Volvo 2000 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2000 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

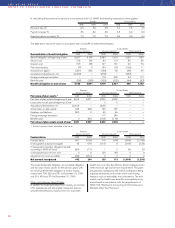

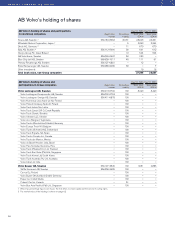

Total

Restricted equity Unrestricted shareholders’

Share capital Legal reserve equity equity

December 31, 1997 2,649 7,241 28,159 38,049

Cash dividend – – (2,208) (2,208)

Net income 1998 – – 24,044 24,044

December 31, 1998 2,649 7,241 49,995 59,885

Cash dividend – – (2,649) (2,649)

Net income 1999 – – 18,547 18,547

December 31, 1999 2,649 7,241 65,893 75,783

Cash dividend – – (3,091) (3,091)

Repurchase of own share – – (11,808) (11,808)

Net income 2000 – – 1,374 1,374

December 31, 2000 2,649 7,241 52,368 62,258

The distribution of share capital by class of shares is shown in Note 21 to the consolidated financial statements, on

pages 65–66.

PARENT COMPANY AB VOLVO

NOTES TO FINANCIAL STATEMENTS

86

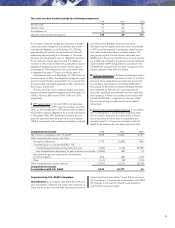

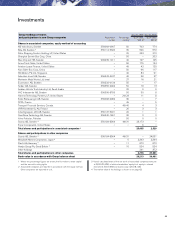

Shares and participations in non-Group

companies

At the beginning of 2000, AB Volvo increased its holdings

in Scania by 1,328, to 30.6% of voting rights and 45.5%

of share capital.

The remaining holding in Eddo Restauragner AB, 6 was

transferred from shares in Group companies to non-Group

companies.

Protorp Förvaltnings AB, with a book value of 12, has

been liquidated.

Shares in Bilia AB with a book value of 29 were sold

when Bilia repurchased some of its outstanding shares.

Total shares in AB Volvofinans, with a book value of 253,

were sold to the Group company Volvo Finance Holding AB.

10% of the participations in Blue Chip Jet HB, with a

book value of 22, were sold to Försäkringsaktiebolaget

Skandia and Volvo Car Corporation. The remaining partici-

pations (40%) were then written down by 28, correspond-

ing to the share of the year’s income.

1999: Shares in Scania AB were acquired during the

year for a total of 23,023, equal to 43.5% of share cap-

ital and 28.6% of voting rights.

5% of the share capital and voting rights in Mitsubishi

Motors Corporation was purchased for 2,343.

Newly issued shares in Henlys Group Plc were sub-

scribed in the amount of 149.

Participations in the Blue Chip Jet HB were written

down by 53, equal to the share of the year’s income.

Share capital was increased by 5 in the newly formed

company Volvo Trademark Holding AB.

Holdings in NLK Näringslivskredit AB were divested.

1998: Shares in Henlys Group Plc were acquired for

376 and in Deutz AG for 670. Participations in Blue Chip

Jet HB were purchased from Pharmacia & Upjohn for 3

and capital contributions amounting to 76 that increased

book value were made. The participations were written

down by 45. The shares in OM Stockholm Exchange

were sold.

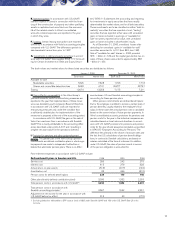

1998 1999 2000

Tax receivables – 41 74

Accounts receivable 5 62 20

Prepaid expenses and accrued income 54 176 407

Other receivables 9 8 12,570

Total 68 287 13,071

Other receviables partained mainly to a receivable from Ford Motor Company, which was reclassified from long-term to

short-term receivables during 2000. The reserve for doubtful receivables amounted to 5 (5; 6) at the end of the year.

Note 12 Other short-term receivables

Note 13 Shareholders’ equity