TripAdvisor 2012 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2012 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

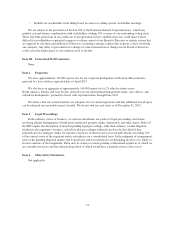

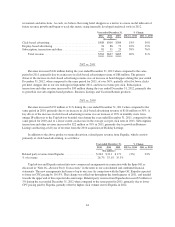

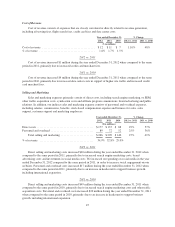

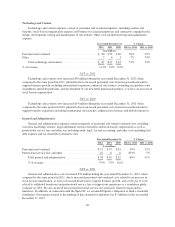

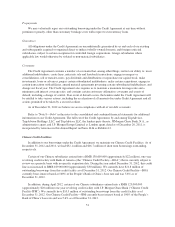

Results of Operations

Selected Financial Data

(in thousands, except per share data)

Year ended December 31, % Change

2012 2011 2010 2012 vs. 2011 2011 vs. 2010

Revenue ......................................... $559,215 $426,045 $313,525 31% 36%

Related-party revenue from Expedia .................. 203,751 211,018 171,110 (3%) 23%

Total revenue ..................................... 762,966 637,063 484,635 20% 31%

Costs and expenses:

Cost of revenue (exclusive of amortization) (1) ...... 12,074 10,873 7,345 11% 48%

Selling and marketing (2) ....................... 266,239 209,176 140,470 27% 49%

Technology and content (2) ..................... 86,640 57,448 43,321 51% 33%

General and administrative (2) ................... 75,641 44,770 31,819 69% 41%

Related-party shared services fee ................. — 9,222 7,900 (100%) 17%

Depreciation ................................. 19,966 18,362 12,871 9% 43%

Amortization of intangible assets ................. 6,110 7,523 14,609 (19%) (49%)

Spin-off costs ................................. — 6,932 — (100%) 100%

Total costs and expenses ............................ 466,670 364,306 258,335 28% 41%

Operating income ................................. 296,296 272,757 226,300 9% 21%

Other income (expense):

Interest (expense) income, net .................... (10,871) 391 (241) (2,880%) 262%

Other, net .................................... (3,450) (1,254) (1,644) 175% (24%)

Total other expense, net ............................ (14,321) (863) (1,885) 1,559% (54%)

Income before income taxes ......................... 281,975 271,894 224,415 4% 21%

Provision for income taxes .......................... (87,387) (94,103) (85,461) (7%) 10%

Net income ....................................... 194,588 177,791 138,954 9% 28%

Net (income) loss attributable to noncontrolling interest . . . (519) (114) (178) 355% (36%)

Net income attributable to TripAdvisor, Inc. .......... $194,069 $177,677 $138,776 9% 28%

Earnings per share attributable to TripAdvisor, Inc :

Basic ....................................... $ 1.39 $ 1.33 $ 1.04 5% 28%

Diluted ...................................... $ 1.37 $ 1.32 $ 1.04 4% 27%

Weighted average common shares outstanding:

Basic ....................................... 139,462 133,461 133,461 4% 0%

Diluted ...................................... 141,341 134,865 133,461 5% 1%

Other financial data:

Adjusted EBITDA (3) .............................. $352,474 $322,918 $260,963 9% 24%

(1) Excludes amortization as follows:

Amortization of acquired technology included in

amortization of intangibles .................... $ 708$ 578$ 1,080

Amortization of website development costs included

in depreciation .............................. 12,816 12,438 8,104

$ 13,524 $ 13,016 $ 9,184

(2) Includes stock-based compensation as follows:

Selling and marketing .......................... $ 4,622 $ 3,216 $ 2,101

Technology and content ........................ 11,400 3,931 2,661

General and administrative ...................... 14,080 10,197 2,421

(3) See “Adjusted EBITDA” discussion below for more information and for a reconciliation of Adjusted

EBITDA to operating income, the most directly comparable financial measure calculated and presented in

accordance with U.S. generally accepted accounting principles, or GAAP.

41