Volvo 2000 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2000 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

72

THE VOLVO GROUP

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

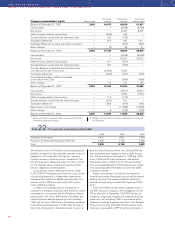

Foreign exchange risks

Volvo’s currency risks are related to changes in contract-

ed and projected flows of payments (commercial expo-

sure), to payment flows related to loans and investments

(financial exposure), and to the translation of assets and

liabilities in foreign subsidiaries (equity exposure). The

objective of the Volvo Group Currency Policy is to mini-

mize the short-term impact of adverse exchange rate

fluctuations on the Volvo Group’s operating income, by

hedging the Group’s firm transaction exposure.

The objective is also to reduce the Group’s balance

sheet exposure to a minimum. Volvo Group Companies

should not assume any currency risk.

Commercial exposure

During 2000 the Volvo Group Currency Policy has been

reviewed and set by the Board. In order to meet the

objective of the Volvo Group Currency Policy, forecasted

currency flows representing firm exposure and forecast-

ed exposure with a pre-fixed price in local currency should

be hedged. Volvo uses forward exchange contracts and

currency options to hedge these flows. In accordance

with the Group’s currency policy, between 50% and 80%

of the net flow in each currency is hedged for the coming

6 months, 30% to 60% for months 7 through 12 and

firm flows beyond 12 months should normally be hedged.

Existing long-term contracts with a maturity exceeding

12 months will remain. The notional value of all forward

and option contracts as of December 31, 2000 was

SEK 16.7 billion (25.0; 47.1).

Other

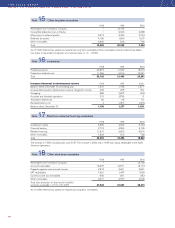

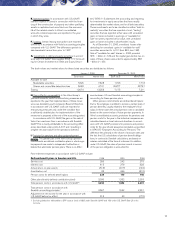

Currencies Currencies Total

Inflow Inflow Outflow Inflow

SEK M USD GBP JPY EUR Net SEK

Due date 2001 amount 616 194 (1,372) 425 1,182

rate18.24 13.16 0,0855 8.70

Due date 2002 amount 291 61 – 59 149

rate18.09 13.07 – 9.02

Due date 2003 amount 59––1–

rate18.94 – – 8.73

Total 966 255 (1,372) 485 1,331

of which, option contracts 46 – – 23 –

Translated to actual value,

SEK M 27,924 3,331 (119) 4,275 1,316 16,727

Fair value of contracts 3(1,314) (190) (8) (8) 216 (1,304)

Year-end exchange rates,

December 31, 2000 9.54 14.22 0.0832 8.86

1 Average contract rate.

2 Average forward contract rate and, for options, the most favorable of the year-end rate and contract rate.

3 Outstanding contracts valued to market rates through so-called fictive closing.

Volvo Group’s net flow per currency

Other

Currencies Currencies Total

Inflow Inflow Outflow Inflow

SEK M USD GBP JPY EUR Net SEK

Net flow 2000 amount 765 288 (3,530) 888

rate 49.1581 13.8620 0.0850 8.4494

Net flow SEK, 47,000 4,000 (300) 7,500 1,100 19,300

Hedged portion, % 580 67 39 48

4 Average exchange rate during the financial year.

5 Outstanding currency contracts, regarding commercial exposure due in 2001, percentage of net flow 2000.

Volvo Group’s outstanding currency contracts pertaining to commercial exposure, December 31, 2000

The table shows forward exchange contracts and option contracts to hedge future flows of commercial payments.

Financial exposure

Group companies operate in local currencies. Through

loans and investments being mainly in the local currency,

financial exposure is reduced. In companies which have

loans and investments in foreign currencies, hedging is

carried out in accordance with Volvo’s financial policy,

which means no currency risks is assumed.

Equity exposure

In conjunction with translation of the Group’s assets and

liabilities in foreign subsidiaries to Swedish kronor a risk

arises that the currency rate will have an effect on the

consolidated balance sheet. Companies in the Volvo

Group are generally formed or acquired with a long term

perspective, where equity is used to fund real assets that

are not to be realized within a foreseeable future. Further-

more, foreign equity exposure is relatively limited in relation

to the consolidated equity in the Volvo Group balance sheet.

As a consequence of the above, equity hedging will

primarily be used if a foreign Volvo Group company is

over capitalized. To avoid extensive equity exposure, the

level of equity in Volvo Group companies wil be kept at a

commercially, legally and fiscally optimal level. At year-

end 2000, net assets in subsidiaries and associated

companies outside Sweden amounted SEK 24 billion.

Hedging of translation exposure from shareholdings

in foreign associated companies or minority interest

companies will be executed on a case-by-case basis.