TripAdvisor 2012 Annual Report Download - page 93

Download and view the complete annual report

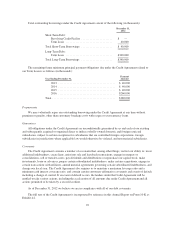

Please find page 93 of the 2012 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.allocable to goodwill, which is not tax deductible, on a retroactive basis. The results of operations of each of the

acquired businesses have been included in our consolidated and combined results from each transaction closing

date forward. We did not have any material acquisitions, individually or in the aggregate, during the years 2012,

2011 and 2010; therefore no pro-forma results have been provided.

During 2011, we paid $13 million of contingent purchase consideration under prior acquisitions. The

amount in 2011 represented an earn-out payment, of which approximately $10 million and $3 million are

recorded to financing activities and operating activities, respectively, in the consolidated and combined statement

of cash flows. All contingent consideration accrued and paid was calculated based on the financial performance

of the acquired entity to which it relates.

In addition to the acquisitions listed in the above table, in October 2011, we purchased a subsidiary in China

from Expedia for $37 million, or $28 million net of acquired cash. This acquisition was accounted for as a

common control transaction, with net liabilities recorded at a carrying value of $4 million, including an

additional $7 million of short term borrowings from the Chinese Credit Facilities (refer to “Note 8—Debt” below

for further information on the Chinese Credit Facilities). No goodwill or other intangibles were recorded as a

result of this acquisition and no contingent payments are outstanding. The difference between the purchase price

and the carrying value of the net liabilities was recorded to additional paid in capital. The results of operations

from this business are included in our consolidated and combined results from the transaction closing date.

NOTE 4: STOCK BASED AWARDS AND OTHER EQUITY INSTRUMENTS

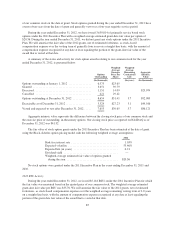

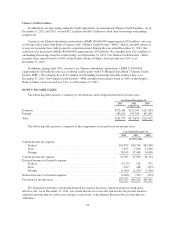

Stock-based compensation expense relates primarily to expense for RSUs and stock options. Our

outstanding RSUs and stock options generally vest over five years and four years, respectively.

For the years ended December 31, 2012, 2011, and 2010, we recognized total stock-based compensation

expense of $30.1 million, $17.3 million, and $7.2 million, respectively. The total income tax benefit related to

stock-based compensation expense was $10.6 million, $6.5 million, and $2.0 million for the years ended

December 31, 2012, 2011, and 2010, respectively.

Stock Based Awards prior to the Spin-Off from Expedia

Prior to the Spin-Off, we participated in the Amended and Restated Expedia, Inc. 2005 Stock and Annual

Incentive Plan, under which we, through Expedia, granted RSUs, stock options, and other stock-based awards to

our directors, officers, employees and consultants. In connection with the Spin-Off, these existing Expedia stock-

based awards were primarily converted as follows:

• Each vested stock option to purchase shares of Expedia common stock converted into an option to

purchase shares of Expedia common stock and an option to purchase shares of TripAdvisor common

stock;

• Each unvested stock option to purchase shares of Expedia common stock converted into a stock option

to purchase shares of common stock of the applicable company for which the employee was employed

following the Spin-Off; and

• All RSUs converted into RSUs of the applicable company for which the employee was employed

following the Spin-Off.

This resulted in a modification to the number of shares subject to each option and the option exercise prices,

which were both based on the relative market capitalization of Expedia and TripAdvisor as of the date of the

Spin-Off. These modifications resulted in a one-time expense of $8.0 million, the majority of which was

recorded to general and administrative expense, primarily due to the modification of vested stock options that

remained unexercised at the date of the Spin-Off.

83