TripAdvisor 2012 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2012 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

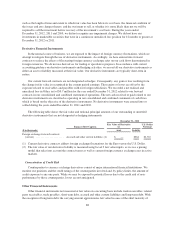

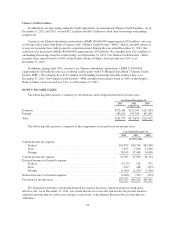

these instruments as reported on the consolidated balance sheets as of December 31, 2012 and December 31,

2011. The carrying value of the long-term borrowings outstanding on our Credit Agreement bear interest at a

variable rate and therefore is also considered to approximate fair value.

In addition during 2012 we had a redeemable noncontrolling interest which was considered a Level 3

liability. The total liability balance at December 31, 2012 and December 31, 2011 is $0 and $3.9 million

respectively, and is included in redeemable noncontrolling interests in the mezzanine section of the consolidated

balance sheets. Refer to “Note 14—Redeemable Noncontrolling Interest’ below for additional information.

We did not have any Level 3 assets for the periods ended December 31, 2012 or 2011.

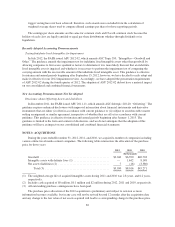

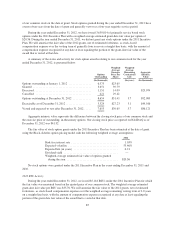

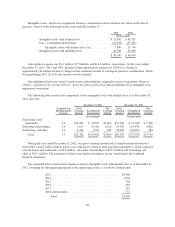

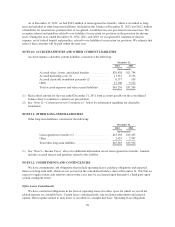

NOTE 6: PROPERTY AND EQUIPMENT, NET

Property and equipment consists of the following:

December 31,

2012 2011

(In thousands)

Capitalized software and website development ......... $48,527 $ 46,878

Leasehold improvements .......................... 14,244 12,924

Computer equipment ............................. 13,174 11,638

Furniture and other equipment ...................... 5,276 5,267

81,221 76,707

Less: accumulated depreciation ..................... (37,626) (43,391)

Projects in progress ............................... 207 1,438

Property and equipment, net ........................ $43,802 $ 34,754

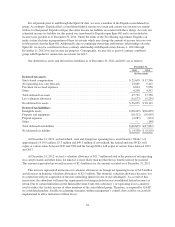

As of December 31, 2012 and 2011, our recorded capitalized software and website development costs, net of

accumulated amortization, were $28.4 million and $21.0 million, respectively. For the years ended December 31,

2012 and 2011, we capitalized $20.2 million and $16.3 million, respectively, related to software and website

development costs. For the years ended December 31, 2012, 2011 and 2010, we recorded amortization of

capitalized software and website development costs of $12.8 million, $12.4 million and $8.1 million, respectively,

which is included in depreciation expense on our consolidated and combined statement of operations.

During the year ended December 31, 2012, we retired property and equipment, primarily capitalized

software and website development, which were no longer in use with a total cost of $25.4 million and associated

accumulated depreciation of $25.2 million, resulting in a loss of $0.2 million included in Other, net on the

consolidated and combined statement of operations.

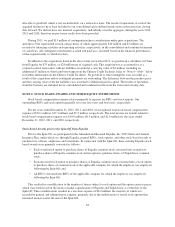

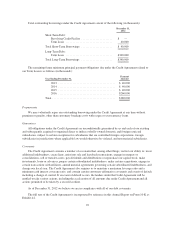

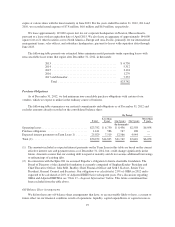

NOTE 7: GOODWILL AND INTANGIBLE ASSETS, NET

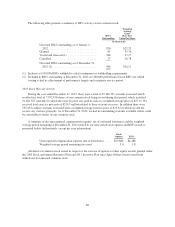

The following table presents the changes in goodwill for the years ended December 31:

2012 2011

(In thousands)

Beginning balance as of January 1 .................. $466,892 $460,610

Additions .................................. 3,043 6,390

Foreign exchange translation adjustment ......... 1,749 (108)

Ending balance as of December 31 .................. $471,684 $466,892

In 2012 and 2011, the additions to goodwill relate to our acquisitions. See “Note 3—Acquisitions,” above

for further information. Refer to “Note 2—Significant Accounting Policies,” above for a discussion of our annual

goodwill impairment assessment.

89