TripAdvisor 2012 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2012 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

such as the length of time and extent to which fair value has been below its cost basis, the financial condition of

the issuer and any changes thereto, and the our intent to sell, or whether it is more likely than not we will be

required to sell the investment before recovery of the investment’s cost basis. During the years ended

December 31, 2012, 2011 and 2010, we did not recognize any impairment charges. We did not have any

investments in marketable securities that were in a continuous unrealized loss position for 12 months or greater at

December 31, 2012 or 2011.

Derivative Financial Instruments

In the normal course of business, we are exposed to the impact of foreign currency fluctuations, which we

attempt to mitigate through the use of derivative instruments. Accordingly, we have entered into forward

contracts to reduce the effects of fluctuating foreign currency exchange rates on our cash flows denominated in

foreign currencies. We do not use derivatives for trading or speculative purposes. In accordance with current

accounting guidance on derivative instruments and hedging activities, we record all our derivative instruments as

either an asset or liability measured at their fair value. Our derivative instruments are typically short-term in

nature.

Our current forward contracts are not designated as hedges. Consequently, any gain or loss resulting from

the change in fair value is recognized in the current period earnings. These gains or losses are offset by the

exposure related to receivables and payables with our foreign subsidiaries. We recorded a net realized and

unrealized loss in Other, net of $0.7 million for the year ended December 31, 2012 related to our forward

contracts in our consolidated and combined statement of operations. The net cash received or paid related to our

derivative instruments are classified as operating in our consolidated and combined statements of cash flows,

which is based on the objective of the derivative instruments. No derivative instruments were entered into or

settled during the years ended December 31, 2011 and 2010.

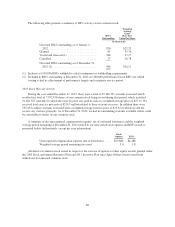

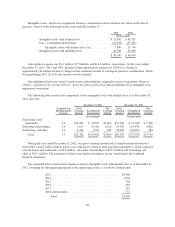

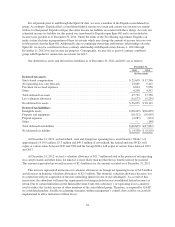

The following table shows the fair value and notional principal amounts of our outstanding or unsettled

derivative instruments that are not designated as hedging instruments:

December 31, 2012

Balance Sheet Caption

Fair Value of Derivative

(2)

U.S. Dollar

Notional

($ in thousands) Asset Liability

Foreign exchange-forward contracts

(current) ...................... Accrued and other current liabilities (1) $ — $$64 $2,710

(1) Current derivative contracts address foreign exchange fluctuations for the Euro versus the U.S. Dollar.

(2) The fair value of our derivative liability is measured using Level 2 fair value inputs, as we use a pricing

model that takes into account the contract terms as well as current foreign currency exchange rates in active

markets.

Concentration of Credit Risk

Counterparties to currency exchange derivatives consist of major international financial institutions. We

monitor our positions and the credit ratings of the counterparties involved and, by policy limits, the amount of

credit exposure to any one party. While we may be exposed to potential losses due to the credit risk of non-

performance by these counterparties, losses are not anticipated.

Other Financial Instruments

Other financial instruments not measured at fair value on a recurring basis include trade receivables, related

party receivables, trade payables, short-term debt, accrued and other current liabilities and long-term debt. With

the exception of long-term debt, the carrying amount approximates fair value because of the short maturity of

88