Volvo 2001 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2001 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE VOLVO GROUP · NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

80

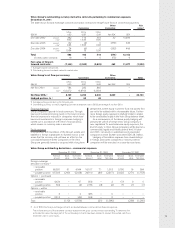

Significant differences between Swedish and U.S.

accounting principles

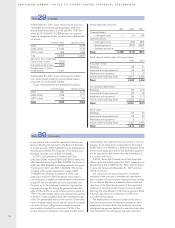

A. Derivative instruments and hedging activities.

Volvo uses forward exchange contracts and currency

options to hedge the value of future commercial flows of

payments in foreign currency. Outstanding contracts that

are highly certain to be covered by currency transactions

are not assigned a value in the consolidated accounts.

Under U.S. GAAP hedge accounting is not applied for

commercial derivatives, why outstanding forward con-

tracts and currency options are valued at market rates.

The profits and losses that thereby arise are included

when calculating income. Unrealized net losses for 2001

pertaining to forwards and options contracts are estimat-

ed at 944 (1,286; 632).

Volvo uses derivative instruments to hedge the value

of the Groups’ financial position. In accordance with U.S.

GAAP, all outstanding derivative instruments are valued

at fair value. The profits and losses that thereby arise are

included when calculating income. Only part of the

Groups’ hedges of financial exposure qualify for hedge

accounting under U.S. GAAP and are accounted for as

such. In those cases the hedged item are valued at fair

value regarding the risk and period beeing hedged and

included when calculating income.

As of January 1, 2001 Volvo has made a transition

adjustment in accordance with FAS 133. Book values of

derivatives, assets and liabilities qualifying for hedge

accounting prior to FAS 133 have been adjusted in

accordance with FAS 133. The transition adjustment will

be accrued over the average maturity of the assets and

liabilities that qualified for hedge accounting prior to FAS

133.

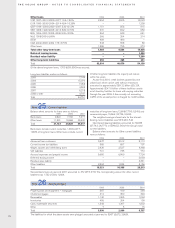

B. Business combinations. Acquisitions of certain sub-

sidiaries are reported differently in accordance with

Volvo’s accounting principles and U.S. GAAP. The differ-

ence is attributable primarily to reporting and amortization

of goodwill.

In 1995, AB Volvo acquired the outstanding 50% of

the shares in Volvo Construction Equipment Corporation

(formerly VME) from Clark Equipment Company, in the

U.S. In conjunction with the acquisition, goodwill of SEK

2.8 billion was reported. The shareholding was written

down by SEK 1.8 billion, which was estimated corres-

ponded to that portion of the goodwill that was attributable

at the time of acquisition to the Volvo trademark. In accord-

ance with U.S. GAAP, the goodwill of SEK 2.8 billion

should be amortized over its estimated useful life (20

years).

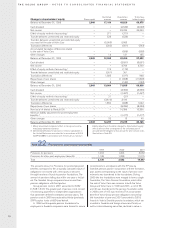

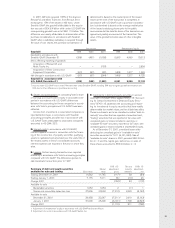

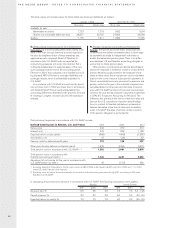

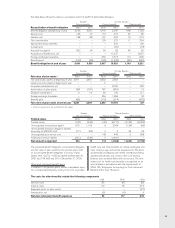

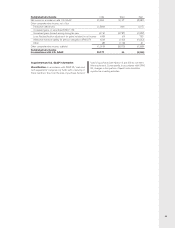

Accounting for derivative instruments and hedging activities

Net income 1999 2000 2001

Derivatives Commercial exposure 576 (654) 342

Derivatives Financial exposure – – (222)

Fair value adjustment hedged items – – 50

Transition adjustment – – 2

Total increasing (decreasing) reported net income 576 (654) 172

Fair value hedges included above

Net income 2001

Derivative contracts, financial exposure 338

Fair value adjustment hedged items (293)

Ineffectiveness in net income 45

Shareholders’ equity 1999 2000 2001

Shareholders’ equity in accordance with

Swedish accounting principles 97,692 88,338 85,185

Items increasing (decreasing) reported shareholders’ equity

Derivative instruments and hedging activities (A) (632) (1,286) (1,114)

Business combinations (B) 1,408 1,317 4,125

Shares and participations (C) 12 36 36

Interest costs (D) 115 112 130

Leasing (E) (189) (163) (149)

Investments in debt and equity securities (F) (256) (6,066) (7,328)

Restructuring costs and income from divestment of Volvo Cars (G) 860 579 –

Pensions and other postemployment benefits (H) 443 109 272

Alecta surplus funds (I) – (523) (412)

Software development (J) 370 754 542

Product development (K) – – (1,962)

Entrance fees, aircraft engine programs (L) (51) (387) (719)

Tax effect of above U.S. GAAP adjustments (165) 1,941 3,024

Net increase (decrease) in shareholders’ equity 1,915 (3,577) (3,555)

Shareholders’ equity in accordance with U.S. GAAP 99,607 84,761 81,630