TripAdvisor 2012 Annual Report Download - page 88

Download and view the complete annual report

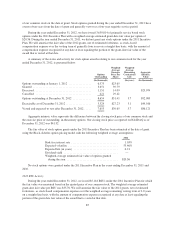

Please find page 88 of the 2012 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Stock-Based Compensation

TripAdvisor Equity Grants Assumed at Spin-Off

All stock-based compensation included in our consolidated and combined financial statements prior to the

Spin-Off relates to Expedia common stock options and restricted stock units (“RSUs”) held by TripAdvisor

employees prior to the Spin-Off. The following methods were used to measure the fair value of these awards and

we will continue to amortize the fair value thereof as follows for all pre-Spin-Off equity grants:

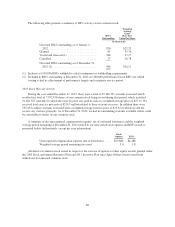

Stock Options. The value of stock options issued or modified, including unvested options assumed in

acquisitions, on the grant date (or modification or acquisition dates, if applicable) were measured at fair value,

using the Black-Scholes option valuation model. The Black-Scholes model incorporates various assumptions

including expected volatility, expected term, dividend yield and risk-free interest rates. The expected volatility

was based on historical volatility of Expedia’s common stock and other relevant factors. The expected term

assumptions were based on historical experience and on the terms and conditions of the stock awards granted to

employees. We will continue to amortize the fair value, net of estimated forfeitures, over the remaining vesting

term on a straight-line basis, with the amount of compensation expense recognized at any date at least equaling

the portion of the grant-date fair value of the award that is vested at that date. The majority of these stock options

vest over four years.

Restricted Stock Units. RSUs are stock awards granted to employees entitling the holder to shares of

common stock as the award vests, typically over a five-year period. RSUs were measured at fair value based on

the number of shares granted and the quoted price of Expedia’s common stock at the date of grant. We will

continue to amortize the fair value of these awards, net of estimated forfeitures, as stock-based compensation

expense over the vesting term on a straight-line basis, with the amount of compensation expense recognized at

any date at least equaling the portion of the grant-date fair value of the award that is vested at that date.

TripAdvisor Equity Grants Awards Issued Subsequent to the Spin-Off

We adopted the TripAdvisor, Inc. 2011 Stock and Annual Incentive Plan, or the 2011 Incentive Plan, as of

December 21, 2011, under which we may grant restricted stock, restricted stock awards, RSUs, stock options and

other stock-based awards to our directors, officers, employees and consultants. Refer to “Note 4—Stock Based

Awards and Other Equity Instruments” below for further information on the 2011 Incentive Plan and our stock

based award activity.

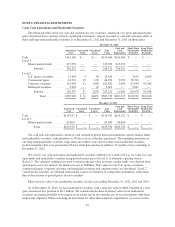

Stock Options. The exercise price for all stock options granted by us to date has been equal to the market

price of the underlying shares of common stock at the date of grant. In this regard, when making stock option

awards, our practice is to determine the applicable grant date and to specify that the exercise price shall be the

closing price of our common stock on the date of grant. Stock options granted during the year ended

December 31, 2012 had a term of ten years from the date of grant and generally vest over a four-year period.

The estimated fair value of the options granted under the 2011 Incentive Plan to date, have been calculated

using a Black-Scholes Merton option-pricing model (“Black-Scholes model”). The Black-Scholes model

incorporates assumptions to value stock-based awards, which includes the risk-free rate of return, volatility,

expected term and expected dividend yield.

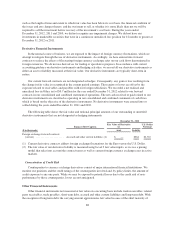

Our risk-free interest rate is based on the rates currently available on zero-coupon U.S. Treasury issues, in

effect at the time of the grant, whose remaining maturity period most closely approximates the stock option’s

expected term assumption. We estimated the volatility of our common stock by using an average of historical

stock price volatility of publicly traded companies that we consider peers based on daily price observations over

a period equivalent or approximate to the expected term of the stock option grants. The decision to use a

weighted average volatility factor of a peer group was based upon the relatively short period of availability of

data on our common stock. We estimated our expected term using the simplified method for all stock options as

78