Volvo 2000 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2000 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

79

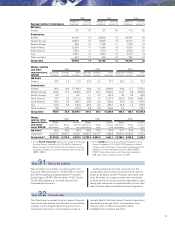

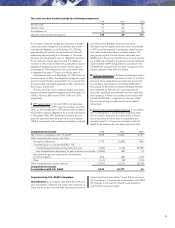

The costs for other benefits include the following components

1998 1999 2000

Service costs 46 35 45

Interest costs 77 60 76

Amortization, net 12 (5) (4)

Net post-retirement benefit expense 135 90 117

Comprehensive income 1998 1999 2000

Net income in accordance with U.S. GAAP 9,432 31,690 3,127

Other comprehensive income, net of tax

Translation differences 1,173 (1,389) 966

Unrealized gains on securities (SFAS 115):

Unrealized gains (losses) arising during the year (186) (419) (3,787)

Less: Reclassification adjustment for gains included in net income (2,655) (43) (1)

Adjustment for pensions and similar commitments

(minimum liability) 452 (54) (132)

Other (141) (8) (119)

Other comprehensive income, subtotal (1,357) (1,913) (3,073)

Comprehensive income

in accordance with U.S. GAAP 8,075 29,777 54

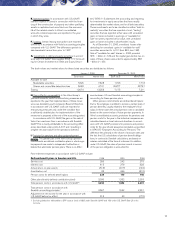

An increase of one percentage point per year in health-

care costs would change the accumulated post-retire-

ment benefit obligation as of December 31, 1999 by

approximately 65, and the net post-retirement benefit

expense by approximately 6. A decrease of 1% would

decrease the accumulated value of obligations by about

57 and reduce costs by approximately 5. In 2000, an

increase of 1% would increase the accumulated value of

obligations by about 81 and increase costs by about 7;

a decrease of 1% would reduce the accumulated value

of obligations by about 70 and cut costs by about 6.

Calculations made as of December 31, 2000 show an

annual increase of 8% in the weighted average per capita

costs of covered health-care benefits; it is assumed that

the percentage will decline gradually to 5% in 2010 and

then remain at that level.

The discount rates used in determining the accumulat-

ed post-retirement benefit obligation as of December 31,

1998, 1999 and 2000 were 6.75%, 7.5% and 7.5%,

respectively.

J. SPP surplus funds. In the mid-1990s and later years

surpluses arose in the SPP insurance company since the

return on the management of ITP pension plan exceeded

the growth in pension obligations. As a result of decisions

in December 1998, SPP distributed, company by com-

pany, the surpluses that had arisen up to and including

1998. In accordance with a statement issued by a special

committee of the Swedish Financial Accounting

Standards Council, surplus funds that were accumulated

in SPP should be reported in companies when their pre-

sent value can be calculated in a reliable manner. The

rules governing how the refund was to be made were

established in the spring of 2000 and an income amount-

ing to 683 was included in the Group’s income statement

under Swedish GAAP during 2000. In accordance with

US GAAP, the surplus funds should be recognised in the

income statement when they are settled.

K. Software development. Software development, used in

the Group’s operations, is conducted in Volvo IT. In Volvo’s

accounts, these expenditures are expensed as incurred.

In accordance with Statement of Position (SOP) 98–1

“Accounting for the Costs of Computer Software Develop-

ed or Obtained for Internal Use” such expenditures

should be capitalized and amortized over the useful lives

of the projects. In Volvo’s accounting in accordance with

U.S. GAAP, SOP 98–1 is applied as of January 1999.

The new accounting principle should not be applied

retroactively.

L. Entrance fees, aircraft engine programs. In connection

with its participation in aircraft engine programs, Volvo

Aero in certain cases pays an entrance fee. In Volvo’s

accounting these entrance fees are capitalized and

amortized over 5 to 10 years. In accordance with U.S.

GAAP, these entrance fees are expensed as incurred.

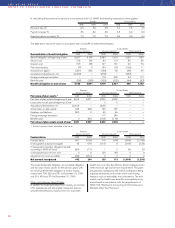

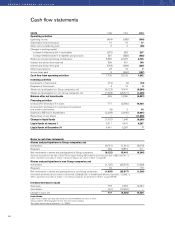

Supplementary U.S. GAAP information

Classification. In accordance with SFAS 95, “cash and

cash equivalents” comprise only funds with a maturity of

three months or less from the date of purchase. Some of

Volvo’s liquid funds (see Notes 19 and 20) do not meet

this requirement. Consequently, in accordance with SFAS

95, changes in this portion of liquid funds should be

reported as investing activities.