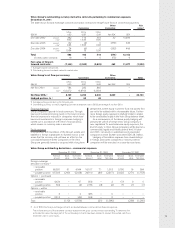

Balance sheet amounts for loans were as follows:

1999 2000 2001

Bank loans 9,822 7,160 7,417

Other loans 11,301 18,668 29,400

Total 21,123 25,828 36,817

maturities of long-term loans,12,608 (7,750; 5,245), and

commercial paper, 15,966 (10,724; 5,526).

The weighted average interest rate for the interest-

bearing current liabilities was 5.4% (6.6; 5.2).

Noninterest-bearing liabilities accounted for 50,935

(27,742; 26,777), or 58% (52; 56) of the Group’s total

current liabilities.

Balance sheet amounts for Other current liabilities

were as follows:

1999 2000 2001

Advances from customers 3,447 3,512 3,112

Current income tax liabilities 569 697 707

Wages, salaries and withholding taxes 2,420 2,527 4,368

VAT liabilities 701 735 772

Accrued expenses and prepaid income 5,680 6,960 7,724

Deferred leasing income – – 2,033

Residual value liability – – 4,341

Other liabilities 2,504 1,934 5,156

Total 15,321 16,365 28,213

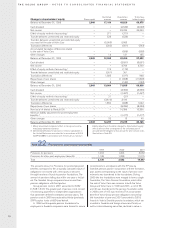

Secured bank loans at year-end 2001 amounted to 472 (473; 415). The corresponding amount for other current

liabilities was 1,732 (1,506; 1,860).

1999 2000 2001

Property, plant and equipment – mortgages 367 109 264

Chattel mortgages 412 350 394

Receivables 1,140 1,065 1,063

Inventories 456 254 199

Cash, marketable securities 1,548 1,207 1,802

Other 7 5 15

Total 3,930 2,990 3,737

The liabilities for which the above assets were pledged amounted at year-end to 3,907 (2,672; 2,865).

Note 25 Current liabilities

Note 26 Assets pledged

Bank loans include current maturities, 1,484 (2,917;

1,893), of long-term loans. Other loans include current

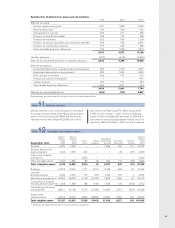

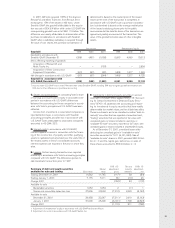

Other loans 1999 2000 2001

USD 1997–2001/2003–2017 1.94–13.0% 2,954 4,905 10,023

EUR 1990–2000/2004–2014 4.84–10.25% – – 1,239

GBP 1994–2000/2003–2007 5.42–8.12% 1,151 858 915

SEK 1988–1999/2003–2013, 3.80–6.15% 631 822 650

BRL 1996–2001/2003–2006 8.29–20.5% 364 849 641

NLG 1998/2004, 6.60% 266 254 214

DEM 489 493 –

CAD 2002/2008–2009 1.75–3.75% 543 558 80

Other loans 1,586 795 274

Total other long-term loans 7,984 9,534 14,036

Deferred leasing income – – 1,898

Residual value liability – – 7,250

Other long-term liabilities 292 265 231

Total 32,514 40,670 54,130

Of the above long-term loans, 1,703 (693; 590) was secured.

Long-term liabilities mature as follows:

2003 7,144

2004 15,079

2005 7,058

2006 4,505

2007 6,218

2008 or later 4,747

Total 44,751

Of other long-term liabilities the majority will mature

within five years.

At year-end 2001, credit facilities granted but not

utilized and which can be used without restrictions

amounted to approximately SEK 22 billion (23; 20).

Approximately SEK 19 billion of these facilities consist-

ed of stand-by facilities for loans with varying maturities

through the year 2006. A fee normally not exceeding

0.25% of the unused portion is charged for credit facilities.