TripAdvisor 2012 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2012 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

trigger vesting have not been achieved; therefore, such awards were excluded from the calculation of

weighted average shares used to compute diluted earnings per share for those reporting periods.

The earnings per share amounts are the same for common stock and Class B common stock because the

holders of each class are legally entitled to equal per share distributions whether through dividends or in

liquidation.

Recently Adopted Accounting Pronouncements

Testing Indefinite-lived Intangibles for Impairment

In July 2012, the FASB issued ASU 2012-02, which amends ASC Topic 350, “Intangibles—Goodwill and

Other.” The guidance amends the impairment test for indefinite lived intangible assets other than goodwill by

allowing companies to first assess qualitative factors to determine if it is more likely than not that an indefinite

lived intangible asset is impaired and whether it is necessary to perform the impairment test of comparing the

carrying amount with the recoverable amount of the indefinite lived intangible asset. This guidance is effective

for interim and annual periods beginning after September 15, 2012, however, we have decided to early adopt and

make it effective for our 2012 impairment review. Accordingly, we have adopted the presentation requirements

of ASU 2012-02 during the fourth quarter of 2012. The adoption of ASU 2012-02 did not have a material impact

on our consolidated and combined financial statements.

New Accounting Pronouncements Not Yet Adopted

Disclosure about Offsetting Assets and Liabilities

In December 2011, the FASB issued ASU 2011-11, which amends ASC Subtopic 210-20, “Offsetting.” The

guidance requires enhanced disclosures with improved information about financial instruments and derivative

instruments that are either (i) offset in accordance with current guidance or (ii) subject to an enforceable master

netting arrangement or similar agreement, irrespective of whether they are offset in accordance with current

guidance. This guidance is effective for interim and annual periods beginning after January 1, 2013. The

guidance is limited to the form and content of disclosures, and we do not anticipate that the adoption of this

guidance will have an impact on our consolidated and combined financial statements.

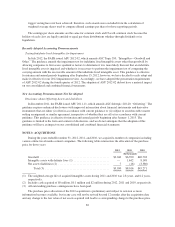

NOTE 3: ACQUISITIONS

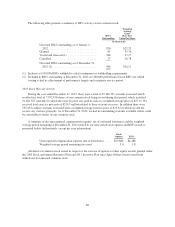

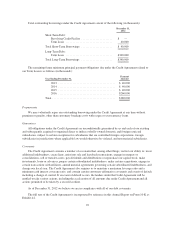

During the years ended December 31, 2012, 2011, and 2010, we acquired a number of companies including

various online travel media content companies. The following table summarizes the allocation of the purchase

price for those years:

2012 2011 2010

(In thousands)

Goodwill ................................................. $3,043 $6,390 $40,703

Intangible assets with definite lives (1) ......................... — 1,642 8,148

Net assets (liabilities) (2) .................................... 7 (16) (3,580)

Total (3) ............................................. $3,050 $8,016 $45,271

(1) The weighted average life of acquired intangible assets during 2011 and 2010 was 2.8 years, and 6.2 years,

respectively.

(2) Includes cash acquired of $0 million, $0.1 million and $2 million during 2012, 2011 and 2010, respectively.

(3) All outstanding purchase contingencies have been paid.

The purchase price allocation of the 2012 acquisition is preliminary and subject to revision as more

information becomes available, but in any case will not be revised beyond 12 months after the acquisition date

and any change to the fair value of net assets acquired will lead to a corresponding change to the purchase price

82