Volvo 2001 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2001 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

39

Construction

Equipment

Volvo Construction Equipment (Volvo CE)

is one of the world’s leading manufacturers

of construction equipment, with production

on four continents and sales in more than

100 countries. The company has held strong

positions in North America and Europe for

many years and is now extending its pres-

ence in Asia, South America and Eastern

Europe. Volvo CE’s products are used in a

number of applications, such as construc-

tion, forest industry, demolition, waste hand-

ling and mining.

The product range comprises wheel load-

ers, excavators, motor graders and articulated

haulers. In addition, Volvo CE manufactures

compact wheel loaders and compact excava-

tors. Volvo CE also offers solutions for

financing and leasing, renting and sales of

used machines.

Total market

The total combined world market for heavy

construction equipment and compact equip-

ment declined by 7% during 2001, com-

pared with the preceding year. In North

America the downturn was 7% and in both

Europe and international markets the

decrease was 7%.

The market for heavy construction equip-

ment declined by about 8% in 2001, of

which North America showed a decline of

10%, Europe approximately 6% and other

markets about 8%.

For compact equipment, the market fell

about 6% during the year, of which Europe

represented a decline of 6% and other mar-

kets 7% in part offset by an increase of 1% in

North America.

Business environment

As a result of a flattening-out in demand and

decreasing volumes there has been increas-

ing price pressure throughout the industry.

Another factor affecting the industry is the

shift in product mix, since the compact mar-

ket is growing more than the heavy equip-

ment market. Consolidation within the con-

struction equipment industry started later

than in the truck business but has picked up

in recent years and this is expected to con-

tinue. Volvo has been part of this consolida-

tion and will continue to play an active role

when opportunities arise. In 2001, Volvo CE

acquired the telehandler business from

UpRight Inc. and the skidsteer loader busi-

ness from Textron’s subsidiary OmniQuip.

Discussions regarding future cooperation

between Volvo and Komatsu in the produc-

tion and development of construction equip-

ment components was also initiated in 2001.

Also during 2001, CaseNewHolland (71%

owned by Fiat) entered a global alliance with

Kobelco of Japan. Deere and Hitachi inte-

grated its marketing operations in North,

Central and South America and also estab-

lished a joint venture for wheel loaders in

Japan and Asia.

97 98 99 00 01

Net sales, SEK bn

16.7 19.4 18.9 20.0 21.1

97 98 99 00 01

Operating income,

SEK bn

1.4 1.5 1.7 1.6 0.9

97 98 99 00 01

Operating margin, %

8.6 7.9 9.1 8.0 4.2

Net sales as percentage

of Volvo Group sales

12 %

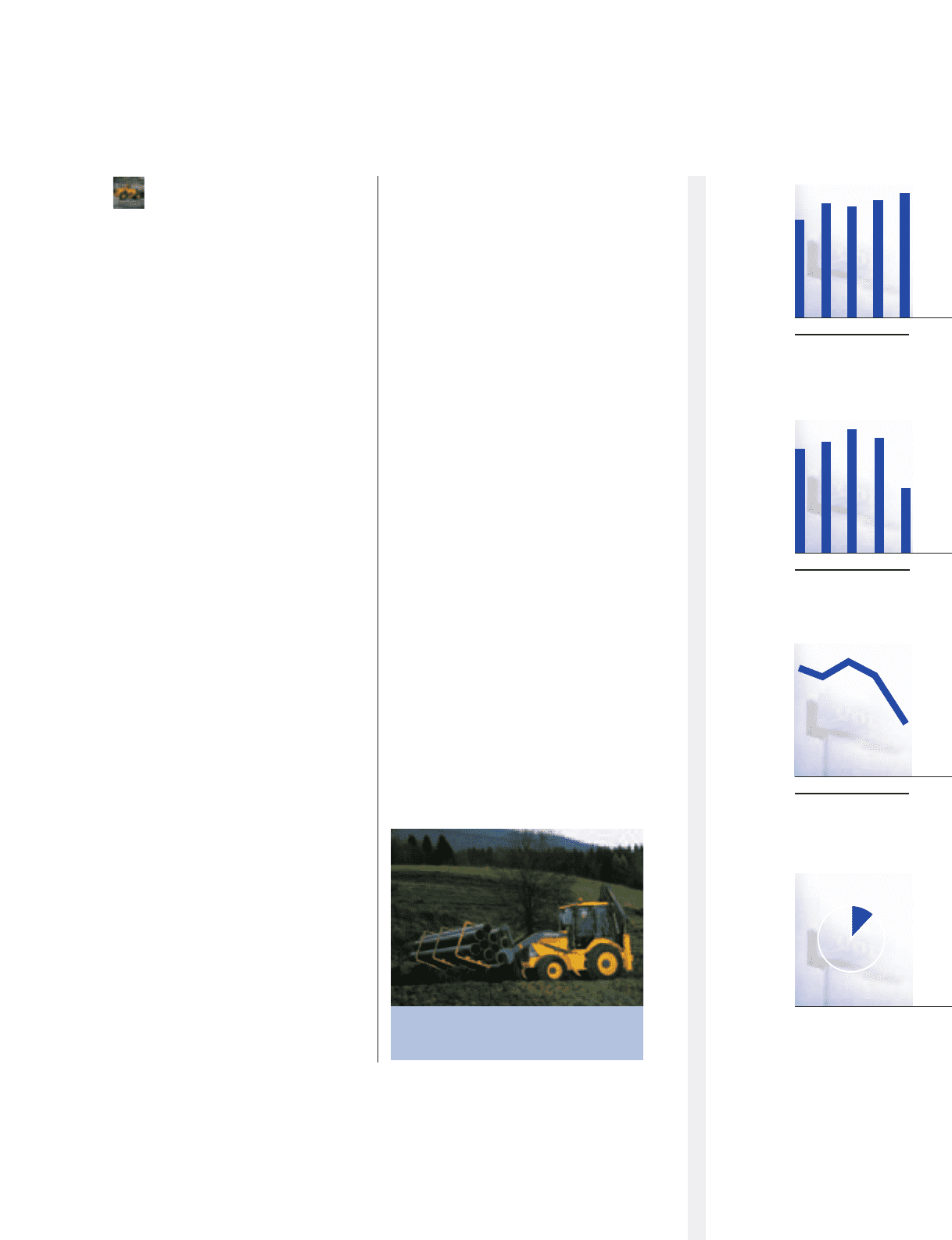

In December, Volvo CE announced the devel-

opment of its own and completely new range

of backhoe loaders.