TripAdvisor 2012 Annual Report Download - page 109

Download and view the complete annual report

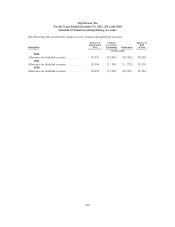

Please find page 109 of the 2012 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TripAdvisor, Inc. Deferred Compensation Plan for Non-Employee Directors

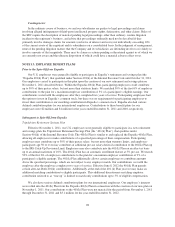

On December 20, 2011, the TripAdvisor, Inc. Deferred Compensation Plan for Non-Employee Directors

(the “Plan”) became effective. Under the Plan, eligible directors who defer their directors’ fees may elect to have

such deferred fees (i) applied to the purchase of share units, representing the number of shares of our common

stock that could have been purchased on the date such fees would otherwise be payable, or (ii) credited to a cash

fund. The cash fund will be credited with interest at an annual rate equal to the weighted average prime or base

lending rate of a financial institution selected in accordance with the terms of the Plan and applicable law. Upon

termination of service as a director of TripAdvisor, a director will receive (i) with respect to share units, such

number of shares of our common stock as the share units represent, and (ii) with respect to the cash fund, a cash

payment. Payments upon termination will be made in either one lump sum or up to five annual installments, as

elected by the eligible director at the time of the deferral election.

Under the 2011 Incentive Plan, 100,000 shares of TripAdvisor common stock are available for issuance to

non-employee directors. There has been no activity from the inception of the Plan through December 31, 2012.

The summary of the material terms of the Plan is qualified in its entirety by the full text of the Plan, which is

incorporated by reference in the Annual Report on this Form 10-K as Exhibit 4.4.

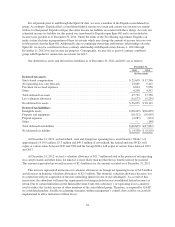

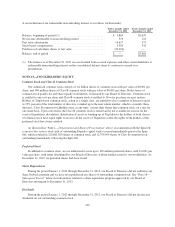

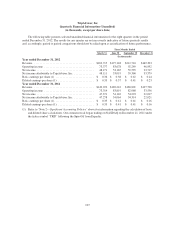

NOTE 14: REDEEMABLE NONCONTROLLING INTEREST

Redeemable noncontrolling interests are measured at fair value, both at the date of acquisition and

subsequently at each reporting period. Our redeemable noncontrolling interest is reported on our consolidated

balance sheets in the mezzanine section in “redeemable noncontrolling interest.”

One of our acquisitions made during 2008 included a noncontrolling interest with certain rights whereby we

could acquire, and the minority shareholders could sell to us, the additional shares of the subsidiary, at fair value

or at adjusted fair values at our discretion, beginning in the fourth quarter of 2012. Fair value determination has

been based on various internal valuation techniques, including industry market comparables and a discounted

cash flow valuation model. Certain assumptions were used in determining fair value, including revenue growth

rates and discount rates. Changes in these assumptions impacted the fair value. Changes in the fair value of the

shares for which the minority shareholders could sell to us have been recorded to the redeemable noncontrolling

interest with charges or credits to additional paid in capital. The final purchase price paid for the remaining

noncontrolling interest subsidiary shares during the fourth quarter of 2012 was $22.3 million, which brought our

ownership to 100% at December 31, 2012.

In addition, we have incurred stock based compensation for the year ending December 31, 2012 and 2011 of

$3.3 million and $0.5 million, respectively related to stock option and RSU issuances which were convertible for

common shares of our noncontrolling interest. All stock option and RSU grants issued by our noncontrolling

interest were issued with an exercise price at fair value, calculated as described above, and generally vested over

a four-year requisite service period. In accordance with current accounting guidance on stock based

compensation, we had classified these awards as liability awards and therefore marked the liability to market at

each report date with stock based compensation expense recognized ratably over the vesting period. All

outstanding stock options and RSU’s were accelerated and thus fully vested and expensed upon the liquidation

event in the fourth quarter of 2012 as provided in the award agreements. As of December 31, 2012 we have no

remaining redeemable noncontrolling interests.

99