Volvo 2000 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2000 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

69

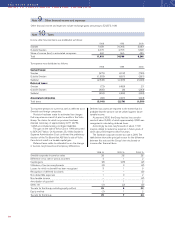

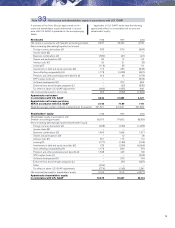

Other items not affecting cash pertain to surplus funds

from SPP –508 (–; –), capital gains on the sale of sub-

sidiaries and other business units, –573 (–26,900; –366),

risk provisions and losses related to doubtful receivables

and customer-financing receivables 522 (766; 526) and

other –120 (17; –186).

Net investments in customer-financing receivables

resulted in 2000 in a negative cash flow of SEK 4.5 bil-

lion (7.1). In this respect, liquid funds were reduced by

SEK 15.5 billion (14.2) pertaining to new investments in

financial leasing contracts and installment contracts.

Investments in shares and participations, net, in 2000

amounted to SEK 1.6 billion, of which SEK 1.3 billion

was attributable to additional investments in Scania. Net

investments in shares and participations during 1999 of

SEK 25.9 billion pertained in entirety to future invest-

ments, of which the acquisition of shares in Scania AB and

Mitsubishi Motors Corporation amounted to SEK 23.0

billion and SEK 2.3 billion, respectively. During 1998,

changes in the Group’s shareholdings resulted in a posi-

tive cash flow of SEK 5.5 billion, of which the sale of

shares, mainly Pharmacia & Upjohn Inc., contributed SEK

6.9 billion, while investments in shares reduced liquid

funds by SEK 1.4 billion.

Net investments during 2000 in loans to external par-

ties contributed to SEK 0.3 billion liquid funds. Net invest-

ments during 1999 in loans to external parties amounted

to SEK 3.2 billion, of which SEK 2.0 billion pertained to

payment of the convertible debenture loan in Henlys group

and SEK 1.3 billion new investment in corporate bonds.

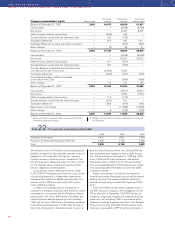

The change during the year in bonds and other loans

generated liquid funds of SEK 8.1 billion (16.3). New

borrowing during the year, mainly the issue of bond loans

and a commercial paper program, provided SEK 19.5 bil-

lion (19.0). Amortization during the year amounted to

SEK 11.4 billion (23.0).

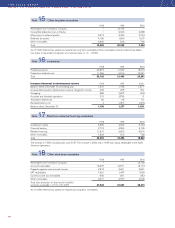

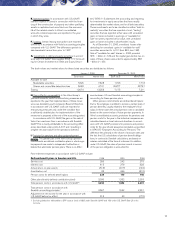

At December 31, 2000, future rental income from non-

cancellable financial and operating leases (minimum

leasing fees) amounted to 26,445 (19,910; 27,272), of

which 25,664 (19,383; 26,670) pertains to customer-

financing companies. Future rental income is distributed

as follows:

Financial leases Operating leases

2001 5,590 3,668

2002-2005 10,704 5,664

2006 or later 776 43

Total 17,070 9,375

Allowance for uncollectible

future rental income (164)

Unearned rental income (1,629)

Present value of future

rental income 15,277

At December 31, 2000, future rental payments (mini-

mum leasing fees) related to noncancellable leases

amounted to 4,385 (5,328; 7,042).

Future rental payments are distributed as follows:

Financial leases Operating leases

2001 544 906

2002–2005 980 1,692

2006 or later 140 123

Total 1,664 2,721

Rental expenses amount to:

1998 1999 2000

Financial leases:

– Contingent rents – – (1)

Operating leases:

– Contingent rents – – (80)

– Rental payments – – (837)

– Sublease payments – – 1

Total (1,826) (1,193) (918)

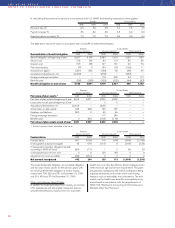

Book value of assets subject to finance lease:

2000

Acquisition costs:

Buildings 48

Land and land improvements 26

Machinery and equipment 12

Assets under operating lease 2,217

Total 2,303

Accumulated depreciation:

Buildings (3)

Land and land improvements (2)

Machinery and equipment (4)

Assets under operating lease (1,022)

Total (1,031)

Book value:

Buildings 45

Land and land improvements 24

Machinery and equipment 8

Assets under operating lease 1,195

Total 1,272

Note 28 Cash flow

Note 29 Leasing

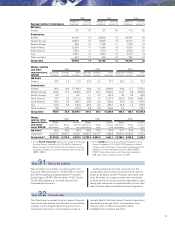

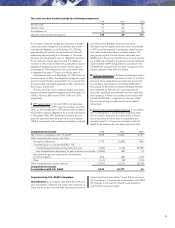

company against Bureau Central Francais, the owner of

the truck and its insurers. These proceedings partly over-

lap with the proceedings in the Commercial Court of

Nanterre. Volvo Group companies are also involved in

proceedings regarding minor matters in connection with

the tunnel fire before courts in Aosta, Italy, and Brussels,

Belgium. Volvo is unable to determine the ultimate out-

come of the litigation referred to above.

Volvo is involved in a number of other legal proceed-

ings incidental to the normal conduct of its businesses.

Volvo does not believe that any liabilities related to such

proceedings are likely to be, in the aggregate, material to

the financial condition of the Group.