Volvo 2000 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2000 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

99

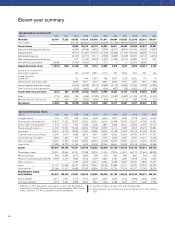

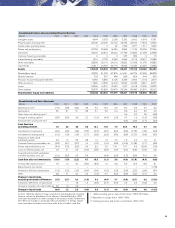

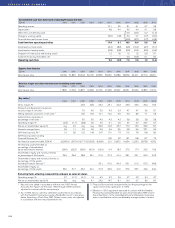

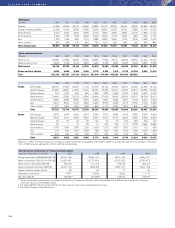

Consolidated balance sheet excluding Financial Services

SEK M 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000

Intangible assets 4,544 5,623 2,258 3,262 5,692 6,518 6,781

Property, plant and equipment 25,246 23,430 24,720 28,755 33,944 17,318 19,652

Assets under operating leases 0 0 49 1,366 1,817 1,611 4,245

Shares and participations 20,782 20,699 16,359 9,894 11,744 35,296 37,366

Inventories 23,047 23,813 23,042 27,756 31,883 21,053 22,998

Customer financing receivables 0 0 0 227 384 9 15

Interest bearing receivables 1,516 2,720 4,060 4,664 4,715 18,617 19,286

Other receivables 28,596 26,110 24,312 25,802 31,398 21,075 24,882

Liquid funds 21,811 20,637 23,170 16,605 15,439 24,465 10,958

Assets 125,542 123,032 117,970 118,331 137,016 145,962 146,183

Shareholders’ equity 43,332 51,200 57,876 61,951 69,375 97,692 88,338

Minority interests 703 351 448 859 804 544 593

Provision for post-employment benefits 6,060 6,855 3,126 3,266 2,904 2,118 2,619

Other provisions 11,806 12,525 12,618 15,962 19,435 9,861 8,277

Loans 24,266 16,301 13,432 1,047 5,018 12,206 18,233

Other liabilities 39,375 35,800 30,470 35,246 39,480 23,541 28,123

Shareholders’ equity and liabilities 125,542 123,032 117,970 118,331 137,016 145,962 146,183

As from 1992 the effects of major acquisitions and divestments of subsid-

iaries as well as the distribution of the shares in Swedish Match in 1996

have been excluded from other changes in the balance sheet. Furthermore

the effects of changes in exchange rates at translation of foreign subsid-

iaries have been excluded, since these effects do not affect cash flow.

1 1999, excluding gain on sale of Volvo Cars of SEK 26.7 billion.

2 Reported on a single line in 1990–1996.

3 Including pensions and similar commitments 1990–1991.

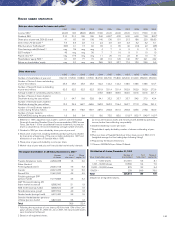

Consolidated cash flow statements

SEK bn 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000

Operating income 1(1.5) (0.5) (3.2) 0.5 9.4 10.4 3.9 8.7 6.9 6.7 6.2

Depreciation 3.0 3.1 3.1 3.8 5.1 5.6 5.4 6.8 9.6 5.2 6.3

Other items not affecting cash 20.6 0.0 0.5 (0.8)

Change in working capital 2(0.5) (0.4) 4.9 2.2 (1.4) (4.4) (1.9) 4.7 1.5 (1.0) (3.3)

Financial items and income tax 2(0.4) (2.0) (1.7) (0.4)

Cash flow from

operating activities 1.0 2.2 4.8 6.5 13.1 11.6 7.4 20.4 16.0 9.7 8.0

Investments in fixed assets (4.6) (2.9) (2.9) (3.5) (4.3) (6.5) (8.2) (9.9) (10.5) (4.9) (5.4)

Investments in leasing assets (1.2) (1.0) (1.3) (1.7) (2.5) (2.6) (3.9) (9.8) (12.7) (5.6) (5.7)

Disposals of fixed assets

and leasing assets 0.2 1.2 0.3 0.8 1.4 1.3 2.0 1.8 2.6 1.6 2.1

Customer financing receivables, net (0.3) (0.1) (3.7) 1.9 (1.5) (1.6) (4.8) (15.5) (12.8) (7.1) (4.5)

Shares and participations, net (5.4) (7.2) (0.2) 0.5 8.2 2.0 14.1 10.7 5.5 (25.9) (1.6)

Loans to external parties, net 0.3 0.1 0.5 (0.2) (0.9) (0.9) (1.9) (0.4) (0.3) (3.2) 0.3

Acquired and divested subsidiaries

and other business units, net (1.0) (0.2) 0.3 0.4 – (4.4) (0.9) (1.3) (5.6) 31.0 0.0

Cash flow after net investments (11.0) (7.9) (2.2) 4.7 13.5 (1.1) 3.8 (4.0) (17.8) (4.4) (6.8)

Increase (decrease) in loans 37.9 1.3 3.2 (5.9) (8.3) 1.5 6.8 5.6 19.5 16.3 8.1

Repurchase of own shares ––––––––––(11.8)

Dividend to AB Volvo shareholders (1.2) (1.2) (1.2) (0.6) (0.6) (1.5) (1.9) (2.0) (2.2) (2.6) (3.1)

Other 2.8 7.1 0.4 0.2 (1.3) 0.7 (5.0) (5.9) (0.2) (0.1) 0.0

Change in liquid funds,

excluding translation differences (1.5) (0.7) 0.2 (1.6) 3.3 (0.4) 3.7 (6.3) (0.7) 9.2 (13.6)

Translation differences on liquid funds – – 1.8 1.3 (0.3) (0.7) (0.3) 0.3 0.3 (0.2) 0.3

Change in long-term securities holdings 0.6 1.9 0.9 ––––––––

Change in liquid funds (0.9) 1.2 2.9 (0.3) 3.0 (1.1) 3.4 (6.0) (0.4) 9.0 (13.3)