Volvo 2000 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2000 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

21

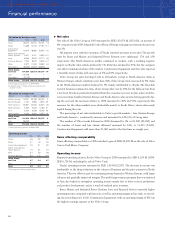

Operating net flow per currency,

excluding divested operations

SEK M 1998 1999 2000

USD 6,400 6,400 7,000

EUR 6,900 7,900 7,500

GBP 2,700 4,200 4,000

JPY (100) 0 (300)

Other currencies 2,200 3,800 1,100

Total 18,100 22,300 19,300

Operating income for 2000 includes SEK 610 M pertaining to realized gains on the remain-

ing securities portfolio in Volvia. Operating income also includes surplus funds of SEK 683 M

from SPP. Income also includes SEK 520 M resulting from a favorable adjustment of gain on

the sale of Volvo Cars. The adjustment of income was due to a supplement to the purchase

price and to the fact that part of a reserve for restructuring costs proved to be unnecessary.

Operating income in the second quarter was charged with provisions within Volvo Trucks in

the amount of approximately SEK 160 M. Operating income in 1999 included a capital gain

of SEK 180 M in connection with the sale of a company in Construction Equipment, as well

as the reversals of reserves of approximately SEK 240 M for customer-financing operations.

The Volvo Group’s operating margin for the year amounted to 4.7% (5.4).

Impact of exchange rates on operating income

The effect of changes in currency exchange rates on operating income in 2000 compared with

1999 was approximately SEK 50 M.

The Swedish krona weakened during 2000 against the inflow currencies, the U.S. dollar,

Canadian dollar and British pound, with considerably positive effects on operating income.

The Swedish krona strengthened against the major inflow currency Euro with adverse effect

on operating income as a consequence. The negative effect was intensified by the weakened

krona against the South-Korean won, in which the Volvo Group has an outflow equivalent to

about SEK 2 billion. Changes in spot-market rates for other currencies had minor effects. The

total effect of changed spot-market rates was positive, approximately SEK 220 M.

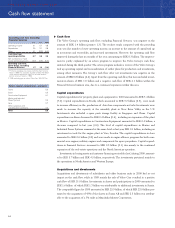

Change of operating income

SEK M

Operating income excluding

items affecting comparability 1999 6,726

Decreased volumes (2,190)

Change in product and market mix, etc. +910

Higher research and development expenses (350)

Reversal of reserves in customer-

financing operations, 1999 (240)

Capital gain on the sale of a company in

Construction Equipment, 1999 (180)

Adjustment of the gain on sale of Volvo Cars +520

Surplus funds from SPP +683

Gains on sale of securities portfolio in Volvia +610

Other (335)

Operating income 2000 6,154

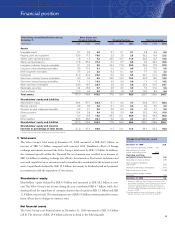

Consolidated income statements Excluding

Cars

SEK M 1998 1998 1999 2000

Net sales 212,936 114,854 125,019 130,070

Cost of sales (163,876) (89,305) (99,501) (104,548)

Gross income 49,060 25,549 25,518 25,522

Research and development expenses (10,104) (4,265) (4,525) (4,876)

Selling expenses (19,042) (8,929) (8,865) (10,140)

Administrative expenses (8,091) (5,652) (4,791) (4,974)

Other operating income and expenses (2,634) (1,322) (611) 622

Items affecting comparability 1(2,331) (1,650) 26,695 –

Operating income 6,858 3,731 33,421 6,154

Income from investments in associated companies 444 567 444

Income from other investments 4,526 170 70

Interest income and similar credits 1,268 1,812 1,588

Interest expenses and similar charges (1,315) (1,505) (1,845)

Other financial income and expenses (162) 131 (165)

Income after financial items 11,619 34,596 6,246

Taxes (3,140) (2,270) (1,510)

Minority interests (42) (104) (27)

Net income 8,437 32,222 4,709

Income per share 19.10 73.00 11.20

1 Items affecting comparability in 1999 pertain to the sale of Volvo Cars and in 1998 to provisions for restructuring costs.

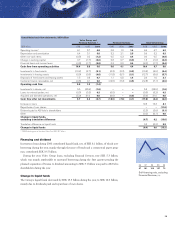

Impact of exchange rates

on operating income

Compared with preceding year, SEK M

Net sales +2,850

Cost of sales (2,370)

Research and development expenses (50)

Selling and administrative expenses (620)

Other operating income and expenses +240

Total effect of changes in exchange

rates on operating income +50

Group sales are reported at average spot prices and the

effects of currency hedges are reported among “Other oper-

ating income and expenses.”