TripAdvisor 2012 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2012 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

For all periods prior to and through the Spin-Off date, we were a member of the Expedia consolidated tax

group. Accordingly, Expedia filed a consolidated federal income tax return and certain state income tax returns

with us for that period. Expedia will pay the entire income tax liability associated with these filings. As such, our

estimated income tax liability for this period was transferred to Expedia upon Spin-Off and is not included in

income taxes payable as of December 31, 2011. Under the terms of the Tax Sharing Agreement, Expedia can

make certain elections in preparation of these tax returns which may change the amount of income taxes we owe

for the period after the Spin-Off. Additionally, due to continuing ownership and business relationships after the

Spin-Off, we may be considered to have a unitary relationship with Expedia from January 1, 2012 through

December 11, 2012 for state income tax purposes. Consequently, we may file as part of a unitary combined

group with Expedia for certain state tax returns for 2012.

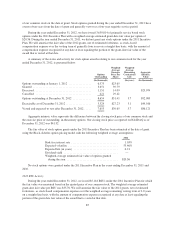

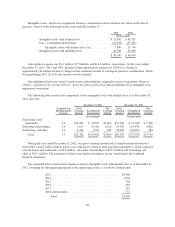

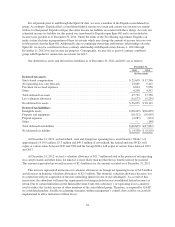

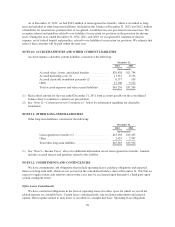

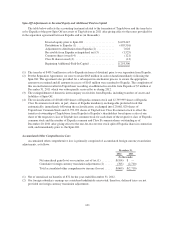

Our deferred tax assets and deferred tax liabilities as of December 31, 2012 and 2011 are as follows:

December 31,

2012 2011

(In thousands)

Deferred tax assets:

Stock-based compensation ................................................... $21,605 $ 17,596

Net operating loss carryforwards .............................................. 15,005 9,415

Provision for accrued expenses ............................................... 6,824 5,950

Other .................................................................... 4,298 4,597

Total deferred tax assets ..................................................... 47,732 37,558

Less valuation allowance .................................................... (11,677) (9,239)

Net deferred tax assets ...................................................... $36,055 $ 28,319

Deferred tax liabilities:

Intangible assets ........................................................... $(28,205) $(26,699)

Property and equipment ..................................................... (10,313) (10,059)

Prepaid expenses ........................................................... (2,087) (923)

Other .................................................................... — (148)

Total deferred tax liabilities .................................................. $(40,605) $(37,829)

Net deferred tax liability ..................................................... $ (4,550) $ (9,510)

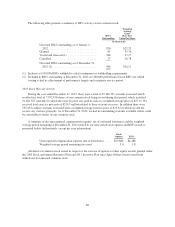

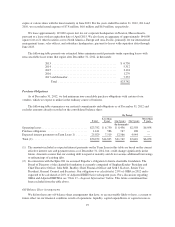

At December 31, 2012, we had federal, state and foreign net operating loss carryforwards (“NOLs”) of

approximately $ 10.0 million, $7.3 million and $49.3 million. If not utilized, the federal and state NOLs will

expire at various times between 2020 and 2032 and the foreign NOLs will expire at various times between 2012

and 2017.

At December 31, 2012, we had a valuation allowance of $11.7 million related to the portion of net operating

loss carryforwards and other items for which it is more likely than not that the tax benefit will not be realized.

This amount represented an overall increase of $2.4 million over the amount recorded as of December 31, 2011.

This increase represented an increase in valuation allowances on foreign net operating losses of $4.9 million

and decreases in domestic valuation allowances of $2.5 million. This domestic valuation allowance decrease was

in connection with our acquisition of the non-controlling interest in one of our subsidiaries. As a result of this

transaction, the subsidiary will meet the requirements for being included in our consolidated federal income tax

return. Due to certain limitations in the Internal Revenue Code, this subsidiary’s net operating losses cannot be

used to reduce the taxable income of other members of the consolidated group. Therefore, as required by GAAP,

we considered prudent, feasible tax planning strategies, within management’s control, that could be successfully

implemented to allow utilization of these losses.

94