Volvo 2000 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2000 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

76

THE VOLVO GROUP

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Significant differences between Swedish and U.S.

accounting principles

A. Foreign currency derivatives. Volvo uses forward

exchange contracts and currency options to hedge the

value of future flows of payments in foreign currency.

Outstanding contracts that are highly certain to be

covered by currency transactions are not assigned a

value in the consolidated accounts.

In accordance with U.S. GAAP, outstanding futures

contracts and currency options are valued at market

through so-called fictive closing. The profits and losses

that thereby arise are included when calculating income.

Unrealized net losses for 2000 pertaining to forwards

and options contracts are estimated at 1,286 (632; 628).

B. Income taxes. Effective in 1999, Volvo adopted the

Swedish Financial Accounting Standards Council’s rec-

ommendation, RR9, Income Taxes, which in all material

respects corresponds with SFAS 109, Accounting for

Income Taxes, and IAS 12, Income Taxes (revised 1996).

Previously, Volvo reported deferred tax receivables relat-

ed to temporary differences and tax loss carryforwards

to the extent that these could be offset against deferred

tax liabilities within the same tax jurisdiction. In 1999,

deferred tax assets are reported under the condition that

it is probable that the amount can be applied against

future taxable income. Comparative figures for 1998

have been restated to reflect the new accounting prin-

ciple. At the beginning of 1998 and 1999, this resulted

in an increase of the Volvo Group’s shareholders’ equity

by SEK 1.5 and 1.3 billion, respectively.

C. Business combinations. Acquisitions of certain sub-

sidiaries are reported differently in accordance with

Volvo’s accounting principles and U.S. GAAP. The differ-

ence is attributable primarily to reporting and amortization

of goodwill.

In 1995, AB Volvo acquired the outstanding 50% of

the shares in Volvo Construction Equipment Corporation

(formerly VME) from Clark Equipment Company, in the

U.S. In conjunction with the acquisition, goodwill of SEK

2.8 billion was reported. The shareholding was written

down by SEK 1.8 billion, which was estimated corres-

ponded to that portion of the goodwill that was attributable

at the time of acquisition to the Volvo trademark. In accord-

ance with U.S. GAAP, the goodwill of SEK 2.8 billion

should be amortized over its estimated useful life (20

years).

Volvo’s earnings in 1993 included a provision for an

excess value related to Volvo Trucks which resulted from

the exchange of shares with Renault. In accordance with

U.S. GAAP, the corresponding excess value should have

been reported as goodwill which was being amortized

over a period of five years.

