Volvo 2000 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2000 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

35

decreased slightly. This overall increase in sales was driven mainly by the positive development

in the excavator business, as well as the increasing market for compact equipment.

The market in Western Europe continued to be the largest single market, accounting for

approximately 51% of sales. North America accounted for nearly 30% of sales and Asia and

the rest of the world for the remaining 19%.

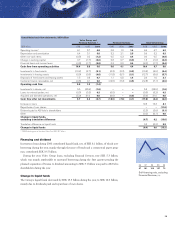

Operating income

Operating income amounted to SEK 1,594 M (1,709), despite the downturn in the market

and price pressure on heavy equipment in North America and Europe. Operating income

included a refund from SPP of SEK 147 M. The operating margin reached 8.0%, a competi-

tive level within the industry.

Production and investments

In 2000, a number of new products were successfully launched, including two new articulat-

ed haulers, A35D and A40D, and a new generation of wheel loaders. In

the field of excavators, a range of new models was introduced. Other

products launched recently include additions to the existing range of

compact excavators, compact wheel loaders and motor graders. The

new products were received very favorably by dealers, customers and

the trade press.

Last year saw the start of production of compact excavators and the assembly of articulat-

ed haulers in South Korea. During the autumn, Volvo CE decided to begin producing con-

struction equipment in Volvo’s bus plant in Poland. In addition to the industrial advantages,

the venture strengthens the company’s presence in the increasingly important markets in

Eastern Europe. To date, a small number of articulated haulers have been assembled there.

New investments were made in e-commerce technology. The company invested USD 5 M

in IronPlanet Inc., a leading U.S.-based e-auction company for used construction equipment.

The investment will act as an additional component of the future e-commerce strategy.

Ambitions for 2001

It is anticipated that the decline in the world market will continue in 2001. Volvo CE’s ambi-

tion is to increase its market shares, and to focus on the softening market demand, with cost

reductions in all areas. In the U.S., where the company currently has 30% of its sales, a restruc-

turing program has been launched. This program is being implemented and will continue dur-

ing 2001. At the marketing level, the company has taken steps to reinforce the relationship

with dealers under a program called “Partners for Profit.”

Strategic development

Volvo CE has grown considerably in recent years and the ambition is to continue growing both

organically and through acquisitions, with a continued focus on profitable growth.

At the marketing level, the company has taken steps to reinforce the Volvo brand.

Range of new products

launched successfully in 2000