TripAdvisor 2012 Annual Report Download - page 152

Download and view the complete annual report

Please find page 152 of the 2012 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

No awards may be granted under the 2011 Plan after December 20, 2021. If the proposed amendment to the 2011

Plan is not approved by stockholders, the 2011 Plan will continue in effect until it expires, and awards may be

granted thereunder, in accordance with its terms.

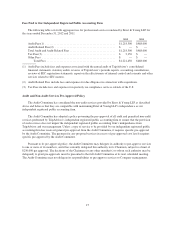

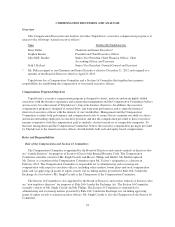

New Plan Benefits

Because the grant of awards under the 2011 Plan is within the discretion of the Compensation Committees,

we cannot determine the dollar value or number of shares of common stock that will in the future be received by

or allocated to any participant in the 2011 Plan. Accordingly, in lieu of providing information regarding benefits

that will be received under the 2011 Plan, the following table provides information concerning the benefits that

were received by the following persons and groups during 2012: each named executive officer; all current

executive officers, as a group; all current directors who are not executive officers, as a group; and all employees

who are not executive officers, as a group.

Options Restricted Stock Units

Name and Position

Average

Exercise

Price

($) Number (#)

Dollar

Value ($)(1) Number (#)

Stephen Kaufer, President and Chief Executive Officer .... 40.20 250,000 — —

Julie M.B. Bradley, Senior Vice President, Chief Financial

Officer, Chief Accounting Officer and Treasurer ........ 40.20 100,000 — —

Seth J. Kalvert, Senior Vice President, General Counsel and

Secretary ....................................... 40.20 50,000 — —

All current executive officers, as a group ................ 40.20 400,000 — —

All current directors who are not executive officers, as a

group .......................................... — — 1,056,091 25,193

All current employees who are not executive officers, as a

group .......................................... 39.72 3,250,814 2,513,146 59,951

(1) Calculations are based on the closing price of our common stock on the NASDAQ of $41.92 on

December 31, 2012, the last trading day in 2012.

Tax Aspects Under the Code

The following is a summary of the principal federal income tax consequences of certain transactions under

the 2011 Plan. It does not describe all federal tax consequences under the 2011 Plan, nor does it describe state or

local tax consequences.

Incentive Options. No taxable income is generally realized by the optionee upon the grant or exercise of an

incentive option. If shares of common stock issued to an optionee pursuant to the exercise of an incentive option

are sold or transferred after two years from the date of grant and after one year from the date of exercise, then

(i) upon sale of such shares, any amount realized in excess of the option price (the amount paid for the shares)

will be taxed to the optionee as a long-term capital gain, and any loss sustained will be a long-term capital loss,

and (ii) the Company will not be entitled to any deduction for federal income tax purposes. The exercise of an

incentive option will give rise to an item of tax preference that may result in alternative minimum tax liability for

the optionee.

If shares of common stock acquired upon the exercise of an incentive option are disposed of prior to the

expiration of the two-year and one-year holding periods described above (a “disqualifying disposition”),

generally (i) the optionee will realize ordinary income in the year of disposition in an amount equal to the excess

20