Volvo 2001 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2001 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PARENT COMPANY AB VOLVO · NOTES TO FINANCIAL STATEMENTS

90

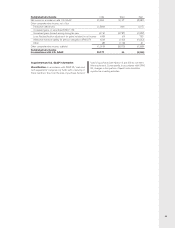

Exchange differences on borrowings and lendings,

including forward contracts related to loans, amounted to

–2 (3; 60). Exchange differences related to operations

are included in Other operating income and expenses.

Other financial income and expenses also include

guarantee commissions from subsidiaries, unrealized

gains (losses) pertaining to a hedge for a program of

personnel options, costs for confirmed credit facilities

and costs of having Volvo shares registered on various

stock exchanges as well as additional financial expenses

attributable to a tax audit previously carried out.

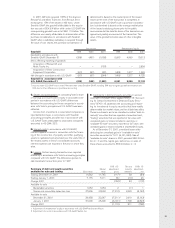

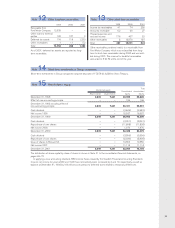

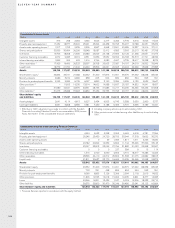

1999 2000 2001

Provision to tax allocation reserve (297) (250) –

Reversal of tax equalization reserve 62 114 –

Reversal of exchange reserve 4 – –

Allocation to extra depreciation 4 3 (1)

Utilization of replacement reserve – – 3

Total (227) (133) 2

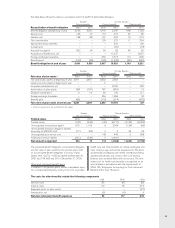

Provision has been made for estimated tax expenses that

may arise as a consequence of the tax audit carried out

mainly during 1992. Claims for which provisions are not

deemed necessary amount to 0 (297; 288), which is

included in contingent liabilities.

Deferred taxes relate to estimated tax on the change

in tax loss carryforwards and temporary differences.

Deferred tax assets are reported to the extent that it is

probable that the amount can be utilized against future

taxable income.

Deferred taxes related to change in tax-loss carryfor-

wards amount to 1,110 (0; 0) and to changes in other

temporary differences to 2 (2; 10). No taxes have been

debited or credited directly to equity.

Note 7Other financial income and expenses

Note 8 Allocations

Note 9 Taxes

Interest income and similar credits amounting to 455

(266; 564) included interest in the amount of 420 (141;

469) from subsidiaries and interest expenses and similar

Note 6 Interest income and expenses

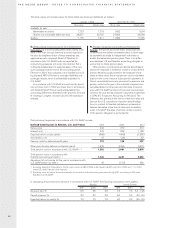

1999 2000 2001

Current taxes 384 (117) (280)

Deferred taxes 10 2 1,112

Total taxes 394 (115) 832

Current taxes were distributed as follows:

Current taxes 1999 2000 2001

Current taxes for the period (165) (217) 0

Adjustment of current taxes prior periods 549 100 (280)

Total taxes 384 (117) (280)

Specification of tax expense for the period 1999 2000 2001

Income before taxes 18,163 1,491 10,282

Tax according to applicable tax rate (28%) (5,086) (417) (2,879)

Capital gains 4,892 43 81

Non-taxable dividends 345 296 7,353

Non-deductible write-downs of shareholdings (255) (104) (3,421)

Other non-deductible expenses (58) (41) (39)

Other non-taxable income 7 8 17

Adjustment of current taxes prior periods 549 100 (280)

Tax expense for the period 394 (115) 832

charges totaling 467 (353; 570), included interest total-

ing 451 (340; 543), paid to subsidiaries.