TripAdvisor 2012 Annual Report Download - page 85

Download and view the complete annual report

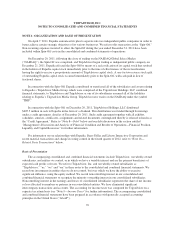

Please find page 85 of the 2012 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.exclude changes in fair value relating to changes in the forward carrying component from its definition of

effectiveness. Accordingly, any gains or losses related to this component are recognized in current income. We

have not entered into any cash flow, fair value or net investment hedges to date as of December 31, 2012.

Derivatives that do not qualify as hedges must be adjusted to fair value through current income. In certain

circumstances, we enter into foreign currency forward exchange contracts (“forward contracts”) to reduce the

effects of fluctuating foreign currency exchange rates on our cash flows denominated in foreign currencies. Our

derivative instruments or forward contracts that were entered into and are not designated as hedges as of

December 31, 2012 are disclosed below in “Note 5—Financial Instruments” in the notes to the consolidated and

combined financial statements. Monetary assets and liabilities denominated in a currency other than the

functional currency of a given subsidiary are remeasured at spot rates in effect on the balance sheet date with the

effects of changes in spot rates reported in Other, net on our consolidated and combined statement of operations.

Accordingly, fair value changes in the forward contracts help mitigate the changes in the value of the remeasured

assets and liabilities attributable to changes in foreign currency exchange rates, except to the extent of the spot-

forward differences. These differences are not expected to be significant due to the short-term nature of the

contracts, which typically have average maturities at inception of less than one year.

Accounts Receivable and Allowance for Doubtful Accounts

Accounts receivable are generally due within 30 days and are recorded net of an allowance for doubtful

accounts. We consider accounts outstanding longer than the contractual payment terms as past due. We

determine our allowance by considering a number of factors, including the length of time trade accounts

receivable are past due, previous loss history, a specific customer’s ability to pay its obligations to us, and the

condition of the general economy and industry as a whole.

Property and Equipment, Including Website and Software Development Costs

We record property and equipment at cost, net of accumulated depreciation. We capitalize certain costs

incurred during the application development stage related to the development of websites and internal use

software. Capitalized costs include internal and external costs, if direct and incremental, and deemed by

management to be significant. We expense costs related to the planning and post-implementation phases of

software and website development as these costs are incurred. Maintenance and enhancement costs (including

those costs in the post-implementation stages) are typically expensed as incurred, unless such costs relate to

substantial upgrades and enhancements to the website or software resulting in added functionality, in which case

the costs are capitalized.

We compute depreciation using the straight-line method over the estimated useful lives of the assets, which

is three to five years for computer equipment, capitalized software and website development and furniture and

other equipment. We depreciate leasehold improvement using the straight-line method, over the shorter of the

estimated useful life of the improvement or the remaining term of the lease.

Leases

We lease facilities in several countries around the world and certain equipment under non-cancelable lease

agreements. The terms of some of the lease agreements provide for rental payments on a graduated basis. Rent expense

is recognized on a straight-line basis over the lease period and accrued as rent expense incurred but not paid.

Recoverability of Goodwill and Indefinite-Lived Intangible Assets

Goodwill:

We account for acquired businesses using the purchase method of accounting which requires that the assets

acquired and liabilities assumed be recorded at the date of acquisition at their respective fair values. Any excess

75