Volvo 2000 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2000 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

43

95%, of which 56% to external customers. Of total leasing, 40% involved contracts longer than

five years.

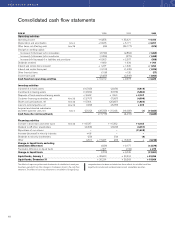

Volvo Treasury’s value added, included in operating income as of 2000, is generated through

management of the Volvo Group’s assets and liabilities, and foreign exchange

operations.

During the year, Volvo Treasury continued to develop the Group’s treasury

operations, in part through the introduction of a common cash-pool system for Europe.

Operating income

Operating income amounted to SEK 1,396 M (977), of which SEK 610 M pertained to gains

on the sale of Volvia’s securities portfolio, and SEK 38 M to SPP refunds. Operating income

1999 included reversals of reserves for customer financing of SEK 240 M. Adjusted for the sale

of securities, including the lower yield from Volvia’s portfolio compared with the preceding

year, the refund from SPP, Volvo Treasury’s income and the reversal of reserves in 1999, oper-

ating income declined by 8%, compared with year-earlier income.

Operating income in the established customer-financing companies was stable, but was

affected by increased credit losses from truck financing in North America. At the same time, in-

come from operations in South America and Eastern Europe was higher than in previous years.

Income from other operations – insurance, real estate and treasury – was higher than in the

preceding year.

Provision for risks

Provision is made for both credit risks and residual-value risks to the degree that residual-value

risks are attributable to the customer-financing company. For customers unable to fulfill their

contractual obligations, specific provisions for credit risks are made based on an individual

assessment of each contract. In addition, in accordance with established policies, provisions are

made for estimated credit and residual-value losses for each customer-financing company,

based on historical data and anticipated future risks.

Total reserves amounted to 2.7% of the credit portfolio at year-end (2.7), of which the

reserve for residual-value risk amounted to 0.4%, and the credit reserve allocated to individ-

ual contracts amounted to 1.6%. Realized credit losses in 2000 amounted to SEK 411 M, com-

pared with SEK 277 M in 1999. The negative effect on income for the year of changes in

reserves and realized credit losses amounted to SEK 397 M.

Strong profitable growth

00

Assets, SEK bn

999897

66.556.543.233.3

97 98 99 00

Return on share-

holders’ equity, %

4.0 8.9 12.0 14.1

97 98 99 00

Market

penetration, %

30 27 26 31

00

Credit portfolio,

SEK bn

999897

53.645.135.426.2

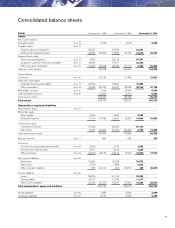

Distribution of credit portfolio, net1

% 1998 1999 2000

Commercial products

Operational leasing 26 25 23

Financial leasing 31 29 28

Installment contracts 26 29 34

Dealer financing 16 16 14

Other customer credits 1 1 1

1) Excluding divested operations in 1998

Condensed income statement1

SEK M 1998 1999 2000

Net sales 7,224 8,637 9,678

Operating income 590 977 1,396

Income from investments

in associated companies 90 89 103

Income after

financial items 680 1,066 1,499

Taxes (242) (316) (471)

Net income 438 750 1,028

1) Excluding divested operations in 1998

Net sales as percentage

of Volvo Group sales

7%