Volvo 2000 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2000 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

14

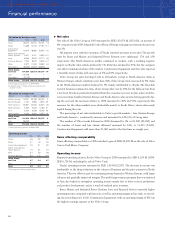

The Volvo share

Exchange listings of Volvo shares,

location and year

Stockholm 1935

London 1972

Frankfurt am Main,

Düsseldorf, Hamburg 1974

USA (NASDAQ) 1985

Brussels 1985

Tokyo 1986

Share capital Dec 31 2000

Registered number of shares1441,520,885

of which, Series A shares2138,604,945

of which, Series B shares3302,915,940

Par value, SEK 6

Share capital, SEK M 2,649

Number of shareholders 230,000

with shares held in own name 132,000

with shares held by trustees 98,000

1 Following the repurchase of own shares, the number

of outstanding shares were 397,368,797. On Jan 2,

2001, the repurchased shares were transferred to

Renault.

2 Series A shares carry one vote each

3 Series B shares carry one tenth vote each

The stock market in 2000

The year 2000 was characterized by declining share prices on stock markets worldwide. The

leading U.S. Index, the Dow Jones Industrial Average, decreased about 5%

and NASDAQ (Volvo listed since 1985), where high technology shares

dominate, closed at nearly 40% down. In Sweden, the OM Stockholm

Exchange’s General Index decreased by 12%. Uncertainties about the macro

economic development in the U.S., as well as the outlook for technology shares, affected the

General Index.

The Volvo share in 2000

Volvo’s market value amounted to SEK 69 billion and the Volvo Series B shares were down

29% at year-end 2000. The main reason for this development was the uncertainty regarding

the market situation in North America.

The OM Stockholm Exchange accounts for the largest percentage of turnover, with an aver-

age of 1.7 million Volvo shares traded each day. During 2000, Volvo was the eighth most ac-

tively traded share in terms of volume, with a 1.6% share of the total market volume. Related

to the market value, Volvo was number twelve with a 1.9% share of the total market value.

Apart from the OM Stockholm Exchange, most trading occurs in London and on NASDAQ.

Trading in Volvo shares in the U.S. is in the form of ADRs, American Depositary Receipts, rep-

resenting Series B shares. Turnover on NASDAQ decreased by 71% during the year, and the

number of outstanding ADRs at December 31, 2000 decreased by 8% to 9.4 million.

During 2000, the percentage of non-Swedish shareholders increased from 28% to 40% of

the share capital (from 16% to 32% of the voting rights). Shares held by Swedish owners were

distributed among institutions (55%), equities funds (18%) and private persons (27%). Of

Volvo’s 230,000 shareholders, the 50 largest accounted for approximately 84% of the voting

rights and 77% of the share capital.

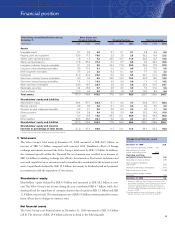

Shareholders in focus

During 2000, AB Volvo repurchased own shares through an offer to the shareholders, which

included a premium of approximately 30%. For the fiscal year 2000, the Board of Directors

proposes that the shareholders at the Annual General Meeting approve a dividend of SEK 8.00

per share (7.00), an increase of 14%, or a total of approximately SEK 3,532 M, based on all

registered shares.

In 2000, SEK 14.9 billion was

transferred to Volvo’s shareholders