Volvo 2001 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2001 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

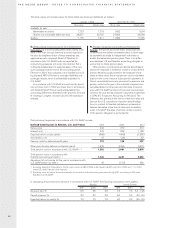

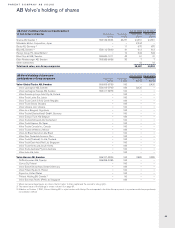

PARENT COMPANY AB VOLVO · NOTES TO FINANCIAL STATEMENTS

92

The shares in Mitsubishi Motors Corporation together

with all rights and obligations relating to the company,

were given a total value of 3,010 and were used as a

shareholder contribution to a newly established German

subsidiary; Herkules VmbH. The company was then divest-

ed to DaimlerCrysler.

The shares in Fortos Ventures AB, with a book value of

258, were sold to Försäkringsaktiebolaget Volvia.

Shareholder contributions that increased the book

value were made to Volvo Holding Sverige AB, 4,900,

Volvo Aero AB, 299, Volvo Holding Mexico, 159, Volvo

Tec hnology Transfer AB, 100, Volvo China Investment Co

Ltd, 81 and Volvo Mobility Systems AB, 8.

Write-downs were carried out on holdings in Sotrof AB,

6,966, VFHS Finans, 3,460, and Volvo Bus de Mexico

(MASA), 43.

2000: Newly issued shares were subscribed for in VNA

Holding Inc for 411, Volvo Truck & Bus Ltd, 211 and in

Volvo China Investment Co Ltd for 194.

Group internal acquisitions were made in Volvo Aero

Holding Norge AS and in Volvo Lastebiler og Busser

Norge AS for 29, following which the companies were

merged with A/S Masten and Volvo Norge AS.

Shares in Eddo Restauranger AB were acquired group

internal for 10, whereafter shares with a book value of 6

were sold to Amica AB. The remaining holding with a book

value of 6 is then accounted for as shares in non-Group

companies.

Shareholder contributions that increased the book

values were made to VFHS Finans AB, 3,460, Volvo Bus

Corporation, 1,054, Volvo Holding Sverige AB, 767, Volvo

Aero Corporation, 302, Volvo Technology Transfer AB, 50,

Volvo Business Services AB, 23, Volvo International

Holding BV, 7 and to the newly formed company Volvo

Mobility Systems AB, 7.

A shareholder contribution of 60 was made to Fortos

Ventures AB, after which the holding was written down by

104.

Write-downs were carried out at the end of the year on

holdings in Volvo International Holding BV, 231, Volvo

Penta UK, 28 and Volvo Aero Turbines UK, 9.

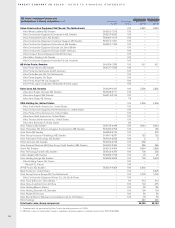

1999: Volvo Personvagnar Holding AB received a

shareholder contribution of 135, after which the share-

holdings, 10,892, were sold to Ford Motor Company. In

connection with the sale, Volvo Car Finance UK Ltd., 431,

and Volvo Car UK Ltd., 265, were sold to Volvo

Personvagnar AB.

Volvo Construction Equipment North America Inc was

acquired from Volvo Construction Equipment NV for 412,

after which the holdings were used as a shareholder con-

tribution to VNA Holding Inc. The value of VNA Holding

Inc. further increased by 7 concerning shares in Volvo

Information Technology North America Inc., which was pre-

sented as a shareholder contribution in 1998.

Holdings in Försäkringsaktiebolaget Volvia, book value

601, were sold to Volvia Holding AB.

Volvo Malaysia Sdn Bhd was purchased from Federal

Auto Holding Sdn Bhd for 26, after which a shareholders’

contribution of 22 was presented, which increased the

book value.

Shares in Volvo Penta Italia SpA were acquired from

AB Volvo Penta and then sold to Volvo Holding Italia SpA.

The book value of Volvo Bus de Mexico (formerly

Mexicana de Autobuses SA de CV) was increased by

accrued expenses of 10 in connection with the acquisition.

Holdings were written down at the end of the year by 681.

Newly issued shares were subscribed for in Volvo Truck

& Bus Ltd. for 202, in Volvo Holding Mexico SA de CV, 42,

and in Volvo Aero Turbines UK Ltd. for 8.

Shareholder contributions that increased book values

were made to Volvo Aero AB, 269, Volvo International

Holding BV, 182, Volvo Information Technology AB, 75,

Volvo Holding Sverige AB, 25, and Volvo Technology

Transfer AB, 20.

Write-downs were carried out at the year-end on hold-

ings in Volvo Information Technology AB, 67, Volvo

Holding Italia SpA, 49, Fortos Ventures AB, 38, Volvo

Holding Danmark AS, 30, Volvo International Holding BV,

28, Volvo Holding Mexico SA de CV, 11 and Volvo

Business Services AB, 6.

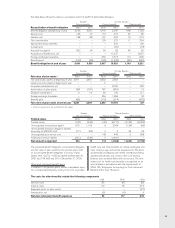

Shares and participations

in non-Group companies

Total shares in Mitsubishi Motors Corporation, with a book

value of 2,344, were transferred to a wholly-owned

German subsidiary, which was then divested to

DaimlerChrysler.

Shares in Lindholmen Teknikpark AB were acquired for 1.

The participations in Blue Chip Jet HB were written

down by 20, corresponding to the share of the year´s

income.

2000: At the beginning of year, AB Volvo increased its

holdings in Scania by 1,328, to 30.6% of voting rights and

45.5% of share capital.

The remaining holding in Eddo Restauranger AB, with a

book value of 6, was transferred from shares in Group

companies to non-Group companies.

Protorp Förvaltnings AB, with a book value of 12, was

liquidated.

Shares in Bilia AB with a book value of 29 were sold

when Bilia repurchased some of its outstanding shares.

Total shares in AB Volvofinans, with a book value of

253, were sold to the Group company Volvo Finance

Holding AB.

10% of the participations in Blue Chip Jet HB, with a

book value of 22, were sold to Försäkringsaktiebolaget

Skandia and Volvo Car Corporation. The remaining partici-

pations (40%) were then written down by 28, correspond-

ing to the share of the year’s income.

1999: Shares in Scania AB were acquired during the

year for a total of 23,023, equal to 28.6% of voting rights

and 43,5% of the share capital.

5% of the share capital and voting rights in Mitsubishi

Motors Corporation was purchased for 2,343.

Newly issued shares in Henlys Group Plc were sub-

scribed in the amount of 149.

Participations in the Blue Chip Jet HB were written

down by 53, equal to the share of the year’s income.

Share capital was increased by 5 in the newly formed

company Volvo Trademark Holding AB.

Holdings in NLK Näringslivskredit AB were divested.