Volvo 2000 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2000 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

73

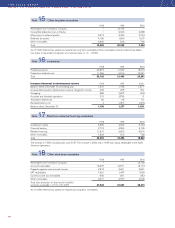

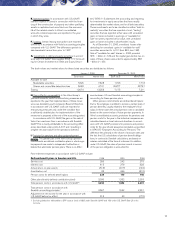

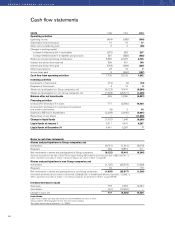

Total outstanding currency risk related contracts

December 31, 1998 December 31, 1999 December 31, 2000

Notional Book Estimated Notional Book Estimated Notional Book Estimated

amount value fair value amount value fair value amount value fair value

Foreign exchange

contracts - commercial

exposure 6

– receivable

position 71,381 145 2,189 69,531 91 4,044 19,017 71 1,513

– payable position 93,215 (491) (3,254) 107,509 (203) (5,628) 24,910 (89) (2,817)

Foreign exchange

contracts - financial

exposure 6

– receivable

position – – – – – – 32,741 34 1,046

– payable position – – – – – – 21,668 (76) (2,894)

Options – purchased

– receivable

position 4,745 – 193 4,434 – 67 808 – 2

– payable position 324 – (5) 392 – (4) 1,736 (3) (4)

Options – written

– receivable

position 2,867 – 38 3 — 0 385 – 0

– payable position 3,147 – (42) 3,415 — (49) 568 – 0

Total (346) (881) (112) (1,570) (63) (3,154)

6 As of 2000, the foreign exchange contracts are divided between commercial and financial exposure.

The notional amount of the derivative contracts represents the gross contract amount outstanding. To determine the estimated fair value,

the major part of the outstanding contracts have been marked to market. Discounted cash flows have been used in some cases.

Interest-rate risks

Interest-rate risks relate to the risk that changes in inter-

est-rate levels affect the Group’s profit. By matching

fixed-interest periods of financial assets and liabilities,

Volvo reduces the effects of interest-rate changes.

Interest-rate swaps are used to change the interest-rate

periods of the Group’s financial assets and liabilities.

Exchange-rate swaps make it possible to borrow in

foreign currencies in different markets without incurring

currency risks.

Volvo also holds standardized futures and forward-

rate agreements. The majority of these contracts are

used to secure interest levels for short-term borrowing

or placement.

Liquidity risks

Volvo ensures maintenance of a strong financial position

by continuously keeping a certain percentage of sales in

liquid assets. A proper balance between short- and long-

term borrowing, as well as the ability to borrow in the

form of credit facilities, are designed to ensure long-term

financing.