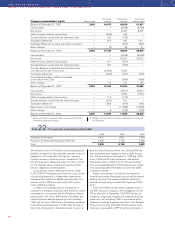

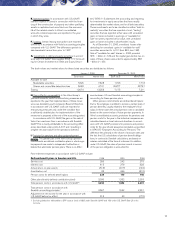

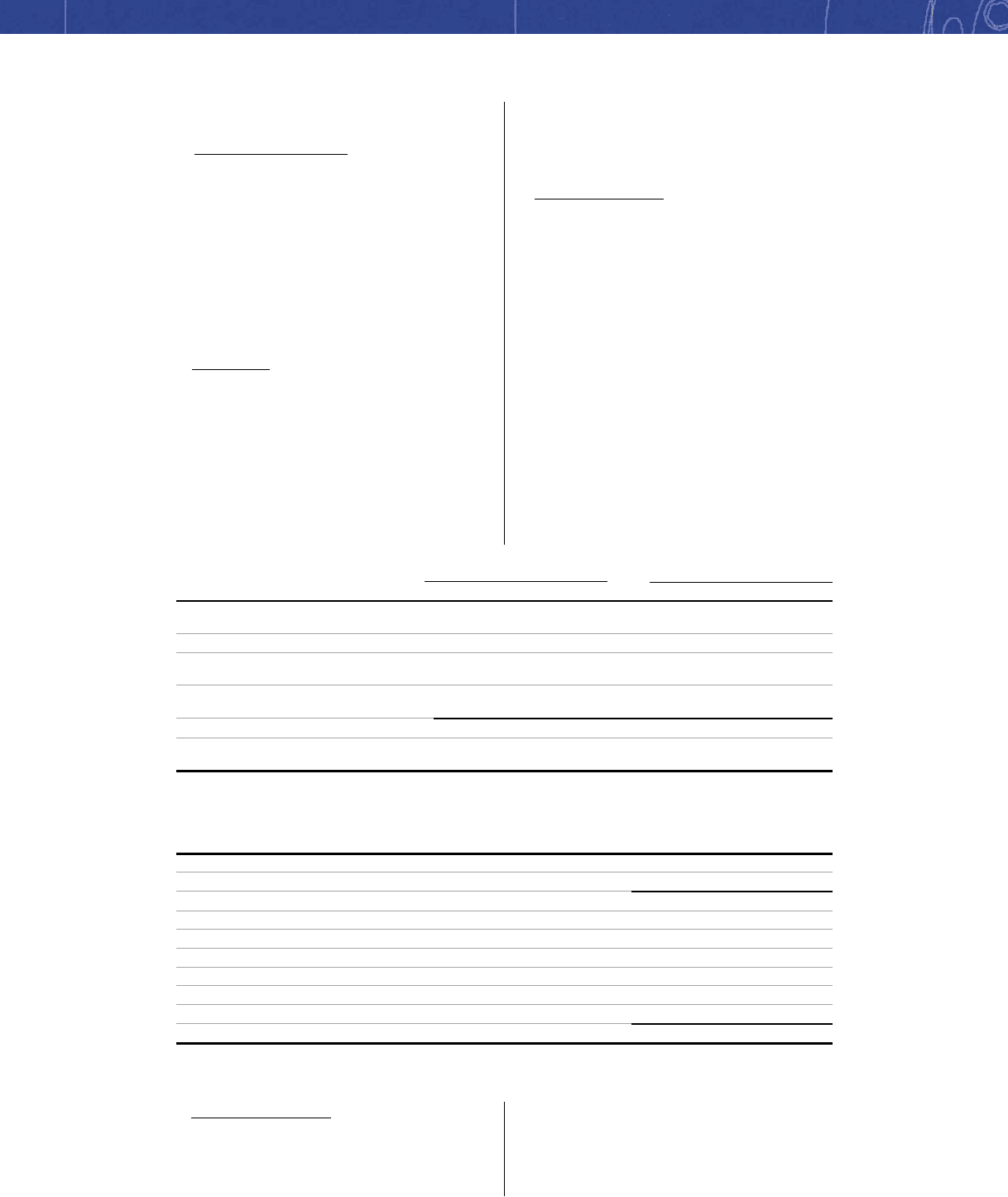

Net income Shareholders’ equity

Goodwill 1998 1999 2000 1998 1999 2000

Goodwill in accordance with

Swedish GAAP, December 31 (512) 1(398) (491) 5,607 5,093 4,969

Items affecting reporting of goodwill:

Volvo Trucks with regard to

exchange of shares with Renault (439) – – – – –

Acquisition of Volvo Construction

Equipment Corporation (91) (91) (91) 1,499 1,408 1,317

Net change in accordance with U.S. GAAP (530) (91) (91) 1,499 1,408 1,317

Approximate goodwill in accordance with

U.S. GAAP, December 31 (1,042) (489) (582) 7,106 6,501 6,286

1 Including write-downs.

1 Adjustment of shareholders’ equity in accordance with U.S. GAAP before tax effects.

2 Adjustment of income in accordance with U.S. GAAP before tax.

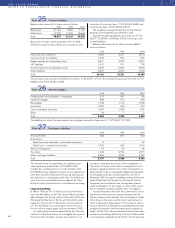

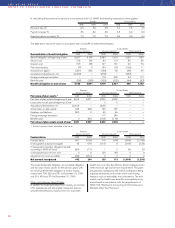

FAS 115- Tax and FAS 115-

Summary of debt and equity securities Market adjustment, minority adjustment,

available for sale and trading Book value value gross interests net

Trading, December 31, 2000 7,175 7,211 36 1(10) 26

Trading, January 1, 2000 12,674 13,258 584 1(164) 420

Change 2000 (548) 2154 (394)

Available for sale

Marketable securities 1,723 1,718 (5) 1 (4)

Shares and convertible debenture loan 29,877 23,781 (6,096) 1,707 (4,389)

Available for sale

December 31, 2000 31,600 25,499 (6,101) 11,708 (4,393)

January 1, 2000 13,409 12,569 (840) 1235 (605)

Change 2000 (5,261) 1,473 (3,788)

D. Shares and participations. In calculating Volvo’s share

of earnings and shareholders’ equity in associated com-

panies in accordance with U.S. GAAP, differences

between the accounting for these companies in accord-

ance with Volvo’s principles and U.S. GAAP have been

reflected.

Income from investments in associated companies is

reported before taxes in accordance with Swedish

accounting principles, and after tax in accordance with

U.S. GAAP. Taxes attributable to associated companies

amounted to 244 (321; 60).