TripAdvisor 2012 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2012 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Increasing Mobile Usage. Consumers are increasingly using smartphone and tablet computing devices to

access the Internet. To address these demands, we continue to extend the platform to develop smartphone and

tablet applications to allow greater access to our travel information and resources. Although the substantial

majority of our smartphone users also access and engage with our websites on personal computers and tablets

where we display advertising, our users could decide to increasingly access our products primarily through

smartphone devices. Historically we have not displayed graphic advertising on smartphones and our smartphone

monetization strategies are still developing. Improvement of our mobile offerings is a key company priority

which we believe is necessary to help us maintain and grow our user base and engagement over the long term

and we will continue to invest and innovate in this growing platform.

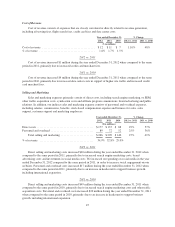

Click-Based Advertising Revenue. In recent years, the majority of our revenue growth resulted from higher

click-based advertising revenue due to increased traffic on our websites and an increase in the volume of clicks

on our advertisers’ placements. Although click-based advertising revenue growth has generally been driven by

traffic volume, we remain focused on the various factors that could impact revenue growth, including, but not

limited to, the growth in hotel shoppers, CPC pricing fluctuations, the overall economy, the ability of advertisers

to monetize our traffic, the quality and mix of traffic to our websites, and the quality and mix of traffic from our

advertising placements to advertisers, as well as advertisers’ evolving approach to transaction attribution models

and return on investment targets. We monitor and regularly respond to changes in these factors in order to

strategically improve our user experience, customer satisfaction and monetization in this dynamic environment.

Global Economic Conditions. In late 2008 and throughout 2009, weak global economic conditions created

uncertainty for travelers and suppliers, and put pressure on discretionary spending on travel and advertising.

Since 2010 the travel industry has been gradually improving. However, global economic conditions remain

uncertain, and in particular, we anticipate travel expenditures in Europe to continue to be adversely effected by

the economic issues overseas.

Spin-Off

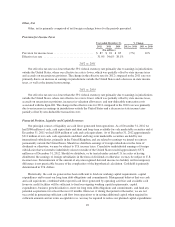

On April 7, 2011, Expedia announced its plan to separate into two independent public companies in order to

better achieve certain strategic objectives of its various businesses. We refer to this transaction as the “Spin-Off.”

Non-recurring expenses incurred to affect the Spin-Off during the year ended December 31, 2011 have been

included within Spin-Off costs in the consolidated and combined statements of operations.

On December 20, 2011, following the close of trading on the NASDAQ Global Select Market

(“NASDAQ”), the Spin-Off was completed, and TripAdvisor began trading as an independent public company

on December 21, 2011. Expedia effected the Spin-Off by means of a reclassification of its capital stock that

resulted in the holders of Expedia capital stock immediately prior to the time of effectiveness of the

reclassification having the right to receive a proportionate amount of TripAdvisor capital stock. A one-for-two

reverse stock split of outstanding Expedia capital stock occurred immediately prior to the Spin-Off, with cash

paid in lieu of fractional shares.

In connection with the Spin-Off, Expedia contributed or transferred all of the subsidiaries and assets relating

to Expedia’s TripAdvisor Media Group, which were comprised of the TripAdvisor Holdings, LLC combined

financial statements, to TripAdvisor and TripAdvisor or one of its subsidiaries assumed all of the liabilities

relating to Expedia’s TripAdvisor Media Group. TripAdvisor now trades on the NASDAQ under the symbol

“TRIP.”

In connection with the Spin-Off, on December 20, 2011, TripAdvisor Holdings, LLC distributed

approximately $406 million in cash to Expedia in the form of a dividend. This distribution was funded through

borrowings under a credit agreement, dated as of December 20, 2011, by and among TripAdvisor, TripAdvisor

Holdings, LLC, and TripAdvisor LLC, the lenders party thereto, JPMorgan Chase Bank, N.A., as administrative

agent, and J.P. Morgan Europe Limited, as London agent (this credit agreement, together with all exhibits,

39