TripAdvisor 2012 Annual Report Download - page 101

Download and view the complete annual report

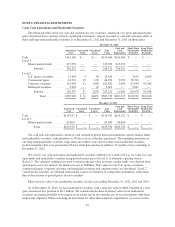

Please find page 101 of the 2012 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOTE 8. DEBT

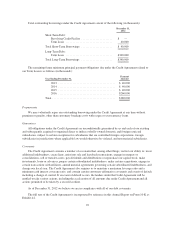

Term Loan Facility Due 2016 and Revolving Credit Facility

Overview

On December 20, 2011, in connection with the Spin-Off, we entered into the Credit Agreement, which

provides $600 million of borrowing including:

• the Term Loan Facility, or Term Loan, in an aggregate principal amount of $400 million with a term of

five years due December 2016; and

• the Revolving Credit Facility in an aggregate principal amount of $200 million available in U.S.

dollars, Euros and British pound sterling with a term of five years expiring December 2016.

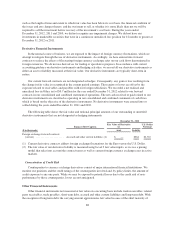

The Term Loan and any loans under the Revolving Credit Facility bear interest by reference to a base rate or

a Eurocurrency rate, in either case plus an applicable margin based on our leverage ratio. We are also required to

pay a quarterly commitment fee, on the average daily unused portion of the Revolving Credit Facility for each

fiscal quarter and fees in connection with the issuance of letters of credit. The Term Loan and loans under the

Revolving Credit Facility currently bear interest at LIBOR plus 175 basis points, or the Eurocurrency Spread, or

the alternate base rate (“ABR”) plus 75 basis points, and undrawn amounts are currently subject to a commitment

fee of 30 basis points.

As of December 31, 2012 we are using a one-month interest period Eurocurrency Spread which is

approximately 2.0% per annum. Interest is currently payable on a monthly basis while we are borrowing under

the one-month interest rate period. The current interest rates are based on current assumptions, leverage and

LIBOR rates and do not take into account that rates will reset periodically.

The Term Loan principal was repayable in quarterly installments on the last day of each calendar quarter in

2012 equal to 1.25% of the original principal amount, with $20 million paid during the year ended December 31,

2012. Principal payments will be equal to 2.5% of the original principal amount in each year thereafter, with the

balance due on the final maturity date.

The Revolving Credit Facility includes $40 million of borrowing capacity available for letters of credit and

$40 million for borrowings on same-day notice. Immediately following the Spin-Off, $10 million was drawn

down under the Revolving Credit Facility, which was repaid during the three months ended March 31, 2012. As

of December 31, 2012 there are no outstanding borrowings under our Revolving Credit Facility.

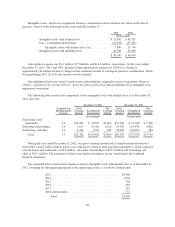

During the years ended December 31, 2012 and 2011, we recorded total interest and commitment fees

related to our Credit Agreement of $8.7 million and $0.3 million, respectively, to interest expense on our

consolidated statement of operations. All unpaid interest and commitment fee amounts as of December 31, 2012

and 2011 were not material.

In connection with the Credit Agreement, we incurred debt financing costs totaling $3.5 million, which were

capitalized as deferred financing costs. Approximately $0.8 million, recorded in other current assets, and

approximately $ 1.8 million, reported in other long term assets, remain on the consolidated balance sheet as of

December 31, 2012, net of amortization. Total amortization expense of $ 0.9 million was recorded for the year

ended December 31, 2012. These costs will continue to be amortized over the remaining term of the Term Loan

using the effective interest rate method and will be included in interest expense on the consolidated and

combined statement of operations.

91