Volvo 2001 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2001 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Volvo in 2001

Large structural changes, business cycle

management and extensive product renewal

dominated the Volvo Group’s activities dur-

ing 2001.

The acquisition of Renault V.I. and Mack

Trucks is of course a radical structural

change, a milestone in the development of

the Group. It has given our business areas

the volumes, the structure and the geo-

graphical scope required for long-term suc-

cess.

The first phase of integration of the new

companies is accomplished according to

plan. A joint organization for the truck com-

panies’ purchasing, product planning and

product development is formed and will

similar to Powertrain have a key role in

securing synergies. Following new account-

ing standards, the integration process from

the acquisition had a negative effect on earn-

ings rather than an effect on goodwill.

Mack Trucks, Renault Trucks and Volvo

Trucks were established as separate business

areas from the beginning of 2002. This has

given them a greater presence and ability to

act more forcefully in the market.

Sharp decline in North America

The business conditions in North America

were – and continue to be – difficult, in par-

ticular for trucks, but construction equip-

ment, buses and engines for leisure boats

were also affected.

Markets in Western Europe weakened

slightly during the year, but from a high

level. Growth in Eastern Europe, Asia and

South America remained favorable, but

volumes were not sufficient to offset the

drop in North America.

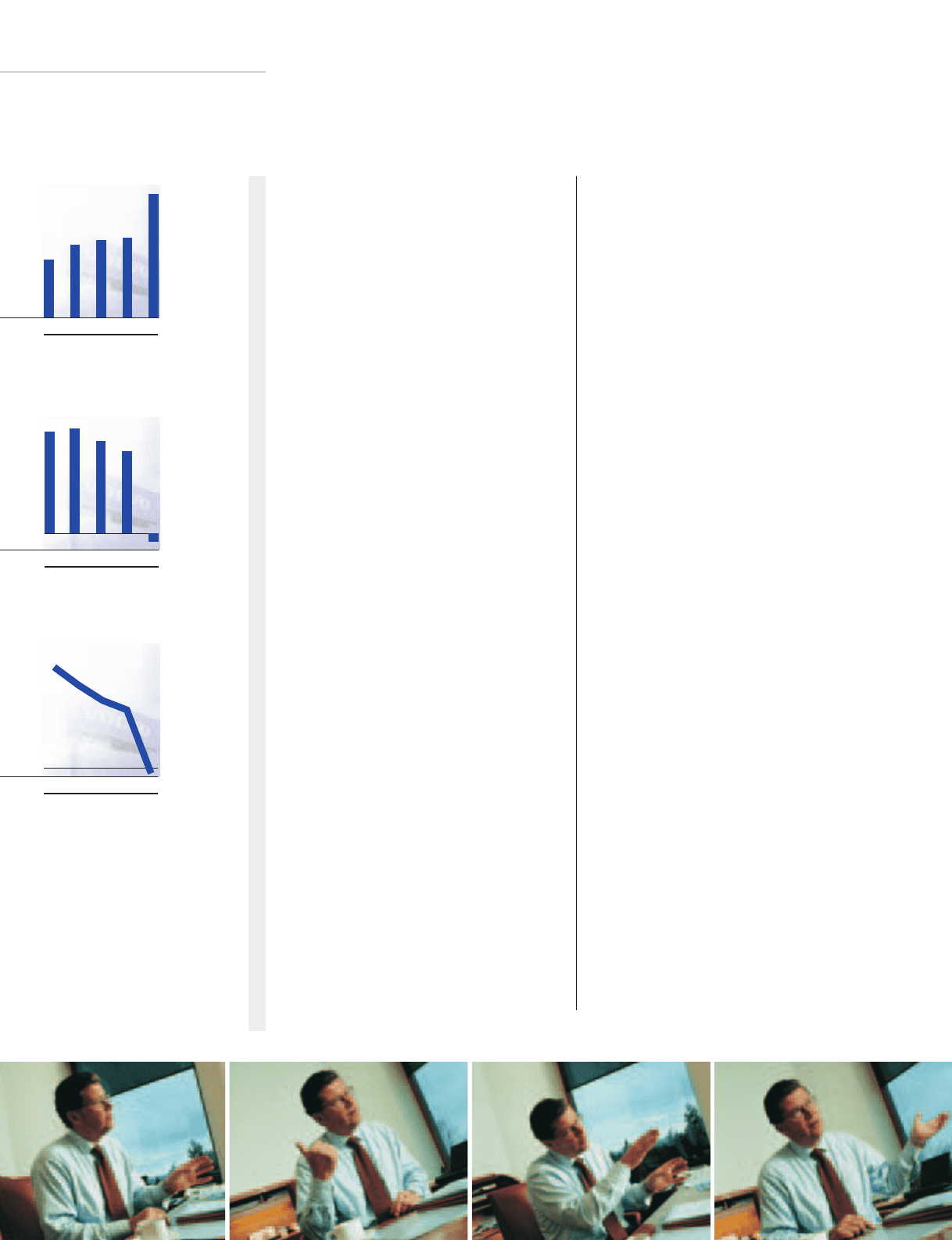

97 98 99 00 01

Net sales*, SEK bn

87.1 107.6 116.4 120.4 180.6

* Excluding divested operations

0

97 98 99 00 01

Operating

income/loss*, SEK bn

8.3 8.5 7.5 6.7 (0.7)

* Excluding divested operations

To adapt operations to demand, we

reduced capacity and inventories. In the US,

for example, decisions were taken to close

the truck plant in Winnsboro and the fabri-

cation plant for construction equipment in

Asheville.

Many painful, yet necessary decisions

have been taken. Some 5,700 employees and

1,400 temporary employees and consultants

left Volvo during 2001.

Extensive product renewal

Despite the present difficult state of the

market, Volvo effected an extensive renewal

of the product segments during 2001. These

new products have improved Volvo’s com-

petitive position within all business areas.

The new Volvo FH, Renault Midlum and

Mack Granite set a new standard on our

truck range. These products promote the

company’s strong positions within long-

haulage, medium-heavy transports and con-

struction trucks.

With its largest industrial project ever, the

TX-platform, Buses has renewed its entire

product range in four years, and thus was

awarded “Busbuilder of the year 2002”.

Volvo CE introduced the new D-series of

articulated haulers and a complete range of

compact equipment.

Penta launched the leisure diesel engine,

KAD300 and strengthened its range of

industrial engines by launching a new 12-

liter engine and 5- to 7-liter engines for

mobile applications.

Aero entered Rolls Royce’s Trent-engine

program for the new Airbus generation and

signed a number of service contracts on

engines.

Comments by the Chief

Executive Officer

THE YEAR 2001

10

0

97 98 99 00 01

9.6 7.9 6.4 5.5 (0.4)

* Excluding divested operations

Operating margin*, %