TripAdvisor 2012 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2012 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

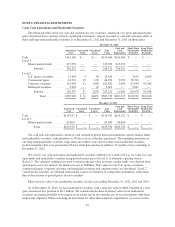

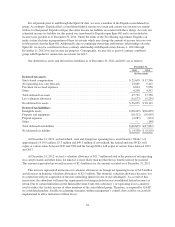

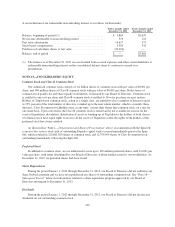

As of December 31, 2012, we had $24.0 million of unrecognized tax benefits, which is classified as long-

term and included in other long-term liabilities. Included in this balance at December 31, 2012 was $10.2 million

of liabilities for uncertain tax positions that, if recognized, would decrease our provision for income taxes. We

recognize interest and penalties related to our liabilities for uncertain tax positions in the provision for income

taxes. During the years ended December 31, 2012, 2011, and 2010, we recognized $1.0 million of interest

expense, net of federal benefit and penalties, related to our liabilities for uncertain tax positions. We estimate that

none of these amounts will be paid within the next year.

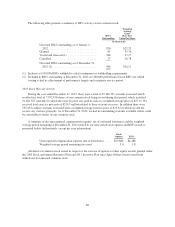

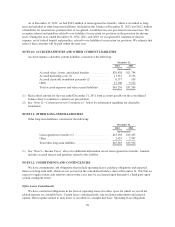

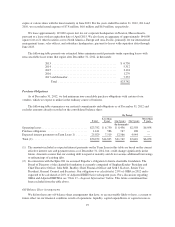

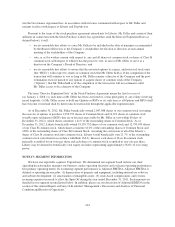

NOTE 10: ACCRUED EXPENSES AND OTHER CURRENT LIABILITIES

Accrued expenses and other current liabilities consisted of the following:

December 31,

2012 2011

(In thousands)

Accrued salary, bonus, and related benefits ............. $29,438 $21,744

Accrued marketing costs (1) ......................... 11,941 6,194

Accrued charitable foundation payments (2) ............ 6,757 109

Other ........................................... 15,100 9,222

Total accrued expenses and other current liabilities ....... $63,236 $37,269

(1) Reclassified amount for the year ended December 31, 2011 from accounts payable on the consolidated

balance sheet to conform to current year presentation.

(2) See “Note 12—Commitments and Contingencies” below for information regarding our charitable

foundation.

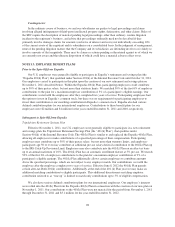

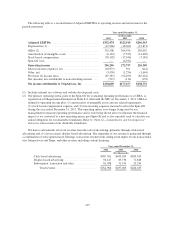

NOTE 11: OTHER LONG-TERM LIABILITIES

Other long-term liabilities consisted of the following:

December 31,

2012 2011

(In thousands)

Unrecognized tax benefits (1) ........................ $23,138 $13,455

Other ........................................... 2,425 2,497

Total other long-term liabilities ...................... $25,563 $15,952

(1) See “Note 9—Income Taxes” above for additional information on our unrecognized tax benefits. Amount

includes accrued interest and penalties related to this liability.

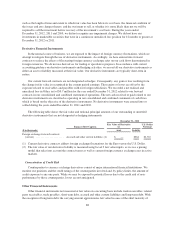

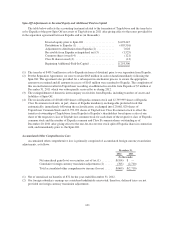

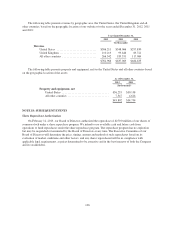

NOTE 12: COMMITMENTS AND CONTINGENCIES

We have commitments and obligations that include operating leases, purchase obligations and expected

interest on long-term debt, which are not accrued on the consolidated balance sheet at December 31, 2012 but we

expect to require future cash outflows and in some cases may be accelerated upon demand of a third party upon

certain contingent events.

Office Lease Commitments

We have contractual obligations in the form of operating leases for office space for which we record the

related expense on a monthly basis. Certain leases contain periodic rent escalation adjustments and renewal

options. Rent expense related to such leases is recorded on a straight-line basis. Operating lease obligations

96