Volvo 2000 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2000 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE VOLVO GROUP

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

62

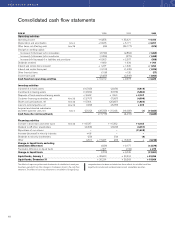

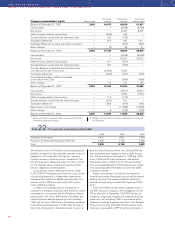

Value in Value in Deprecia- Subsidaries Trans- Value in Book value

Accumulated balance balance tion and acquired lation Re- balance in balance

depreciation and sheet sheet amortiza- Sales/ and differ- classifi- sheet sheet

amortization 1998 1999 tion 2scrapping divested ences cations 2000 2000 3

Goodwill 1,592 1,836 491 – – 74 (47) 2,354 4,969

Entrance fees,

aircraft engine programs 1,134 1,170 82 (32) – 2 (1) 1,221 457

Other intangible assets 113 325 75 (17) – 9 (2) 390 1,499

Total intangible assets 2,839 3,331 648 (49) 0 85 (50) 3,965 6,925

Buildings 6,840 3,654 461 (73) 51 99 6 4,198 7,846

Land and land improvements 597 226 25 (5) – 10 (1) 255 2,535

Machinery and equipment131,550 15,143 2,247 (916) (197) 332 (95) 16,514 10,462

Construction in progress,

including advance payments – – – – – – – – 1,388

Total buildings, machinery

and equipment 38,987 19,023 2,733 (994) (146) 441 (90) 20,967 22,231

Assets under operating leases 5,354 4,179 2,870 (1,621) – 276 (666) 5,038 14,216

Total tangible assets 44,341 23,202 5,603 (2,615) (146) 717 (756) 26,005 36,447

1 Machinery and equipment pertains mainly to production equipment.

2 Includes write-downs.

3 Acquisition cost less accumulated depreciation and amortization.

Capital expenditures amounted to 5,430 (5,172;

10,549). Investments in assets under operating leases

amounted to 5,709 (5,578; 12,654).

Capital expenditures approved but not yet implement-

ed at December 31, 2000, amounted to SEK 6.8 billion

(7.2; 18.0).

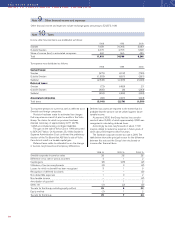

automation. It offers products, services and complete

solutions in production equipment, maintenance and ser-

vice to customers within the manufacturing industry.

Eddo Restauranger AB

As from December, 2000, Volvo owns 30% of Eddo

Restauranger after the divestment of 51% to Amica AB,

which acquired 51% of the shares in 2000 and has the

option to acquire the remaining shares in 2002.

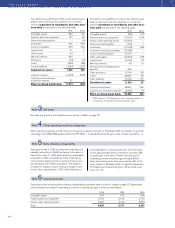

Mitsubishi Motors Corporation

In 1999, an agreement was signed between Volvo and

Mitsubishi Motors Corporation covering ownership co-

operation and a letter of intent to form a strategic alliance

between the companies regarding market, product and

industrial cooperation in trucks and buses. In conjunction

with this agreement Volvo acquired shares corresponding

to 5% of the votes and capital in Mitsubishi Motors.

Scania AB

During 1999, Volvo acquired 43.5% of the capital and

28.6% of the voting rights in Scania, one of the world’s

leading manufacturers of trucks and buses. At December

2000, Volvo’s holding in Scania was 45.5% of the capital

and 30.6% of the voting rights.

Petro Stopping Centers Holding LP

In 1999, Volvo acquired 28.7% of the truck-stop chain

Petro Stopping Centers in the U.S. This expanded

service to Volvo’s truck customers along the interstate

network in the U.S., offering preventative maintenance,

spare parts sales, emergency road service and minor

repairs.

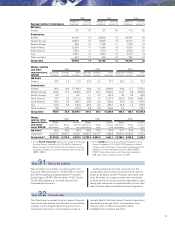

A specification of Group holdings of shares and partici-

pations appears on page 89.

The Volvo Group has transactions with some of its

associated companies. As of December 31, 2000, the

Group’s net receivables from associated companies

amounted to 358 (820; 6,260).

The market value of Volvo’s holdings of shares and

participations in listed companies as of December 31,

2000 is shown below.

Book value Market value

Scania AB 24,051 19,015

Mitsubishi Motors 2,344 1,331

Deutz AG 670 166

Bilia AB 570 721

Henlys Group 524 443

Total holdings

in listed companies 28,159 21,676

Holdings in non-

listed companies 2,322 –

Total shares and

participations 30,481 –

Shanghai Sunwin Bus Corporation

In 2000, Volvo and the Chinese vehicle manufacturer,

Shanghai Automotive Industry Corporation, signed

agreeements covering establishment in Shanghai of a

joint-venture company, Shanghai Sunwin Bus Corporation,

for the manufacture and sale of city and commuter bus-

es. Each party will own 50% of the new company.

Euromation AB

In 2000, a new company was formed, in which Volvo

acquired 55%. Euromation is a supplier within industrial

Note 13 Shares and participations