Volvo 2000 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2000 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

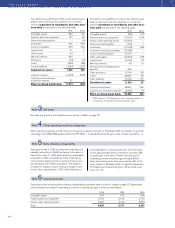

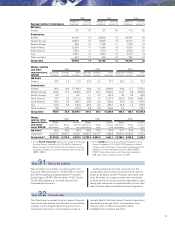

1998 1999 2000

Warranties 6,599 3,594 3,644

Provisions in insurance operations 2,139 2,491 2,488

Provisions attributable to participations in associated companies 1,819 155 43

Restructuring measures 1,718 1,621 798

Provison for residual value risks 954 519 725

Provision for service contracts 629 913 1,247

Other provisions 7,012 3,321 3,731

Total 20,870 12,614 12,676

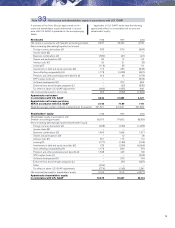

The listing below shows the Group’s non-current liabil-

ities in which the largest loans are distributed by curren-

cy. Most are issued by Volvo Treasury AB and Volvo

Group Finance Europe BV. Information on loan terms

is as of December 31, 2000. Volvo hedges foreign-

exchange and interest-rate risks using derivative instru-

ments. See also Note 32.

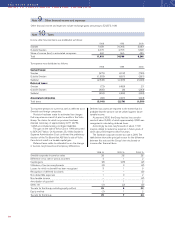

Bond loans 1998 1999 2000

FRF 1995–1998/2005–2009, 6.13–7.63% 3,887 3,271 3,383

GBP 1999/2003, 6.27% – – 142

DKK 1996–1998/2002–2005, 4.30–6.00% 704 377 389

SEK 1997–2000/2002–2008, 4.08–12.51% 3,749 3,101 2,952

JPY 1995–1999/2002–2005, 0.10–3.33% 2,640 4,654 4,812

HKD 1999/2006, 7.99% – – 122

ITL 1,357 221 –

NLG 1998/2003, 5.163% 214 248 256

DEM 771 – –

USD 1997–2000/2002–2008, 6.93–7.36% 1,921 1,918 667

EUR 1999–2000/2002–2009, 0.10–6.24% – 10,002 17,505

Other bond loans 381 446 644

Total bond loans 15,624 24,238 30,872

Other loans 1998 1999 2000

USD 1997–2000/2002–2017, 5.50–9.35% 3,721 2,954 4,487

GBP 1994–2000/2002–2009, 5.42–8.12% 777 1,151 858

DEM 1996–2000/2002–2006, 4.64% 46 489 493

BRL 1996–2000/2002–2006, 6.00–18.14% 258 364 849

NLG 1998–2000/2002–2004, 5.25–6.60% 214 266 254

SEK 1989–1999/2006–2013, 4.00–9.00% 657 631 822

CAD 1988/2003, 9.35% 490 543 558

PEI 1999–2000/2002–2004, 5.43–8.01% – – 418

Other loans 3,567 1,586 794

Total other long-term loans 9,730 7,984 9,533

Other long-term liabilities 658 292 265

Total 26,012 32,514 40,670

Of the above long-term loans, 2,360 (2,527; 2,823) was secured.

67

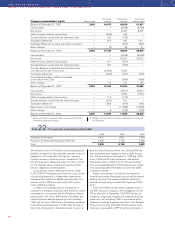

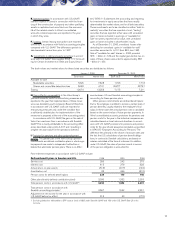

the financial statements when the present value could

be calculated in a reliable manner. The rules governing

how the refund was to be made were established in the

spring of 2000 and a refund of 683 was recognized in

Volvo's accounts during the second quarter of 2000. The

present value of the refund was included as Other oper-

ating income in the income statement. In the balance

sheet, the unsettled refunds are shown as interest-bear-

ing receivables.

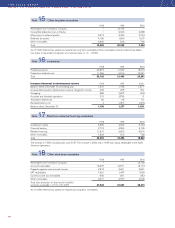

Long-term liabilities mature as follows:

2002 6,532

2003 5,408

2004 10,844

2005 5,650

2006 1,843

2007 or later 10,393

Total 40,670

At year-end 2000, credit facilities granted but not utilized

and which can be used without restrictions amounted to

approximately SEK 23 billion (20; 22). In 2000 approxi-

mately SEK 19 billion of these facilities consisted of

stand-by facilities for loans with varying maturities

through the year 2003. A fee normally not exceeding

0.25% of the unused portion is charged for credit facilities.

Note 23 Other provisions

Note 24 Non-current liabilities