Volvo 2001 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2001 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE VOLVO GROUP · NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

74

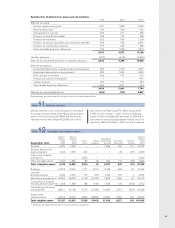

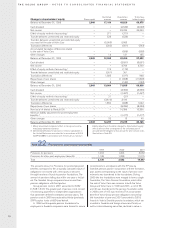

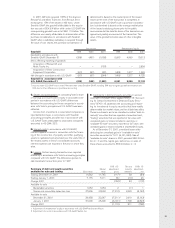

In accordance with a resolution adopted at the Annual

General Meeting, the fee paid to the Board of Directors

is a fixed amount of SEK 3,250,000, to be distributed as

decided by the Board. The Chairman of the Board, Lars

Ramqvist, receives a fee of SEK 1,000,000.

In 2001, Leif Johansson, President and Chief

Executive Officer, received SEK 9,597,900 in salary and

other benefits amounting to SEK 520,838. The bonus in

2000 was SEK 534,600 and will be saved for five years.

The bonus for 2001 was SEK 1,640,000. This bonus,

including a 6% upward adjustment, a total of SEK

1,738,400 was allocated to pension. In 2001, Leif

Johansson received 13,600 employee stock options.

Leif Johansson is eligible to take retirement with pension

at age 55. Pension benefits are earned gradually over

the years up to the employee’s retirement age and are

fully earned at age 55. During the period between the

ages of 55 and 65, he would receive a pension equal to

70% of his pensionable salary, and a pension amounting

to 50% of his pensionable salary after reaching the age

of 65. The pensionable salary is the sum of 12 times the

current monthly salary, Volvo’s internal value for company

car, and a five year rolling annual average of earned

bonus which is limited to a maximum of 50% of the

annual salary. Leif Johansson has twelve months notice

of termination from AB Volvo and six months on his own

initiative. If Leif Johansson’s employment is terminated

by AB Volvo, he is entitled to a severance payment equal

to two years’ salary, plus bonus. The severance payment

will be adjusted for any income after the termination of

his contract with Volvo.

In 2001, Sören Gyll, President and Chief Executive

Officer up to and including April 22, 1997, received a car

benefit amounting to SEK 69,100. Sören Gyll continued

to serve the Group until December 31, 1997 and then

retired on pension.

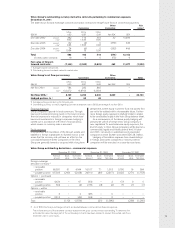

Leif Johansson, the Group Executive Committee,

members of the executive committees of subsidiaries

and a number of key executives receive bonuses in addi-

tion to salaries. Bonuses are based on the income and

cash flow of the Volvo Group and/or of the executive’s

company, in accordance with the bonus system estab-

lished by the Volvo Board in 1993 and reviewed in 2000.

A bonus may amount to a maximum of 50% of an

executive’s annual salary.

The employment contracts of certain senior execu-

tives contain provisions for severance payments when

employment is terminated by the Company, as well as

rules governing pension payments to executives who take

early retirement. The rules governing early retirement

Note 30 Personnel

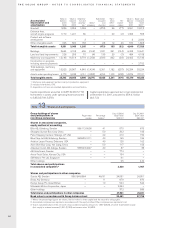

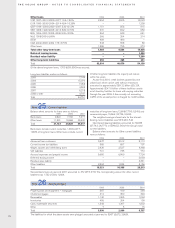

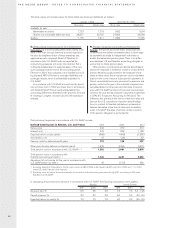

At December 31, 2001, future rental income from non-

cancellable financial and operating leases (minimum

leasing fees) amounted to 31,109 (26,445; 19,910), of

which 30,161 (25,664; 19,383) pertains to customer-

financing companies. Future rental income is distributed

as follows:

Financial leases Operating leases

2002 6,797 4,238

2003–2006 11,534 7,129

2007 or later 323 1,088

Total 18,654 12,455

Allowance for uncollectible

future rental income (252)

Unearned rental income (955)

Present value of future

rental income 17,447

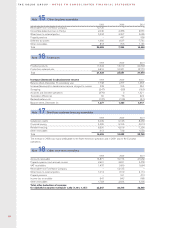

At December 31, 2001, future rental payments (mini-

mum leasing fees) related to noncancellable leases

amounted to 5,192 (4,385; 5,328).

Future rental payments are distributed as follows:

Financial leases Operating leases

2002 440 1,019

2003–2006 1,058 1,771

2007 or later 140 764

Total 1,638 3,554

Rental expenses amount to:

1999 2000 2001

Financial leases:

– Contingent rents – (1) (4)

Operating leases:

– Contingent rents – (80) (82)

– Rental payments – (837) (899)

– Sublease payments – 1 14

Total (1,193) (917) (971)

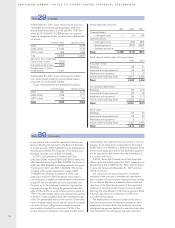

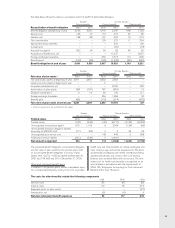

Book value of assets subject to finance lease:

2000 2001

Acquisition costs:

Buildings 48 71

Land and land improvements 26 40

Machinery and equipment 12 23

Assets under operating lease 2,217 2,330

Total 2,303 2,464

Accumulated depreciation:

Buildings (3) (14)

Land and land improvements (2) (8)

Machinery and equipment (4) (11)

Assets under operating lease (1,022) (914)

Total (1,031) (947)

Book value:

Buildings 45 57

Land and land improvements 24 32

Machinery and equipment 8 12

Assets under operating lease 1,195 1,416

Total 1,272 1,517

Note 29 Leasing