Volvo 2000 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2000 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

33

THE VOLVO GROUP YEAR 2000

Construction Equipment

Volvo Construction Equipment offers high-quality products to meet and exceed the needs of

demanding customers worldwide. As one of the largest manufacturers of con-

struction equipment in the world, the company offers around 130 models.

Volvo CE’s product range comprises excavators, wheel loaders, articulated

haulers and motor graders. The products are used in construction, extraction,

aggregate production, loading and haulage, road construction and industrial

applications. All products are built to work in all kinds of climates and

ground conditions. Volvo’s product range within compact machines includes compact excava-

tors and compact wheel loaders.

Volvo CE, with production facilities on four continents, markets its products in more than

100 countries, mainly via independent dealers. Europe and North America are the largest mar-

kets.

Total market

The total market for heavy construction equipment increased by approximately 3% in 2000,

compared with 1999. The market in Western Europe grew by 6%, while the market in North

America declined by 12%. The total increase in other markets amounted to 12%.

The markets in South America and Eastern Europe continued to improve during the year.

The market in Asia strengthened, although there were signs of softening demand towards the

end of the year.

In the compact segment, there was continued strong growth and the global market increased

by approximately 4%.

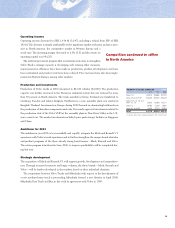

Business environment

As a result of a flattening-out in demand and decreasing volumes there has been increasing

price pressure throughout the industry. Another factor affecting the industry is the shift in

product mix, since the compact market is growing more than the heavy equipment market.

The construction equipment sector has gone through a period of consolidation in recent

years and this is expected to continue. Volvo has been part of this consolidation and will

continue to play an active part when opportunities arise.

Sales and market shares

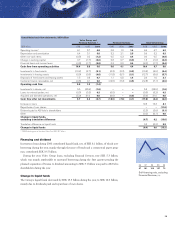

Net sales increased by approximately 6% and amounted to SEK 19,993 M. A record number

of more than 21,000 machines were sold during the year. The number of light construction

equipment units sold increased while the number of heavy construction equipment units sold

More than 21,000 machines

sold in 2000, a new all-time high

for Volvo CE

▲

96 97 98 99 00

Net sales, SEK bn

12.8 16.7 19.4 18.9 20.0

96 97 98 99 00

Operating margin, %

9.1 8.6 7.9 9.1 8.0

96 97 98 99 00

Operating income,

SEK bn

1.2 1.4 1.5 1.7 1.6

Net sales per market

Construction Equipment

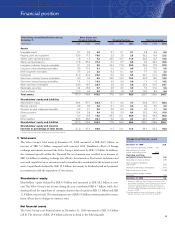

SEK M 1998 1999 2000

Western Europe 9,557 9,901 10,029

Eastern Europe 336 193 255

North America 6,548 5,725 5,823

South America 957 498 776

Asia 1,092 1,903 2,484

Other markets 882 662 626

Total 19,372 18,882 19,993

Net sales as percentage

of Volvo Group sales

15 %