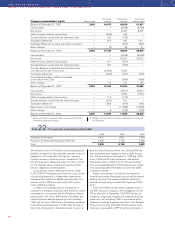

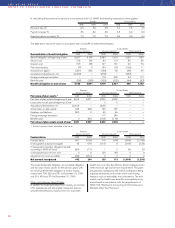

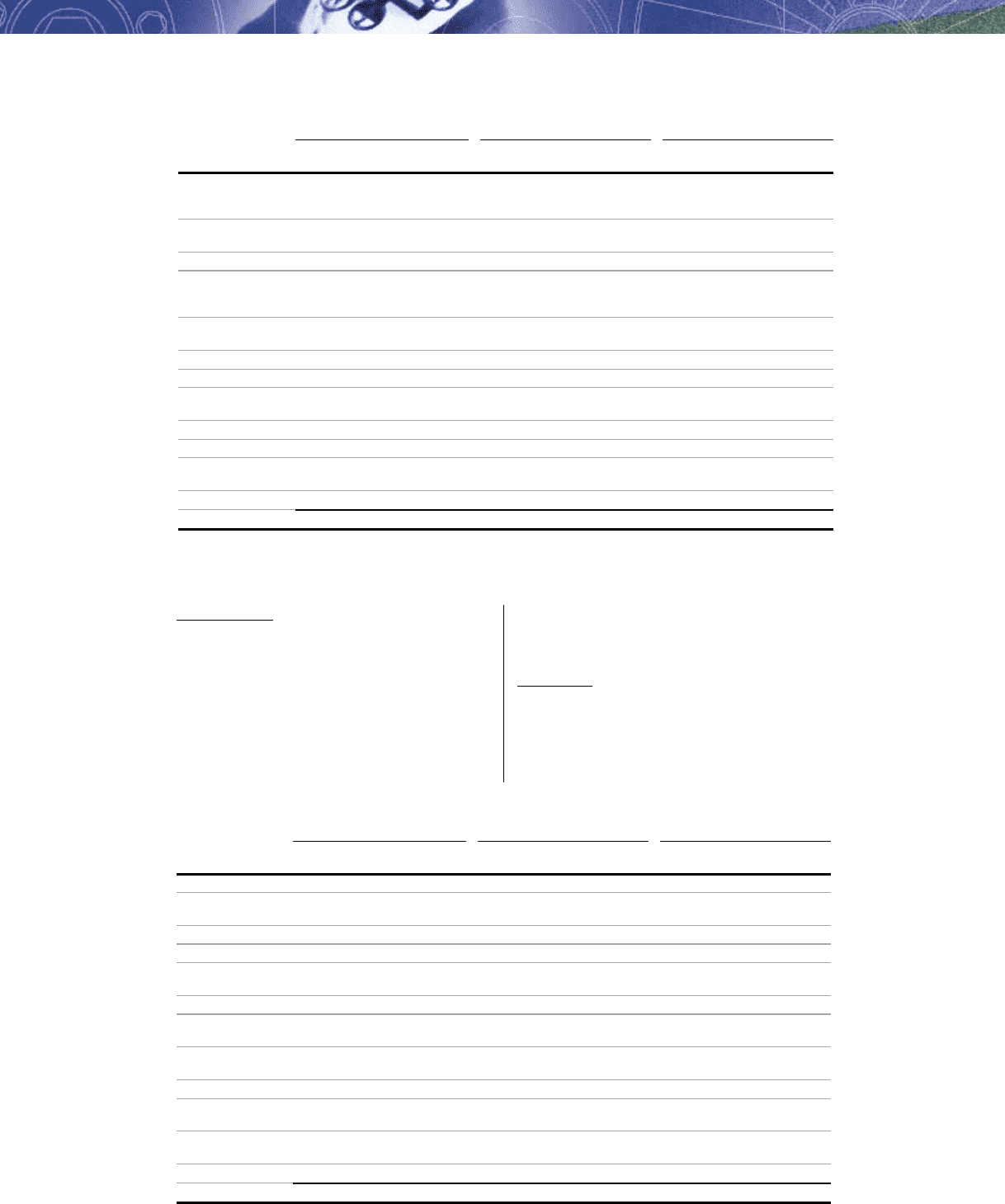

Volvo Group outstanding interest-risk related contracts

December 31, 1998 December 31, 1999 December 31, 2000

Notional Book Estimated Notional Book Estimated Notional Book Estimated

amount value fair value amount value fair value amount value fair value

Interest-rate swaps 7

– receivable

position 42,273 67 1,362 87,647 486 3,055 64,345 561 2,990

– payable position 65,266 (624) (1,519) 94,934 (373) (3,461) 57,488 (366) (2,969)

Forwards and futures

– receivable

position 240,245 – 1,781 231,907 – 99 174,576 0 201

– payable position 262,968 (54) (1,855) 220,640 – (61) 201,657 (28) (247)

Options purchased,

caps and floors

– receivable

position – – – – – – 52 0 1

– payable position – – – – – – – – –

Options written,

caps and floors

– receivable

position – – – – – – – – –

– payable position 420 (50) (50) – – – 55 0 0

Total (661) (281) 113 (368) 167 (24)

7 As from 2000 interest-rate swaps in foreign currencies are reported as interest-risk related contracts and are included in interest-

rate swaps. Comparative figures for 1998 and 1999 have been calculated.