TripAdvisor 2012 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2012 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

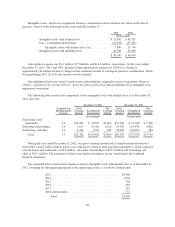

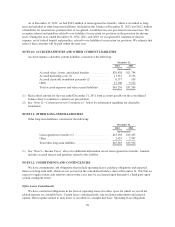

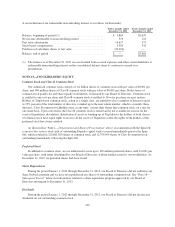

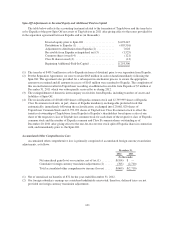

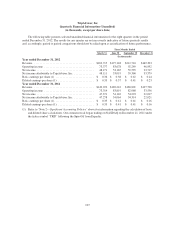

A reconciliation of our redeemable noncontrolling interest is as follows (in thousands):

Twelve months ended

December 31, 2012

Twelve months ended

December 31, 2011

Balance, beginning of period (1) ............................... $ 3,863 $2,637

Net income attributable to noncontrolling interest ................. 519 114

Fair value adjustments ....................................... 14,617 571

Stock based compensation .................................... 3,305 541

Purchases of subsidiary shares at fair value ....................... (22,304) —

Balance, end of period ....................................... $ — $3,863

(1) The balance as of December 31, 2011 was reclassified from accrued expenses and other current liabilities to

redeemable noncontrolling interest on the consolidated balance sheet to conform to current year

presentation.

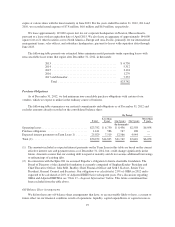

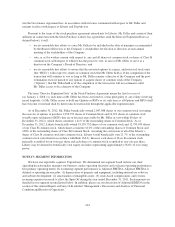

NOTE 15—STOCKHOLDERS’ EQUITY

Common Stock and Class B Common Stock

Our authorized common stock consists of 1.6 billion shares of common stock with par value of $0.001 per

share, and 400 million shares of Class B common stock with par value of $0.001 per share. Both classes of

common stock qualify for and share equally in dividends, if declared by our Board of Directors. Common stock

is entitled to one vote per share and Class B common stock is entitled to 10 votes per share on most matters.

Holders of TripAdvisor common stock, acting as a single class, are entitled to elect a number of directors equal

to 25% percent of the total number of directors, rounded up to the next whole number, which is currently three

directors. Class B common stockholders may, at any time, convert their shares into common stock, on a one for

one share basis. Upon conversion, the Class B common stock is retired and is not available for reissue. In the

event of liquidation, dissolution, distribution of assets or winding-up of TripAdvisor the holders of both classes

of common stock have equal rights to receive all the assets of TripAdvisor after the rights of the holders of the

preferred stock have been satisfied.

As discussed in “Note 1—Organization and Basis of Presentation” above, in connection with the Spin-Off,

a one-for-two reverse stock split of outstanding Expedia capital stock occurred immediately prior to the Spin-

Off, which resulted in 120,661,020 shares of common stock and 12,799,999 shares of Class B common stock

outstanding immediately following the Spin-Off.

Preferred Stock

In addition to common stock, we are authorized to issue up to 100 million preferred shares, with $ 0.001 par

value per share, with terms determined by our Board of Directors, without further action by our stockholders. At

December 31, 2012, no preferred shares had been issued.

Share Repurchases

During the period January 1, 2012 through December 31, 2012, our Board of Directors did not authorize any

share buyback program and we have not repurchased any shares of outstanding common stock. See “Note 18—

Subsequent Events” below for information related to a share repurchase program approved by our Board of

Directors subsequent to December 31, 2012.

Dividends

During the period January 1, 2012 through December 31, 2012, our Board of Directors did not declare any

dividends on our outstanding common stock.

100