Volvo 2000 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2000 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

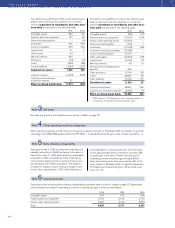

Notes to consolidated financial statements

53

Amounts in SEK M unless otherwise specified. The amounts within parentheses refer to the two preceding years; the

first figure is for 1999 and the second for 1998.

Earlier, these items were included in the Volvo Group’s

net interest income/expense. Comparable figures for

1998 and 1999 have been adjusted to conform to the

revised classification principle. As a result of the above,

the definition of the Volvo Group’s net financial assets

has also been modified. Effective in 2000, the Volvo

Group’s net financial assets have been calculated

excluding the Financial Services business area since

financial income and expense in Financial Services is

reported in consolidated operating income. As of

January 1, 2000, as a result of the new definition, Volvo’s

net financial assets were reduced by SEK 2.2 billion.

Effective in 2000, Volvo Treasury’s income is reported

as part of the operating income in the Financial Services

business area. Volvo Treasury’s income includes interest

income and similar income, interest expense and similar

expenses, as well as overhead costs of Volvo Treasury’s

operations. However, income excludes the effects of the

equity-capital base in Volvo Treasury. Based on the above

definition, Volvo Treasury’s income for 2000 amounted to

SEK 151 M. Of this amount, SEK 183 M was formerly

included in interest income in accordance with the earlier

principle, and a deficit of SEK 32 M was included in

Other financial expenses.

Change in identification of overhead costs in Volvo’s

spare-parts operations

Effective in 2000, the method of calculating Volvo’s

product costs related to spare parts has been revised.

Beginning in 2000, overhead costs of the Volvo Group’s

spare-parts business, which earlier were included among

administrative costs, are being included among cost of

sales. Comparable figures for 1999 have been adjusted

to conform to the changed classification.

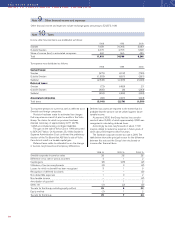

Income taxes

Effective in 1999, Volvo adopted the Swedish Financial

Accounting Standards Councils Recommendation,

Income Taxes, RR9, which in all significant respects

corresponds with the International Accounting Standard

Committee’s (IASC’s) recommendation, Income Taxes,

IAS 12 (revised 1996). Volvo formerly recognized

deferred tax assets pertaining to temporary differences,

as well as tax loss carryforwards, to the degree that

these items could be netted against deferred tax liabil-

ities in the same tax jurisdiction. Effective in 1999,

deferred tax assets are recognized, provided that it is

probable that the amounts can be utilized in connection

with future taxable income. The comparable figures for

1998 have been restated to reflect the new accounting

principle. At January 1, 1998 and 1999, this resulted in

an increase in the Volvo Group’s shareholders’ equity of

SEK 1.5 and 1.3 billion, respectively.

Volvo’s operations

Considering the prevailing competitive situation and the

ongoing consolidation in the transport vehicle industry,

Volvo chose at the beginning of 1999 to divest Volvo

Cars to the Ford Motor Company. Consequently, Volvo’s

operations are now concentrated in commercial vehicles

and service with the aim of further developing its market

positions in trucks, buses, construction equipment, engines

for marine and industrial applications and engine com-

ponents and service for the aerospace industry. Effective

in 2000, Volvo’s operations in customer-financing, insur-

ance, treasury and real estate were brought together in a

separate business area, Financial Services. When pre-

senting the Volvo Group’s sales and operating income

per segment, the results of Financial Services operations

are reported separately from those of the other five busi-

ness areas. Comparable figures for 1998 and 1999

have been adjusted to conform to the new organization.

Operating structure

The Volvo Group’s operations during 2000 were organiz-

ed in six business areas: Trucks, Buses, Construction

Equipment, Marine and Industrial Power Systems, Aero

and Financial Services. In addition to the six business

areas, there are certain operations, consisting mainly of

service companies, that are designed to support the

business areas’ operations.

Each business area except Financial Services has

total responsibility for its operating income and operating

capital. The Financial Services business area has respon-

sibility for its net income and total balance sheet within

certain restrictions and principles that are established

centrally.

The supervision and coordination of treasury and tax

matters is organized centrally to obtain the benefits of

a Groupwide approach.

The legal structure of the Volvo Group is based on

optimal handling of treasury, tax and administrative mat-

ters and, accordingly, differs from the operating structure.

The consolidated financial statements for AB Volvo

(the Parent Company) and its subsidiaries are prepared

in accordance with Swedish GAAP. These accounting

principles differ in significant respects from U.S. GAAP,

see Note 33.

Changes in accounting principles

Financial income and expenses in the Financial Services

business area

In connection with the formation of the Financial Services

business area, there has been a modification of the prin-

ciples used to classify financial income and expense in

Volvo’s insurance and real estate businesses. Effective in

2000, financial income and expense in these operations

are reported in the Volvo Group’s operating income.

Note 1Accounting principles