Volvo 2001 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2001 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

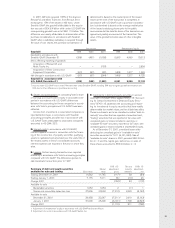

89

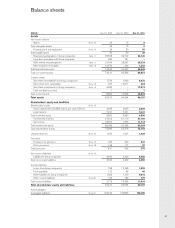

Amounts in SEK M unless otherwise specified. The

amounts within parentheses refer to the two preceding

years; the first figure is for 2000 and the second for 1999.

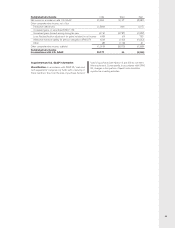

The accounting principles applied by Volvo are

described in Note 1 on pages 57–60. Reporting of Group

contributions is in accordance with the pronouncement of

the Swedish Financial Accounting Standards Council

issued in 1998. Group contributions are reported among

Income from investments in Group companies. Surplus

funds in Alecta are accounted for in accordance with a

statement issued by a special committee of the Swedish

Financial Accounting Standards Council.

As of January 1, 2001, the Parent Company is applying

the new accounting standard, RR9 Income Taxes, issued

by the Swedish Financial Accounting Standards Council.

Restatement of the two preceding years has increased

net income by 2 for year 2000 and 10 for 1999.

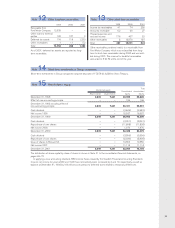

Intra-Group transactions

Of the Parent Company’s sales, 353 (253; 258) were to

Group companies and purchases from Group companies

amounted to 188 (249; 266).

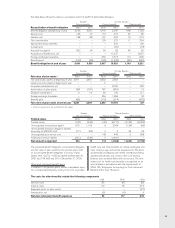

Employees

The number of employees at year-end was 122 (122;

124). Wages, salaries and social costs amounted to

207 (187; 183). Information on the average number of

employees as well as wages, salaries and other remu-

neration is shown in Note 30 on pages 74–76.

Fees to auditors

Fees and other remuneration paid to external auditors

for the fiscal year 2001 totaled 51 (42; 15), of which

3 (4; 5) for auditing, distributed between

PricewaterhouseCoopers, 3 (4; 5) and others, 0 (0; 0),

and 48 (38; 10) related to non-audit services from

PricewaterhouseCoopers.

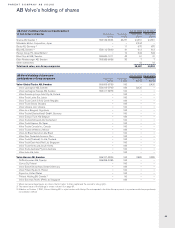

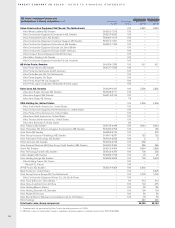

Of the income reported, 24,814 (589; 996) pertained to

dividends from Group companies, whereof 20,649 from

Sotrof AB. Group contributions totaled a net of –3,450

(received 928;1,416). Write-downs of shareholdings

amounted to 12,217 (372; 910). Gain on sale of shares

totaled a net amount of 452, of which 289 pertained to

group-internal transfers. Gains on group internal transfers

were attributable to the sale of shares in Volvo

Lastvagnar AB to Volvo Global Trucks AB, 258 and the

sale of shares in Fortos Ventures AB, 32 to Försäkrings-

aktiebolaget Volvia. Herkules VmbH, a subsidiary and the

holder of shares in Mitsubishi Motors Company, was sold

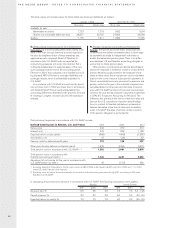

Dividends from associated companies that are reported

in the Group accounts in accordance with the equity

method amounted to 42 (49; 42). The participation in

Blue Chip Jet HB amounted to a loss of 20 (28; 53).

Income in 2000 included a net loss of 187 pertaining to

Of the income reported, 663 (662; 194) pertained to divi-

dends from other companies. The dividend from Scania

AB was 637 (637; 180) and from Henlys Group Plc 26

Administrative expenses include depreciation of 17 (17; 19) of which 3 (4; 5) pertained to machinery and equipment,

1 (0; 1) to buildings and 13 (13; 13) to rights in the Volvo Ocean Race.

Other operating income and expenses include surplus funds of 3 (89; 0) from Alecta as well as profit-sharing payments to

employees in the amount of 0 (0; 1).

Note 5 Income from other shares and participations

Notes to financial statements

sale of shares. This was attributable to capital loss from

sale of shares in AB Volvofinans 224, a gain from sale of

shares and put options in Bilia 31 and a gain from sale

of shares in Blue Chip Jet HB 6.

to DaimlerChrysler, thus resulting in a capital gain of 172

in AB Volvo.

Income in 2000 included an additional capital gain of

382, pertaining to the sale of shares in Volvo

Personvagnar Holding AB to Ford Motor Company in

1999 and a gain of 30 for the sale of shares in Eddo

Restauranger AB to Amica AB.

Income in 1999 included a gain on sales of shares of

17,784 in Volvo Personvagnar Holding AB. Group-inter-

nal transfers resulted in a net loss of 558, which primarily

was attributable to capital loss on the sale of shares in

Försäkringsaktiebolaget Volvia 596, and a gain on the

sale of Volvo Penta Italia SpA, 35.

Note 3 Income from investments in Group companies

Note 1 Administrative expenses

Note 2 Other operating income and expenses

Note 4 Income from investments in associated companies

(23; 13). Transfer of shares together with rights and obli-

gations relating to Mitsubishi Motors Corporation to a sub-

sidiary, Herkules VmbH, resulted in a capital gain of 595.