TripAdvisor 2012 Annual Report Download - page 94

Download and view the complete annual report

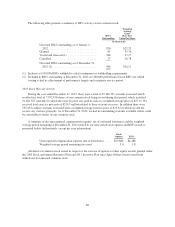

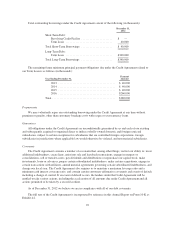

Please find page 94 of the 2012 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In addition, upon Spin-Off, we entered into a warrant agreement (the “Warrant Agreement”) with Mellon

Investor Services LLC and issued warrants exercisable for TripAdvisor common stock in respect of previously

outstanding warrants exercisable for Expedia common stock that were adjusted on account of Expedia’s reverse

stock split and the Spin-Off. The warrants, which totaled 32,186,792 at Spin-Off, were subsequently converted

into 7,952,456 shares of our common stock during the year ended December 31, 2012, prior to their expiration

date of May 7, 2012. Refer to “2012 Stock Warrant Activity,” below,for a discussion of warrant activity during

the year ended December 31, 2012.

One tranche of warrants (issued in respect of Expedia warrants that had featured an exercise price of $12.23

per warrant prior to adjustment) were exercisable for 0.25 (one-quarter) of a share of TripAdvisor common stock

at an exercise price equal to $6.48 per warrant, and the other tranche of warrants (issued in respect of Expedia

warrants that had featured an exercise price of $14.45 per warrant prior to adjustment) were exercisable for 0.25

(one-quarter) of a share of TripAdvisor common stock at an exercise price equal to $7.66 per warrant. The

exercise price could have been paid in cash or via “cashless exercise” as set forth in the Warrant Agreement. In

total, at Spin-Off, the warrants could have been converted into a maximum of 8,046,698 shares of our common

stock without any further adjustments to the Warrant Agreement.

The summary of the material terms of the Warrant Agreement set forth above is qualified in its entirety by

the full text of the Warrant Agreement, which is incorporated by reference in this Annual Report on Form 10-K

as Exhibit 4.1.

Stock Based Awards Subsequent to the Spin-Off from Expedia

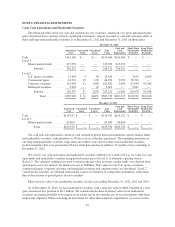

TripAdvisor, Inc. 2011 Stock and Annual Incentive Plan

On December 20, 2011, the 2011 Incentive Plan became effective. A summary of certain important features

of the 2011 Incentive Plan can be found below. The summary of the material terms of the 2011 Incentive Plan is

qualified in its entirety by the full text of the 2011 Incentive Plan which is incorporated by reference in this

Annual Report on Form 10-K as Exhibit 4.3. The purpose of the 2011 Incentive Plan is to give us a competitive

advantage in attracting, retaining and motivating officers and employees and to provide us with the ability to

provide incentives more directly linked to the profitability of our businesses and increases in stockholder value.

Under the terms of the 2011 Incentive Plan, we are authorized to grant incentive stock options (“ISOs”), non-

qualified stock options (“NSOs”), stock appreciation rights (“SARs”), restricted stock, restricted stock units

(RSUs) and other stock based awards to full and part-time employees of the Company and its subsidiaries or

affiliates, where legally eligible to participate, as well as consultants and non-employee directors of the

Company, its subsidiaries and affiliates. The 2011 Incentive Plan will govern TripAdvisor options and

TripAdvisor RSUs that have converted from existing Expedia options and Expedia RSUs in connection with the

Spin-Off as well as other award grants made following the Spin-Off pursuant to the 2011 Incentive Plan.

The 2011 Incentive Plan authorizes the issuance of up to 10,000,000 shares of TripAdvisor Common Stock

pursuant to new awards under the 2011 Incentive Plan, plus shares to be granted pursuant to the assumption of

outstanding adjusted awards. During a calendar year, no single participant may be granted (a) stock options

covering in excess of 3,000,000 shares of TripAdvisor Common Stock, or (b) restricted stock or RSUs, intended

to qualify under Section 162(m) (4)(C) of the Code, covering in excess of 2,000,000 shares of TripAdvisor

common stock; provided, however, that adjusted awards will not be subject to these limitations. The maximum

number of shares of TripAdvisor common stock that may be granted pursuant to stock options intended to be

incentive stock options within the meaning of Section 422 of the Code is 7,000,000 shares.

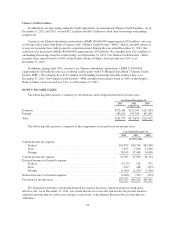

2012 Stock Option Activity

The exercise price for all stock options granted by us to date has been equal to the market price of the

underlying shares of common stock at the date of grant. In this regard, when making stock option awards, our

practice is to determine the applicable grant date and to specify that the exercise price shall be the closing price

84