Volvo 2000 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2000 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32

THE VOLVO GROUP YEAR 2000

BUSES

Europe and to favorable currency effects. Volvo’s share of the market for heavy buses in

Europe improved to 18% (15%). There was a favorable trend of business in the UK, in particu-

lar, where Volvo regained market shares as a result of new and successfully

launched products. The Nordic markets also showed strong growth. At year-

end, order bookings were 25% lower than on the same date in 1999. Order

bookings in North America, the Middle East and Europe declined, due mainly

to a slower market development and a change in product-generations.

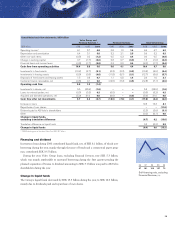

Operating income

Operating income in 2000 nearly doubled to SEK 440 M (224), including a refund from SPP

of SEK 22 M. The higher operating income was a result of increased sales, high utilization of

capacity and positive effects of an improved cost level. The positive trend in Mexico continued

but the demand for coaches weakened in Canada and the U.S. The operating margin increased

to 2.6%, compared with 1.5% in 1999.

Production and investments

During the year Volvo produced 11,244 (10,050) buses and bus chassis, of which 49% were

complete buses. There was a high degree of utilization in the production system in Europe and

North America.

Moving the production in Great Britain to Sweden and Poland continued the consolidation

of the industrial structure. The planned capacity in Poland is 2,500, including 1,100 complete

buses. An expansion of the existing plant in Mexico was inaugurated for the production of the

Volvo 7550 coach model. In June 2000, Volvo Buses signed an agreement with Shanghai

Automotive Industry Corporation to establish a joint-venture company in China for produc-

tion and sales of city and commuter buses. The first bus was produced in September 2000.

Ambitions for 2001

Europe shows a decreasing market in 2001 and the weakening in the U.S. and Canada will con-

tinue. The business activities in China and other parts of Asia will increase during 2001. The

process of exploiting existing strengths and building for the future continues. Key areas in this

process are increased profitability through high quality, reduced product costs based on more

efficient production processes, customer focused sales strategy and improved assets manage-

ment. The future launches of products based on the new modularized TX platform will con-

tinue to support this program.

Strategic development

Volvo Buses has grown rapidly, through organic growth and through several acquisitions and

joint ventures in Europe, North America and Asia. Volvo will continue to exploit the global

presence and the synergies between the different companies and build on common compon-

ents whenever feasible. The products will be further modularized, which will reduce the num-

ber of parts and suppliers drastically. A series of new products based on the TX platform will

follow during the next couple of years and TX modules are planned to be introduced.

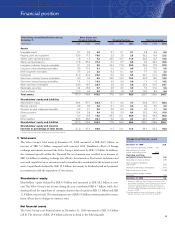

Number of vehicles invoiced Buses

1998 1999 2000

Western Europe 3,580 3,430 3,870

Eastern Europe 280 200 124

North America 2,730 3,640 3,869

South America 1,510 710 980

Asia 1,650 1,000 1,659

Other markets 450 520 513

Total 10,200 9,500 11,015

Largest markets Buses

Volvo buses Market share,

registrations %

1999 2000 1999 2000

Mexico 1,270 1,620 18.5 16.0

United States 11,850 1,520 n/a n/a

Great Britain 790 1,230 28.3 48.6

Brazil 460 610 6.4 6.4

Sweden 470 560 47.3 54.5

1 Deliveries from factory.

Net sales per market Buses

SEK M 1998 1999 2000

Western Europe 5,528 5,735 6,767

Eastern Europe 366 226 182

North America 5,574 6,871 7,723

South America 910 469 732

Asia 1,519 943 1,269

Other markets 389 469 514

Total 14,286 14,713 17,187

Deliveries of buses

and chassis increased by 16%