Volvo 2000 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2000 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

77

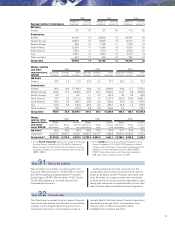

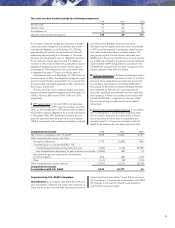

Post-retirement expenses in accordance with U.S. GAAP include:

Defined-benefit plans in Sweden and U.S. 1998 1999 2000

Service cost 289 242 279

Interest cost 415 279 328

Actual return on plan assets (513) (817) (149)

Amortization, net 33 466 (310)

Pension costs for defined benefit plans 224 170 148

Other plans (mainly defined contribution plans) 3,030 1,332 2,253

Total pension costs in accordance with U.S. GAAP 13,254 1,502 2,401

Total pension costs in accordance with

Swedish accounting principles 13,567 1,542 2,231

Adjustment of net income for the year in accordance with

U.S. GAAP before tax effect 313 40 (170)

1 Excluding deduction attributable to SPP surplus funds of 683 under Swedish GAAP and 160 under U.S. GAAP. See (J) in this

footnote.

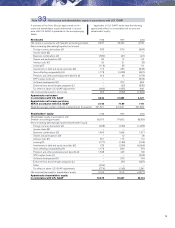

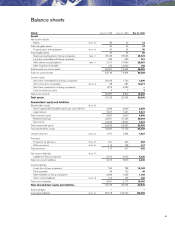

January 1, 2000 December 31, 2000

Book value Market value Book value Market value

Available for sale

Marketable securities 7,826 7,828 1,723 1,718

Shares and convertible debenture loan 5,583 4,741 29,877 23,781

Trading 12,674 13,258 7,175 7,211

The book values and market values for these listed securities are distributed as follows:

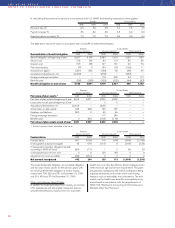

H. Items affecting comparability. In the Volvo Group’s

year-end accounts, costs for restructuring measures are

reported in the year that implementation of these meas-

ures was decided by each company’s Board of Directors.

In accordance with U.S. GAAP, costs are reported for

restructuring measures only under the condition that

a sufficiently detailed plan for implementation of the

measures is prepared at the end of the accounting period.

In accordance with U.S. GAAP, the gain on the sale of

Volvo Cars was lower than in accordance with Swedish

GAAP. This is mainly attributable to the accounting differ-

ences described under points A, E, H and I resulting in

a higher net asset value for the operations divested.

I. Provision for pensions and other postemployment

benefits. The greater part of the Volvo Group’s pension

commitments are defined contribution plans in which regu-

lar payments are made to independent authorities or

bodies that administer pension plans. There is no differ-

ence between U.S. and Swedish accounting principles in

accounting for these pension plans.

Other pension commitments are defined benefit plans;

that is, the employee is entitled to receive a certain level of

pension benefits, usually related to the employee’s final

salary. In these cases the annual pension cost is calculated

based on the current value of future pension payments. In

Volvo’s consolidated accounts, provisions for pensions and

pension costs for the year in the individual companies are

calculated based on local rules and directives. In accord-

ance with U.S. GAAP, provisions for pensions and pension

costs for the year should always be calculated as specified

in SFAS 87, “Employers Accounting for Pensions.” The

difference lies primarily in the choice of discount rates and

the fact that U.S. calculations of pension benefit obliga-

tions, in contrast to Swedish calculations, are based on

salaries calculated at the time of retirement. In addition,

under U.S. GAAP, the value of pension assets in excess

of the pension obligation is accounted for.

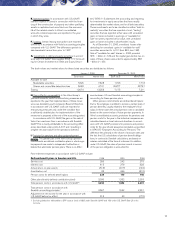

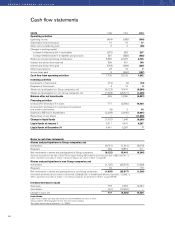

E. Interest expense. In accordance with U.S. GAAP,

interest expense incurred in connection with the finan-

cing of the construction of property and other qualifying

assets is capitalized and amortized over the economic

life of the related assets. In Volvo’s consolidated

accounts, interest expenses are reported in the year

in which they arise.

F. Leasing. Certain leasing transactions are reported

differently in accordance with Volvo’s accounting principles

compared with U.S. GAAP. The differences pertain to

sale-leaseback transactions prior to 1997.

G. Investments in debt and equity securities. In accord-

ance with U.S. GAAP, Volvo applies SFAS 115: “Account-

ing for Certain Investments in Debt and Equity Securi-

ties.” SFAS 115 addresses the accounting and reporting

for investments in equity securities that have readily

determinable fair market values, and for all debt securities.

These investments are to be classified as either “held-to-

maturity” securities that are reported at cost, “trading”

securities that are reported at fair value with unrealized

gains or losses included in earnings, or “available-for-

sale” securities, reported at fair value, with unrealized

gains or losses included in shareholders’ equity.

As of December 31, 2000, unrealized losses after

deducting for unrealized gains in “available-for-sale”

securities amounted to 6,101 (loss 840; loss 198).

Sale of “available-for-sale” shares in 2000 provided

SEK – billion (–; 6.6) and the capital gain, before tax, on

sales of these shares amounted to approximately SEK

– billion (–; 4.5).