TripAdvisor 2012 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2012 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.we do not have sufficient historical exercise data on our common stock. Our expected dividend yield is zero, as

we have not paid any dividends on our common stock to date.

We amortize the fair value, net of estimated forfeitures, as stock-based compensation expense over the

vesting term on a straight-line basis, with the amount of compensation expense recognized at any date at least

equaling the portion of the grant-date fair value of the award that is vested at that date.

Restricted Stock Units. RSUs are stock awards that are granted to employees entitling the holder to shares

of our common stock as the award vests. RSUs are measured at fair value based on the number of shares granted

and the quoted price of our common stock at the date of grant. We amortize the fair value, net of estimated

forfeitures, as stock-based compensation expense over the vesting term on a straight-line basis, with the amount

of compensation expense recognized at any date at least equaling the portion of the grant-date fair value of the

award that is vested at that date.

Performance-based stock options and RSUs vest upon achievement of certain company-based performance

conditions and a requisite service period. On the date of grant, the fair value of performance-based awards is

determined based on the fair value, which is calculated using the same method as our service based stock options

and RSUs described above. We then assess whether it is probable that the performance targets would be

achieved. If assessed as probable, compensation expense will be recorded for these awards over the estimated

performance period on a straight-line basis. At each reporting period, we will reassess the probability of

achieving the performance targets and the performance period required to meet those targets. The estimation of

whether the performance targets will be achieved and of the performance period required to achieve the targets

requires judgment, and to the extent actual results or updated estimates differ from our current estimates, the

cumulative effect on current and prior periods of those changes will be recorded in the period estimates are

revised, or the change in estimate will be applied prospectively depending on whether the change affects the

estimate of total compensation cost to be recognized or merely affects the period over which compensation cost

is to be recognized. The ultimate number of shares issued and the related compensation expense recognized will

be based on a comparison of the final performance metrics to the specified targets.

Estimates of fair value are not intended to predict actual future events or the value ultimately realized by

employees who receive these awards, and subsequent events are not indicative of the reasonableness of our

original estimates of fair value. We have considered many factors when estimating expected forfeitures,

including our historical attrition rates, the employee class and historical experience. The estimate of stock awards

that will ultimately be forfeited requires significant judgment and, to the extent that actual results or updated

estimates differ from our current estimates, such amounts will be recorded as a cumulative adjustment in the

period such estimates are revised.

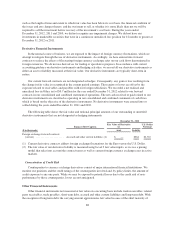

Certain Risks and Concentrations

Our business is subject to certain risks and concentrations including dependence on relationships with our

customers. We are highly dependent on our advertising and media relationship with Expedia, (see “Note 16—

Related Party Transactions”), which accounted for approximately 27%, 33% and 35% of our total revenue in

2012, 2011 and 2010, respectively. In addition, another customer accounted for approximately 21%, 16% and

11% of our revenue in 2012, 2011 and 2010, respectively. As of December 31, 2012 and 2011, there were no

customers that accounted for 10% or more of our trade receivables.

Contingent Liabilities

Periodically, we review the status of all significant outstanding matters to assess any potential financial

exposure. When (i) it is probable that an asset has been impaired or a liability has been incurred and (ii) the

amount of the loss can be reasonably estimated, we record the estimated loss in our consolidated and combined

statements of operations. We provide disclosure in the notes to the consolidated and combined financial

statements for loss contingencies that do not meet both these conditions if there is a reasonable possibility that a

79