TripAdvisor 2012 Annual Report Download - page 178

Download and view the complete annual report

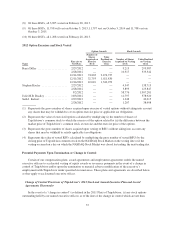

Please find page 178 of the 2012 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.allocations from Expedia for accounting, legal, tax, corporate development, financial reporting, treasury and real

estate functions and included an allocation of employee compensation within these functions. These allocations

were determined on a basis that Expedia and we considered to be a reasonable reflection of the cost of services

provided or the benefit received by us. These expenses were allocated based on a number of factors including

headcount, estimated time spent and operating expenses. It was not practicable to determine the amounts of these

expenses that would have been incurred had we operated as an unaffiliated entity. In the opinion of our

management, the allocation method was reasonable.

Other related-party operating expenses which were included within selling and marketing expense were

$6.4 million, $4.3 million, and $1.2 million for the years ended December 31, 2012, 2011 and 2010, respectively,

which primarily consisted of marketing expense for exit windows.

Related party net interest income (expense) of $0.5 million and ($0.2) million for the years ending

December 31, 2011 and 2010 are reflected in the consolidated and combined statements of operations within

interest income (expense), net and were primarily intercompany in nature, arising from the transfer of liquid

funds between Expedia and us that occurred as part of Expedia’s treasury operations prior to the Spin-Off.

The net related party receivable balances with Expedia reflected in our consolidated balance sheets as of

December 31, 2012 and 2011 were $24.0 million receivable and $14.1 million, respectively. In addition to the

revenue and expense relationships described above, the change in the net related party receivable balance was

also affected by our transfer of domestic cash receipts to Expedia during the periods prior to the Spin-Off offset

by Expedia’s funding of our payroll and income tax payments as well as certain acquisitions. In connection with

the Spin-Off, all domestic intercompany receivables/payables with Expedia were extinguished.

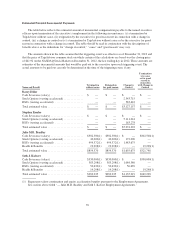

As discussed in “Note 1 — Organization and Basis of Presentation” in our Annual Report on Form 10-K

filed with the SEC on February 15, 2013, we transferred $405.5 million in cash to Expedia in the form of a

dividend, prior to completion of the Spin-Off. Per the Separation Agreement we were to retain $165 million in

cash on hand immediately following the Spin-off and the agreement also provided for a subsequent reconciliation

process to ensure the appropriate amount was retained. The completion of this reconciliation resulted in us

recording an additional receivable from Expedia of $7 million at December 31, 2011, which was subsequently

received by us during 2012.

We were a guarantor of Expedia’s credit facility and outstanding senior notes. These guarantees were full,

unconditional, joint and several, and were released upon Spin-Off.

From the completion of the Spin-Off until December 11, 2012, as a result of the irrevocable proxy of

Liberty described in more detail below under “— Liberty and Barry Diller”, Mr. Diller was effectively able to

control the outcome of all matters submitted to a vote or for the consent of TripAdvisor’s stockholders (other

than with respect to the election by the holders of TripAdvisor common stock of 25% of the members of

TripAdvisor’s Board of Directors and matters as to which Delaware law requires a separate class vote).

Additionally, Mr. Diller was the Chairman and Senior Executive of Expedia, and through similar arrangements

between Mr. Diller and Liberty, Mr. Diller was effectively able to control the outcome of all matters submitted to

a vote or for the consent of Expedia’s stockholders (other than with respect to the election by the holders of

Expedia common stock of 25% of the members of Expedia’s Board of Directors and matters as to which

Delaware law requires a separate class vote). As a result, from the completion of the Spin-Off until December 11,

2012, TripAdvisor and Expedia were related parties since they were under common control. On December 11,

2012, as a result of the purchase by Liberty of an aggregate of 4,799,848 shares of common stock of TripAdvisor

from Mr. Diller and certain of his affiliates which is described in further detail below under “— Liberty and

Barry Diller”, Expedia and TripAdvisor are no longer under common control. However, Expedia continues to be

a related party to TripAdvisor due to Liberty’s ownership of Expedia stock.

For purposes of governing certain of the ongoing relationships between us and Expedia at and after the

Spin-Off, and to provide for an orderly transition, we and Expedia have entered into various agreements,

46