TripAdvisor 2012 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2012 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(iii) the Governance Agreement has, in accordance with its terms, terminated with respect to Mr. Diller and

remains in effect with respect to Liberty and TripAdvisor.

Pursuant to the terms of the stock purchase agreement entered into by Liberty, Mr. Diller and certain of their

affiliates in connection with the Stock Purchase, Liberty has agreed that, until the Director Expiration Date (as

defined below), it will:

• use its reasonable best efforts to cause Mr. Diller to be included in the slate of nominees recommended

by the Board of Directors to the Company’s stockholders for election as directors at each annual

meeting of the stockholders of the Company,

• vote, or act by written consent with respect to, any and all shares of common stock or shares of Class B

common stock with respect to which it has the power to vote, in favor of Mr. Diller to serve as a

director on the Company’s Board of Directors, and

• use its reasonable best efforts to ensure that the unvested options to acquire, and restricted stock units

(the “RSUs”) with respect to, shares of common stock that Mr. Diller held as of the completion of the

transaction will continue to vest as long as Mr. Diller remains a director of the Company and the post-

termination exercise period of any options to acquire shares of common stock of the Company

(“Options”) that Mr. Diller held as of the completion of the transaction will not commence until

Mr. Diller ceases to be a director of the Company.

The term “Director Expiration Date” in the Stock Purchase Agreement means the first to occur of

(w) January 1, 2018, (x) such time as Mr. Diller has been convicted of, or has pled guilty to, any felony involving

moral turpitude, (y) Mr. Diller ceases to hold any Options or RSUs or (z) such time as all Options and RSUs shall

have become vested and shall by their terms be exercisable through the applicable expiration date.

As of December 31, 2012, Mr. Diller beneficially owned 2,047,088 shares of our common stock (assuming

the exercise of options to purchase 1,994,759 shares of Common Stock and 10,319 shares of common stock

issuable upon settlement of RSUs that are or become exercisable by Mr. Diller or vest within 60 days of

December 31, 2012), which shares constitute 1.41% of the outstanding shares of Common Stock. As of

December 31, 2012, Liberty beneficially owned 18,159,752 shares of our common stock and 12,799,999 shares

of our Class B common stock, which shares constitute 14.0% of the outstanding shares of Common Stock and

100% of the outstanding shares of Class B Common Stock. Assuming the conversion of all of the Liberty’s

shares of Class B common stock into common stock, Liberty would beneficially own 21.7% of the outstanding

common stock (calculated in accordance with Rule 13d-3). Because each share of Class B common stock

generally is entitled to ten votes per share and each share of common stock is entitled to one vote per share,

Liberty may be deemed to beneficially own equity securities representing approximately 56.6% of our voting

power.

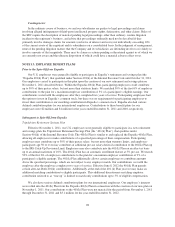

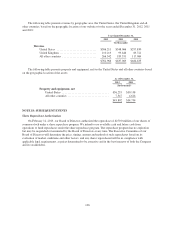

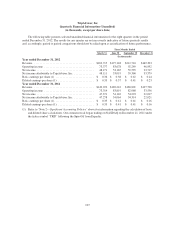

NOTE 17: SEGMENT INFORMATION

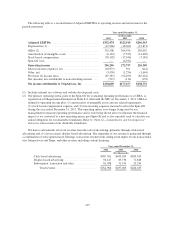

We have one reportable segment: TripAdvisor. We determined our segment based on how our chief

operating decision maker manages our business, makes operating decisions and evaluates operating performance.

Our primary operating metric for evaluating segment performance is Adjusted EBITDA. Adjusted EBITDA is

defined as operating income plus: (1) depreciation of property and equipment, including internal use software

and website development; (2) amortization of intangible assets; (3) stock-based compensation; and (4) non-

recurring expenses incurred to effect the Spin-Off during the year ended December 31, 2011. Such amounts are

detailed in our segment reconciliation below. In addition, please see our discussion of Adjusted EBITDA in the

section of this Annual Report on Form 10-K entitled “Management’s Discussion and Analysis of Financial

Condition and Results of Operations.”

104