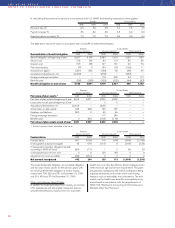

Volvo 2000 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2000 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

78

THE VOLVO GROUP

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

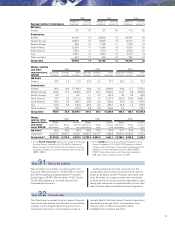

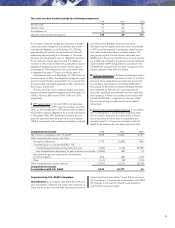

In calculating the provisions for pensions in accordance with U.S. GAAP, the following assumptions were applied:

Sweden United States

1998 1999 2000 1998 1999 2000

Discount rate, % 6.5 5.5 5.5 7.0 7.5 7.5

Payroll increase, % 3.5 3.0 3.0 4.5 6.0 6.0

Expected return on assets, % 7.0 7.0 7.0 9.0 9.0 9.0

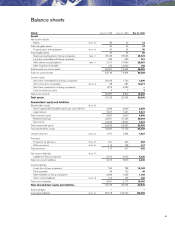

The table below shows the status in accordance with U.S. GAAP of defined-benefit plans.

Sweden United States

Pension benefits Pension benefits Other benefits

Reconciliation of benefit obligation 1999 2000 1999 2000 1999 2000

Benefit obligation at beginning of year 5,557 3,105 2,380 1,916 1,238 906

Service cost 158 166 84 113 35 45

Interest cost 153 168 127 161 60 76

Plan amendments (7) 0 134 103 (128) 11

Actuarial loss (gain) (201) 302 (140) 30 (46) 45

Acquisitions/divestments, net (2,459) – (678) – (252) –

Foreign-exchange translation – – 118 239 43 112

Benefits paid (96) (100) (109) (125) (44) (52)

Benefit obligation at end of year 3,105 3,641 1,916 2,437 906 1,143

Sweden United States

Pension benefits Pension benefits Other benefits

Fair value of plan assets 11999 2000 1999 2000 1999 2000

Fair value of plan assets at beginning of year 5,519 3,671 2,200 2,032 – –

Lump sums not yet paid at beginning of year – – 0 0 – –

Acquisitions/divestments, net (2,412) – (429) – – –

Actual return on plan assets 645 (39) 199 187 – –

Employer contributions (81) 0 49 46 – –

Foreign-exchange translation – – 117 246 – –

Benefits paid 0 (95) (104) (119) – –

Fair value of plan assets at end of year 3,671 3,537 2,032 2,392 – –

1 Assets in pension funds, estimated at fair value.

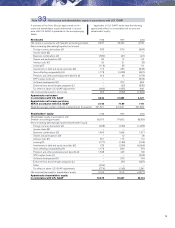

The projected benefit obligation, accumulated obligation

and fair value of plan assets for the pension plans with

an accumulated benefit obligation in excess of plan

assets were 704, 682 and 531 at December 31, 2000

and 516, 499 and 374 at December 31, 1999.

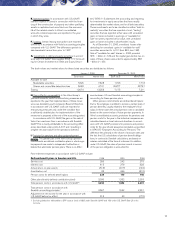

Other post-retirement benefit plans

In addition to its pension plans, the Company and certain

of its subsidiaries and associated companies sponsor

unfunded benefit plans, mainly in the U.S., to provide

health care and other benefits for retired employees who

meet minimum age and service requirements. The plans

are generally contributory, with retiree contributions being

adjusted periodically, and contain other cost-sharing

features such as deductibles and coinsurance. The esti-

mated cost for health-care benefits is recognized on an

accrual basis in accordance with the requirements of

SFAS 106, “Employers’ Accounting for Post-retirement

Benefits Other than Pensions.”

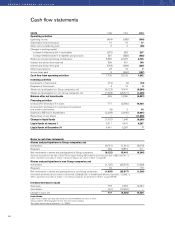

Sweden United States

Pension benefits Pension benefits Other benefits

Funded status 1999 2000 1999 2000 1999 2000

Funded status 567 (103) 116 (45) (906) (1,143)

Unrecognized actuarial loss (gain) 43 679 (110) 8 (159) (124)

Unrecognized transition obligation (asset),

according to SFAS 87 (net) (90) (71) 1 2 56 33

Unrecognized prior service cost 0 0 126 148 0 0

Adjustment to minimum liability (78) (261) 0 0 0 0

Net amount recognized 442 244 133 113 (1,009) (1,234)