Volvo 2000 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2000 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

59

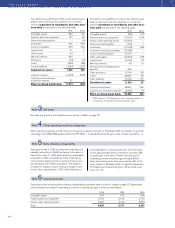

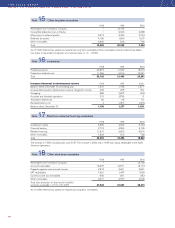

Volvo’s share of income in associated companies before taxes, is shown below:

Income (loss) Dividends received

1998 1999 2000 1998 1999 2000

Bilia AB 131 89 120 35 35 41

AB Volvofinans 87 89 111 7 8 8

Aviation Lease Finance 3 7 19 – – –

Xian Silver Bus Corp 16 4 13 – – –

AVC Intressenter AB 6 1 (1) 506 81 24

Omninova Technology AB 0 (26) (17) – – –

Turbec (4) (22) (44) – – –

Arrow Truck Sales – (21) (76) – – –

Petro Stopping Centers Holding LP – (13) (46) – – –

Other companies (25) (10) 15 1 9 31

Holdings no longer reported as

equity method investments

Scania AB 1– 467 341 – – 637

Netherlands Car BV 232 –––––

VOCS Finance Ltd 16 – – 85 – –

Other companies (2) –––––

Subtotal 460 565 435 634 133 741

Gains (loss) on sale of shares

in associated companies

Other companies (16) 2 9

Subtotal (16) 2 9

Total income from investments

in associated companies 444 567 444

1 On March 14, 2000 the European Commission rejected Volvo's application for approval of Volvo’s proposed acquisition of Scania.

As a result, Volvo's holding in Scania is no longer reported in accordance with the equity method.

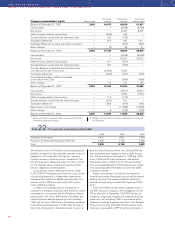

1998 1999 2000

Dividends received

Scania AB 1– 180 –

Henlys Group Plc – 13 23

Pharmacia & Upjohn, Inc. 43 – –

Other 3 8 3

Subtotal 46 201 26

Gain on sales of securities

Pharmacia & Upjohn, Inc. 4,452 — –

Stockholms Fondbörs AB 33 — –

Holdings of Volvo Technology Transfer 2– – 105

Other (5) 3(31) 3(61) 3

Subtotal 4,480 (31) 44

Total 4,526 170 70

1 Pertains to dividends received during the period when Volvo’s holding was less than 20%.

2 A Volvo venture-capital company.

3 Including write-down of shares.

Note 8Income from other investments

Note 7Income from investments in associated companies