Volvo 2000 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2000 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

65

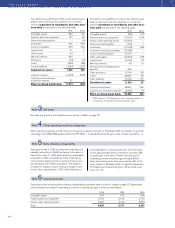

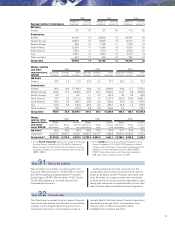

Change of reserve for doubtful accounts receivable 1998 1999 2000

Balance sheet, December 31, preceding year 710 927 1,147

Change of reserve charged to income 126 382 151

Utilization of reserve related to actual losses (61) (86) (10)

Acquired and divested operations 37 (178) 4

Translation differences 35 (60) 67

Reclassifications, etc. 80 162 (258)

Balance sheet, December 31, current year 927 1,147 1,101

Marketable securities consist mainly of interest-bearing securities, distributed as shown below:

1998 1999 2000

Government securities 2,902 1,848 1,581

Banks and financial institutions 240 5,419 2,702

Corporate institutions – 8,559 2,348

Real estate financial institutions 1,851 3,411 2,581

Securities issued by associated companies 1,368 725 –

Shares 783 833 –

Other 24 161 356

Total 7,168 20,956 9,568

1998 1999 2000

Cash in banks 8,771 4,324 5,802

Time deposits in banks 4,285 3,989 598

Total 13,056 8,313 6,400

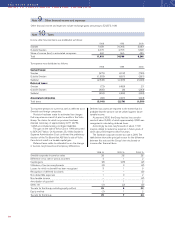

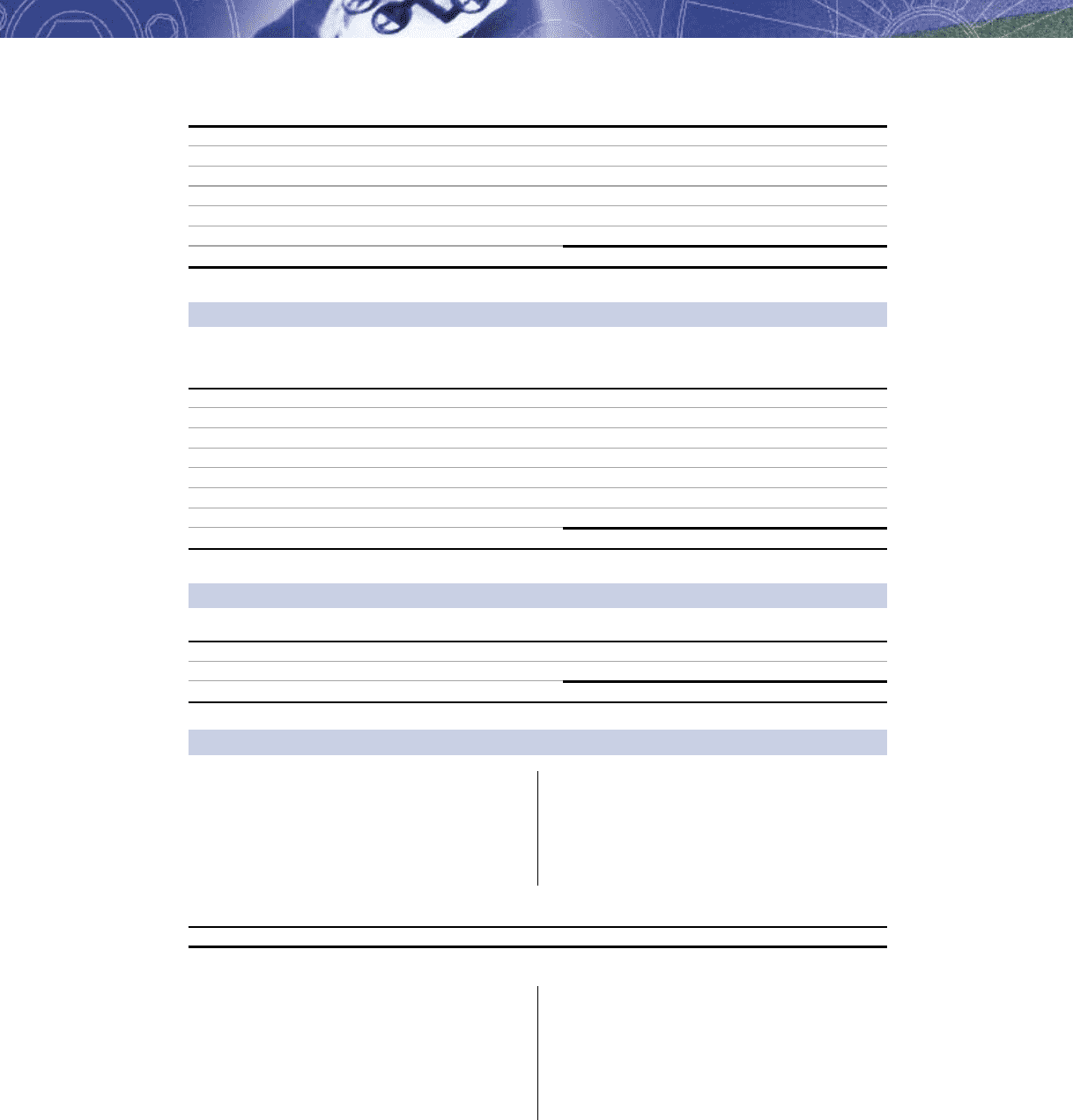

The share capital of the Parent Company is divided into

two series of shares: A and B. Both series carry the

same rights, except that each Series A share carries the

right to one vote and each Series B share carries the

right to one tenth of a vote. During 2000, AB Volvo

repurchased 10% of its registered shares, 13,860,494

Series A shares and 30,291,594 Series B shares for

SEK 11.8 billion. On January 2, 2001, the repurchased

shares were transferred to Renault S.A. as partial pay-

ment for the shares of Renault V.I, whereby the number

of outstanding Volvo shares amounts to 441,520,885.

The average number of outstanding shares was

421,683,857 in 2000.

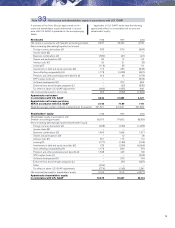

Number of shares outstanding and par value A (no.) B (no.) Total (no.) Par value 1

December 31, 2000 124,744,451 272,624,346 397,368,797 2,649

1 Par value per share is SEK 6.00 (total par value is based on 441,520,885 registered shares).

In accordance with the Swedish Companies Act, distribu-

tion of dividends is limited to the lesser of the unrestrict-

ed equity shown in the consolidated or Parent Company

balance sheets after proposed appropriations to restrict-

ed equity. Unrestricted equity in the Parent Company at

December 31, 2000 amounted to 52,368.

As of December 31, 2000, Volvo related foundations

holdings in Volvo were 1.16% of the share capital and

2.71% of the voting rights.

As shown in the consolidated balance sheet as of

December 31, 2000, unrestricted equity amounted to

71,885 (82,490; 49,626). It is estimated that SEK

49,000 of this amount will be allocated to restricted

reserves.

Note 19 Marketable securities

Note 20 Cash and bank accounts

Note 21 Shareholders’ equity