Volvo 2000 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2000 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE VOLVO GROUP

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

56

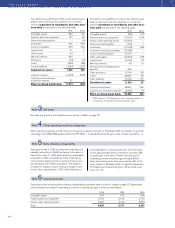

Parent Company holdings of share in subsidiaries as of

December 31, 2000 are shown on pages 90–91.

Significant acquisitions, formations and divestments

within the Group are shown below.

Eddo Restauranger AB

In December 2000, AB Volvo and Volvo Car Corporation

divested in total 51% of the Eddo Restauranger restau-

rant chain to Amica AB, a company within the Fazer

Group. Eddo was 55% owned by AB Volvo and 45% by

Volvo Car Corporation. Amica AB acquired the shares in

proportion to earlier holdings by AB Volvo and Volvo Car

Corporation. The remaining holdings in Eddo by AB

Volvo is 30%. Amica has an option to acquire and AB

Volvo has an option to sell the remaining shares. The

options expire in 2002.

Duffields of East Anglia Ltd

In July 2000, Volvo Trucks acquired Duffields of East

Anglia Ltd, a company that has been a Volvo dealer

since 1969. Duffields is represented in the east of

England where they operate from ten own dealerships,

manage two customer workshops and are responsible

for a small independent dealer.

Volvo (Southern Africa) (Pty) Ltd

In February 2000, the new wholly-owned company Volvo

(Southern Africa) (Pty) Ltd acquired the assets of the

former distributor in South Africa for approximately USD

10 million, including dealerships in South Africa and an

assembly plant for trucks and bus chassis in Botswana.

The company will run operations within the truck, bus,

construction equipment and marine and industrial

engines sectors.

Truck Engine Parts Division

In February 2000, Volvo Aero’s Truck Engine Parts Division

(TEPD) was taken over by the Finnveden engineering

group. TEPD produces components for trucks.

Volvo Maquinaria de Construccion Espana SA

As part of the strategy to mainly organize sales through

independent dealers, Volvo Construction Equipment divest-

ed its market company in Spain in the second quarter of

1999. The buyer was Auto Sueco Lda, which previously

was Volvo’s partner in Portugal for more than 50 years.

The gain on the sale amounted to SEK 0.2 billion.

Pro-Pav and Superpac

In April 1999, Volvo Construction Equipment reached an

agreement covering the sale of its operations under the

trademarks Pro-Pav and Superpac. The operations were

previously conducted within the Canadian subsidiary

Champion Road Machinery.

Mecalac

In March 1999, Volvo Construction Equipment divested

65% of its operations involving compact machinery under

the Mecalac brand name. Concurrently, the intention to

divest the remaining 35% interest within three years was

announced.

Jet Support Corporation

As a result of the agreement between Volvo Aero and

Boeing that grants Volvo Aero exclusive rights to market

and to sell surplus spare parts to the fleet of Boeing air-

craft on the world market, primarily to aircraft types that

are no longer manufactured, the operations of American

Jet Support Corporation were acquired in April 1999.

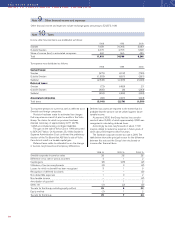

Note 2Acquisitions and divestments of shares in subsidiaries

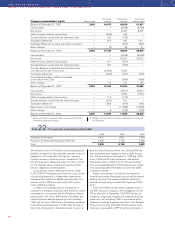

Research and development expenses

and warranty expenses

Research and development expenses are charged to

income as incurred.

Estimated costs for product warranties are charged to

cost of sales when the products are sold.

Items affecting comparability

Items affecting comparability are reported separately in

the income statement. They pertain to considerable

restructuring costs and considerable gains and losses

mainly attributable to changes in the composition of the

Group.

Deferred taxes, allocations and untaxed reserves

Tax legislation in Sweden and other countries sometimes

contains rules other than those identified with generally

accepted accounting principles, and which pertain to the

timing of taxation and measurement of certain commercial

transactions. Deferred taxes are provided for on differ-

ences which arise between the taxable value and reported

value of assets and liabilities (temporary differences) as

well as on tax loss carryforwards. However, with regards to

the valuation of deferred tax assets (the value of future tax

deductions), these items are recognized provided that it is

probable that the amounts can be utilized in connection

with future taxable income.

Tax laws in Sweden and certain other countries allow

companies to defer payment of taxes through allocations

to untaxed reserves. These items are treated as temporary

differences in the consolidated balance sheet, that is, a

division is made between deferred tax liability and equity

capital (restricted reserves). In the consolidated income

statement an allocation to, or withdrawal from, untaxed

reserves is divided between deferred taxes and net in-

come for the year.

Application of estimated values

In preparing the year-end financial statements in accord-

ance with generally accepted accounting principles,

company management makes certain estimates and

assumptions which affect the value of assets and liabil-

ities as well as contingent liabilities at the balance sheet

date. Reported amounts for income and expenses in the

reporting period are also affected. The actual results may

differ from these estimates.